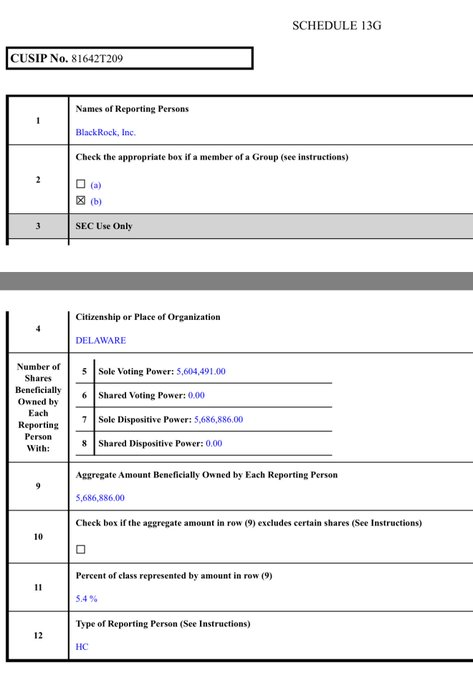

The world’s largest investment management firm, BlackRock (NYSE: BLK), has disclosed a 5.4% ownership stake in biopharmaceutical company Sellas Life Sciences Group (NASDAQ: SLS).

Specifically, the stake amounts to 5,686,886 shares, giving the investment giant voting control in the company, according to a Schedule 13G filing with the U.S. Securities Exchange Commission.

Notably, BlackRock’s endorsement comes at a crucial time as SLS stock has shown strong bullish momentum in recent sessions. In after-hours trading on Friday, the stock rallied 38%, having closed the day’s session at $2.14, marking a 100% gain year to date.

SLS stock fundamentals

At the same time, the firm’s fundamentals appear to support potential sustained growth. Sellas Life Sciences, a late-stage biotechnology firm, has recently demonstrated meaningful clinical progress across its pipeline.

The company’s lead candidate, galinpepimut-S (GPS), is currently in a Phase 3 trial known as REGAL, targeting acute myeloid leukemia (AML). The independent data-monitoring committee overseeing the study confirmed that the trial could proceed without modification after a positive interim safety review.

Median survival among patients has reportedly exceeded 13.5 months, more than double the historical average for standard treatments. The final data readout is expected by the end of 2025.

Sellas’s second key notable program, SLS009 (tambiciclib), a selective CDK9 inhibitor also targeting AML, has produced encouraging Phase 2 results.

To this end, part of Friday’s rally came after reports that SLS009 showed strong preclinical results in T-cell prolymphocytic leukemia, improving survival and reducing tumor burden both alone and in combination with venetoclax.

The U.S. Food and Drug Administration (FDA) has already granted Sellas Fast Track and Orphan Drug designations for both programs, with guidance to initiate a first-line AML trial for SLS009 in early 2026.

Overall, BlackRock’s disclosure suggests growing institutional confidence in Sellas’s long-term potential despite the inherent risks of biotech investing.

For investors, future valuation will likely hinge on the outcome of the REGAL trial, which could prove transformative if final data confirm the early survival benefit.

Featured image via Shutterstock