Bitcoin (BTC) has recently struggled to break past the $60,000 resistance, with analysts suggesting a significant price peak may still be ahead.

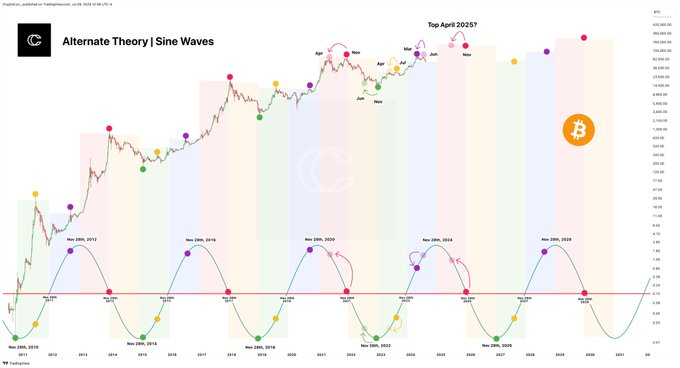

In a July 9 analysis shared by CryptoCon on X, Bitcoin’s traditional four-year price pattern is under scrutiny for a potential shift. The analysis uses sine waves spanning various time frames to identify key moments hinting at a possible change in the asset’s cyclical behavior.

Historically, Bitcoin has adhered to a consistent four-year pattern for 14 years. However, March 2024 saw deviations from this established trend, marking a notable departure. According to CryptoCon, this observation suggests an evolving price behavior for Bitcoin.

Notably, key milestones include a significant peak in April 2021 and a crucial low in June 2022, aligning with previous cycles. Additionally, an early peak in April 2023 indicated a potential shift in timing for price highs within the cycle.

Bitcoin’s next price top

CryptoCon highlighted that the anticipated second early peak for this cycle was expected around July 9, 2023. Instead, a high occurred in March 2024, confirming the Alternate Theory for the first time. This unexpected development implies potential changes in Bitcoin’s price patterns, carrying implications for future movements.

According to CryptoCon, if the Alternate Theory holds, a significant price peak could occur in April 2025, potentially coinciding with a Bitcoin post-halving rally.

Recent bearish sentiment, exacerbated by institutions like the German government auctioning approximately €2.5 billion worth of Bitcoin, has pushed Bitcoin below the $60,000 support level, sparking market concern.

However, amidst this bearish sentiment, investors are eyeing potential bullish catalysts, such as the anticipated approval of an Ethereum (ETH) exchange-traded fund (ETF). Notably, Ethereum has already seen increased whale transactions in anticipation of the ETF, which could boost market optimism.

Bitcoin price analysis

Currently, Bitcoin is holding above the $58,000 mark, though it failed to sustain gains above the $59,000 resistance zone. At the time of reporting, Bitcoin was trading at $58,490, up 2% in the last 24 hours but down 2.6% over the past week.

Meanwhile, maintaining the support of around $58,500 could allow Bitcoin to target $59,000 in the short term, with $60,000 remaining as a longer-term objective.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.