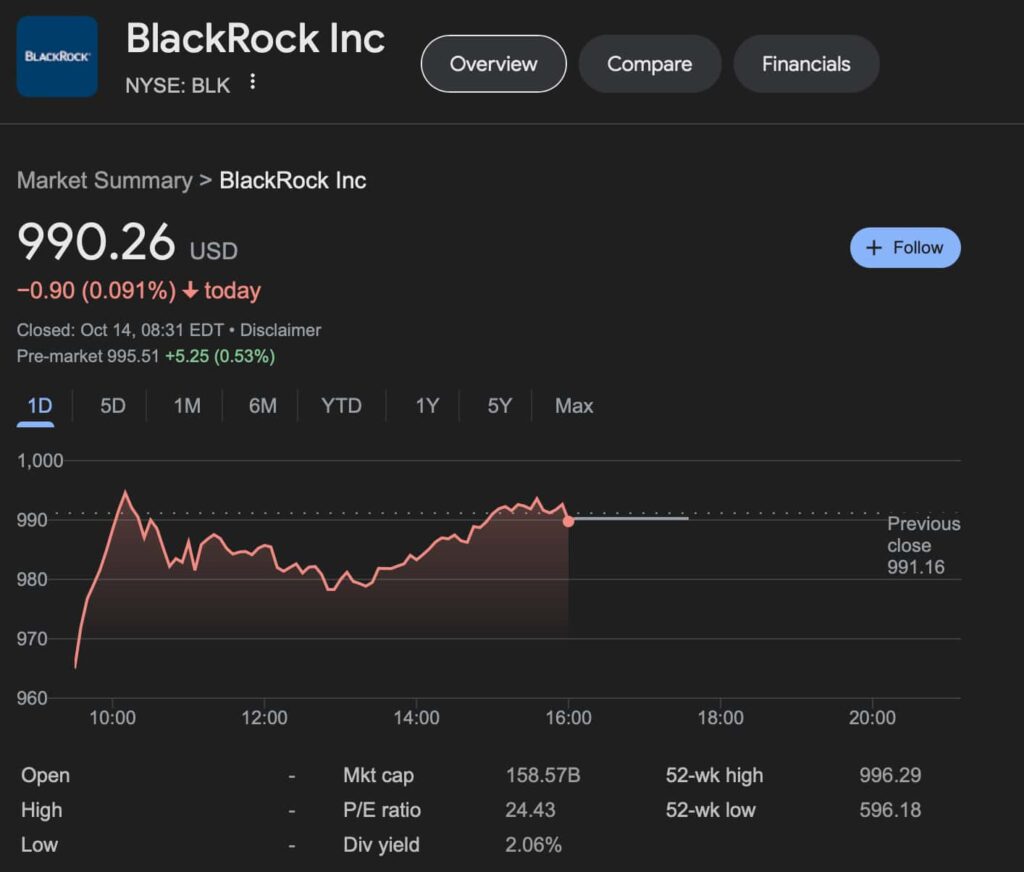

BlackRock (NYSE: BLK) is on the verge of breaking through the $1,000 mark, closing at $990.26 on Friday after a +3.63% gain for the day.

The stock has surged an impressive 10.62% over the past month, and it’s up a remarkable 55.84% over the past year.

With momentum building, the big question is: will BlackRock’s share price hit $1,000 next?

Strong Financials fuel BLK stock rally

Driving this rally are BlackRock’s robust third-quarter results. The investment management titan reported adjusted earnings of $11.46 per share, marking a 5% year-over-year increase.

Revenues also jumped 15% to $5.2 billion, easily surpassing Wall Street’s expectations of $5.03 billion. This growth was fueled by a 5% increase in organic base fees, along with higher performance fees.

In addition to strong top- and bottom-line performance, BlackRock reached a new milestone in its assets under management (AUM), hitting $11.5 trillion.

Over the past 12 months alone, the company has added $2.4 trillion in AUM. The third quarter alone saw $221 billion in net inflows, highlighting the confidence that clients continue to place in the firm.

Clients look to BlackRock

BlackRock’s growth story doesn’t end with its Q3 results. The company completed its $12.5 billion acquisition of Global Infrastructure Partners (GIP) on October 1, adding $116 billion in private market assets to its already massive portfolio.

The acquisition is part of BlackRock’s broader strategy to position itself as the go-to destination for clients looking to invest in both public and private markets.

What’s more, the deal strengthens BlackRock’s infrastructure offerings, a sector with growing global demand. With GIP now under its belt, the company’s ability to serve institutional investors seeking infrastructure and private market exposure has expanded significantly.

Can BlackRock break through $1,000?

Technically, BlackRock is trading near the top of its recent range, which spans from $886.60 to $996.29 over the past month. Pre-market data shows the stock up slightly to $995.51 (+0.53%), making the $1,000 level well within reach.

Key support is currently in the $941.25 to $965.60 range, formed by a mix of trend lines and important moving averages on the daily chart.

If the stock can break through near-term resistance at $965.50, analysts expect $1,000 to become the next level of support, signaling a psychological milestone for the stock.

Following its Q3 earnings, analysts have raised their price targets for BlackRock, reflecting growing confidence in the company’s ability to continue delivering strong results.

Goldman Sachs, for instance, increased its price target to $1,118 from $1,040, maintaining its Buy rating. The investment bank expects BlackRock’s operating income and EPS to grow at a low-to-mid-teens rate over the next one to two years, thanks to the company’s margin expansion and return to organic base fee growth.

Evercore ISI also raised its price target to $1,040, citing BlackRock’s strategic acquisitions and its expanding capabilities in the private markets space. The firm remains optimistic about BlackRock’s future, giving it an Outperform rating.

Is $1,000 just the beginning for BlackRock stock?

With BlackRock nearing the $1,000 threshold, investors are eager to see if the stock can sustain its momentum and break through this psychological barrier. The world’s largest asset manager’s strong financials, strategic acquisitions, and bullish analyst sentiment suggest that there’s more room for growth.

As the global demand for diversified investments across both public and private markets continues to rise, BlackRock seems well-positioned to capitalize on these trends.

If the stock does push past $1,000, the question won’t be if BlackRock will continue growing, but how far it can go.