BlackRock, the world’s largest investment firm, accelerated its cryptocurrency buying spree this week, splashing over $300 million on Bitcoin (BTC).

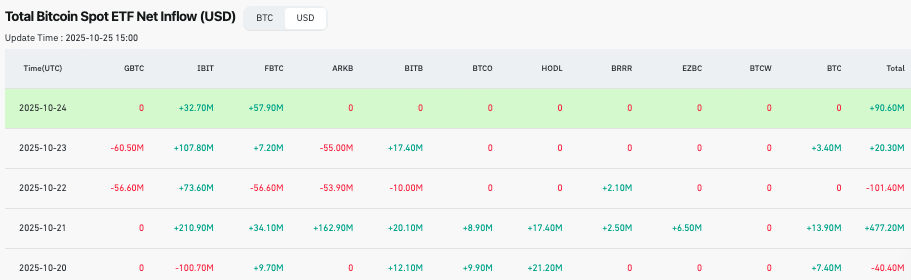

Data from October 20–24 show that the firm’s Bitcoin ETF, IBIT, attracted $324.3 million in net inflows, signaling strong institutional appetite for the leading cryptocurrency despite recent market volatility.

According to Coinglass data, BlackRock’s inflows fluctuated but maintained a dominant upward trend. The week began with a net outflow of $100.7 million on October 20, coinciding with mild weakness in Bitcoin’s price.

However, investor sentiment quickly reversed as inflows surged to $210.9 million on October 21, marking a strong rebound that set the tone for the rest of the week.

Momentum continued with $73.6 million added on October 22 and a further $107.8 million on October 23, reflecting renewed institutional accumulation. By October 24, inflows slowed to a more modest $32.7 million.

Bitcoin sustainable price

The sustained capital injection from BlackRock has helped stabilize overall ETF market sentiment. While total spot Bitcoin ETF flows fluctuated, BlackRock’s consistent buying pressure more than offset the pullbacks, helping to prevent Bitcoin’s price from dropping below the $100,000 mark.

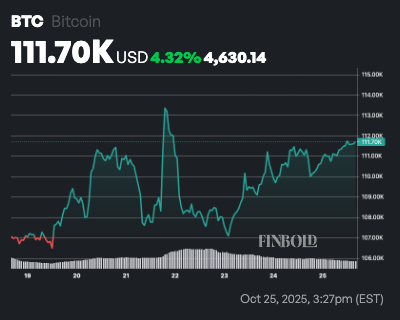

Bitcoin now appears to be stabilizing above the $110,000 level. Momentum had weakened following the sharp market decline on October 10, but long-term demand remains solid, with analysts projecting bullish sentiment in the coming weeks.

For instance, Tiger Research projects a $200,000 target for Bitcoin in Q4, despite rising volatility, citing continued market buying.

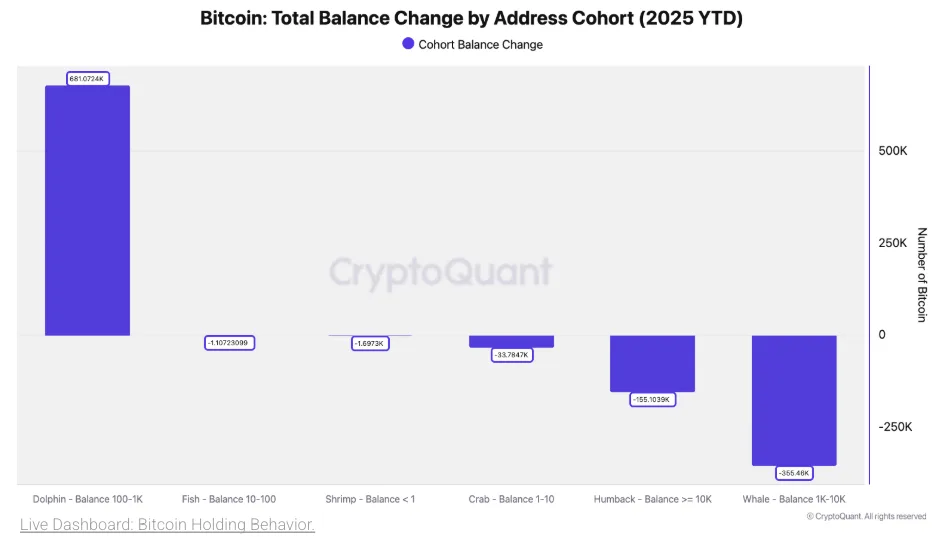

Meanwhile, CryptoQuant highlighted the “dolphin” cohort, wallets holding 100 to 1,000 BTC, as a key indicator of Bitcoin’s structural demand. This group now holds 26% of Bitcoin’s total supply, with a significant year-over-year increase of 681,000 BTC in 2025.

Bitcoin price analysis

By press time, Bitcoin was trading at $111,702, up 0.6% in the past 24 hours and more than 4% on the weekly timeline.

Short-term moving averages suggest a mild bearish bias, as the 50-day simple moving average (SMA) sits slightly higher at $114,427, indicating potential resistance.

However, Bitcoin remains comfortably above its 200-day SMA of $105,582, showing that the broader trend is still upward despite short-term consolidation.

The 14-day Relative Strength Index (RSI) stands at 47.72, reinforcing a neutral sentiment as it hovers near the midpoint of the scale.

Featured image via Shutterstock