Following the recent announcement by the United States Securities and Exchange Commission (SEC) on imposing new rules that would place under its supervision individuals trading cryptocurrencies, a famous Bitcoin (BTC) skeptic, Peter Schiff, has lashed out at the regulator.

As it happens, the agency has recently adopted a 247-page rule that requires “market participants who engage in certain dealer roles, in particular those who take on significant liquidity-providing roles in the markets, to register with the SEC,” according to the press release on February 6.

Indeed, under the newly introduced rules, individuals trading crypto assets, securities, or government securities, with assets exceeding $50 million, will have to “become members of a self-regulatory organization (SRO) and comply with federal securities laws and regulatory obligations.”

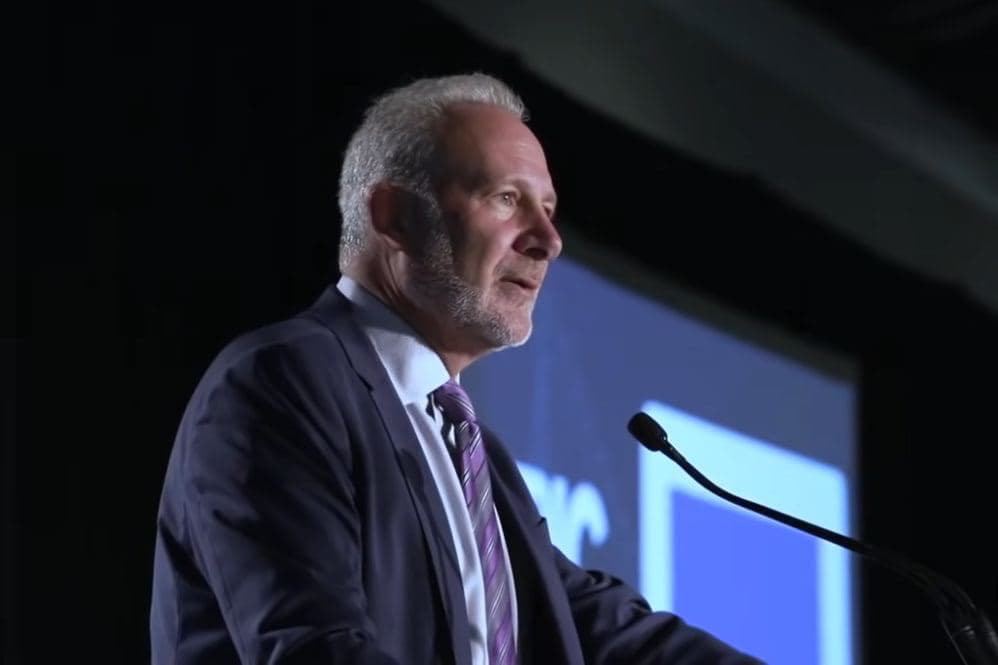

Schiff’s opposition to the rules

Commenting on the development, an economist and prominent critic of the flagship decentralized finance (DeFi) asset, Peter Schiff, pointed out the lack of logic in the SEC’s reasoning for making its most recent decision, as there was no law that would back it up, as he said in an X post on February 6.

Interestingly, Schiff has been very vocal about his skepticism toward Bitcoin, arguing that the maiden crypto asset would ultimately collapse to zero and noting that it would only reach $10 million by 2031 if the US dollar “goes the way of the German Papiermark” and crashes, as Finbold reported on January 29.

Commissioner Peirce’s dissent

Meanwhile, the SEC’s latest rule-making has hardly been unanimous. As paraphrased by attorney Gabriel Shapiro, Commissioner Hester Peirce asked the SEC staff how many people would fall under this rule and whether those writing the code would need to register, to which she received a reply that:

“If you write software and also you are using the software to deal cryptosecurities, then you are in. (…) It’s a market that’s not transparent or compliant, so we don’t have data.”

In response, the Commissioner, who has often expressed dissatisfaction with how her agency treated the crypto market, said that they “are not compliant because they can’t figure out our rules” and concluded that carrying out these rules “will be a huge implementation challenge for us.”

As Shapiro subsequently wrote, SEC’s chairman Gary Gensler said during this exchange that “there is a de minimis threshold… I think it’s $50 million?” referring to the amount of assets that the securities watchdog considers too trivial or minor to merit consideration in legal terms.