Bitcoin (BTC) has fallen short of the highly anticipated $100,000 milestone, a psychological barrier closely monitored by market participants.

The cryptocurrency experienced a modest pullback of 0.73% over the past 24 hours, trading at $93,465 at press time. This minor decline follows a post-election surge that propelled BTC to a record high of $99,609 on November 22.

While renewed investor optimism initially fueled strong upward momentum, Bitcoin now faces formidable technical and market resistance, raising concerns about the sustainability of its current bull run.

Why Bitcoin stalled near $100,000

Bitcoin’s recent 7% decline from its peak over the past four days has caught many off guard. Analysts cite several key factors behind this pullback.

First, the November rally, driven by Donald Trump’s re-election and his pro-crypto stance, has started losing steam as the market adjusts to potential fiscal and regulatory changes, signaling the exhaustion of post-election euphoria.

Additionally, profit-taking by long-term holders has intensified selling pressure, echoing patterns seen during Bitcoin’s unsuccessful attempt to break past $73,500 in March.

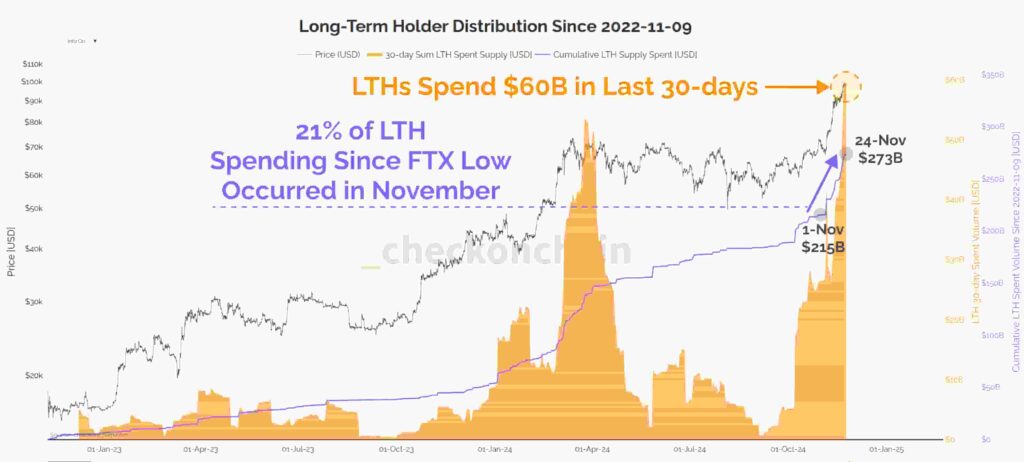

Data shows that long-term holders have offloaded $60 billion worth of Bitcoin in the past 30 days. Notably, 21% of all long-term holder supply moved since the FTX collapse was sold in November, marking the heaviest profit-taking of the current cycle.

Long-term holder distribution. Source: Checkonchain/X

Adding to the challenges, miners are offloading approximately 2,500 BTC daily, valued at $231 million, further amplifying supply-side pressure.

Technical analysis: The role of the Fibonacci channel

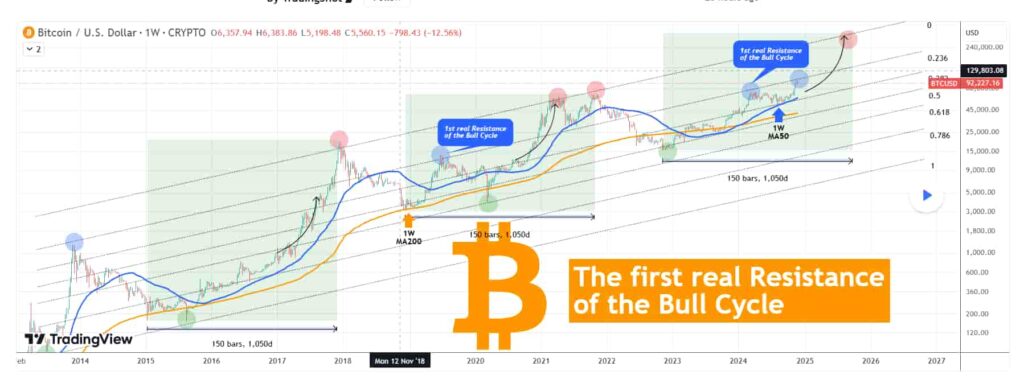

An analysis by TradingShot highlights the impact of the Fibonacci Channel, a recurring technical pattern that has consistently influenced Bitcoin’s performance across the last three bull cycles.

This pattern, defined by key Fibonacci retracement levels, has historically served as a roadmap for identifying critical resistance points.

For instance, the 0.236 Fibonacci level rejected price rallies during bull cycles on June 24, 2019, and May 11, 2024. Similarly, Bitcoin’s rejection on November 22 occurred at this same level, earning it the designation of the “1st Real Resistance of the Bull Cycle.”

Historically, Bitcoin’s bull cycles have reached their peak at the 0.0 Fibonacci level, technically the top of the channel. While this cycle has yet to reach that peak, the rejection at 0.236 suggests BTC faces significant hurdles before testing higher levels.

Market dynamics and sentiment

Despite Bitcoin’s recent correction, the broader market narrative remains largely bullish. Institutional investors continue to demonstrate a robust interest in the cryptocurrency.

MicroStrategy has continued to accumulate Bitcoin, recently adding $5.4 billion worth of BTC to its holdings. Additionally, U.S.-based spot Bitcoin ETFs have seen strong inflows, averaging $670 million daily between November 18 and November 22.

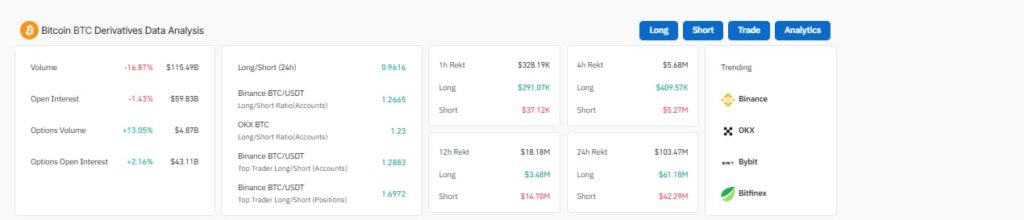

On the derivatives side, market sentiment leans cautiously optimistic. Data from CoinGlass reveals a 16.87% decline in trading volume, while options open interest and volume have registered slight increases, indicating that traders are strategically positioning for potential volatility.

The long/short ratios indicate a modest tilt toward long positions, particularly among top traders. At the same time, liquidation data reflects moderate selling pressure but no signs of widespread capitulation.

These metrics collectively highlight a stable yet cautious market environment. The absence of panic selling and the sustained interest from institutional and retail players alike suggest that the recent correction is more of a temporary pullback than a harbinger of a bearish trend reversal.

As such, Bitcoin continues to hold a slightly bullish undertone despite short-term resistance at the $100,000 level.

What lies ahead for Bitcoin?

Historical data suggests Bitcoin’s bull cycles last approximately 150 weeks, pointing to a potential peak in late 2025.

Analysts, including Deutsche Bank strategist Marion Laboure, believe long-term trends such as institutional adoption and regulatory clarity will drive further price gains.

In the short term, resistance at $100,000 remains a critical challenge. Analysts warn that continued profit-taking and leverage-induced corrections could push Bitcoin to retest lower support levels near $85,000.

However, the broader narrative of increasing adoption, corporate interest, and macroeconomic hedging positions Bitcoin for higher highs in the long run.

Featured image via Shutterstock