Ethereum (ETH) exchange-traded funds (ETFs) saw remarkable adoption in August, drawing $3.87 billion in net inflows overall.

However, institutional crypto strategies are shifting once again in favor of Bitcoin (BTC) as a digital hedge.

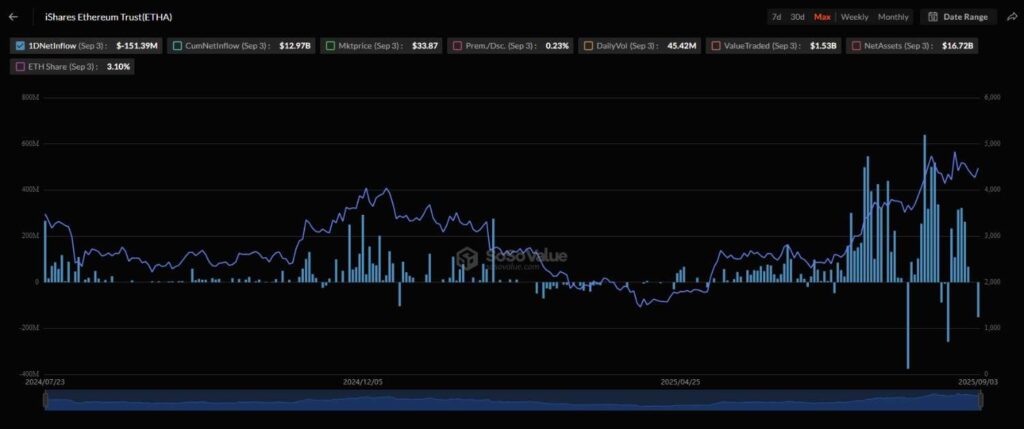

Namely, on September 3, BlackRock unloaded $151.39 million worth of ETH while purchasing an additional $289.84 million worth of BTC, according to the data retrieved from SoSoValue.

Bitcoin ETFs dominating once again

As mentioned, the move is not a one-off incident, but rather reflects a broader recalibration in institutional portfolios in a period of increasing macro uncertainty.

Indeed, Bitcoin ETFs also recorded $332.7 million in net inflows on Tuesday, September 2, as well after losing around $751 million last month. The accumulation was again led by Fidelity and BlackRock, which reported $132.7 million and $72.8 million in additions.

A key driver appears to be expectations around U.S. monetary policy, as traders increasingly bet on looming Federal Reserve rate cuts. According to crypto prediction platform Polymarket, odds of a rate cut in September now stand at 87%.

At the time of writing, the world’s largest crypto fund holds $12.97 billion worth of Ethereum, which amounts to 3.10% of the cryptocurrency’s market share. At the same time, the fund controls nearly $84 billion in Bitcoin, or 3.76% of the asset’s total circulating supply.

Featured image via Shutterstock