The BNB Foundation has successfully completed its 27th quarterly token burn, removing approximately 1.944 million BNB tokens from circulation, valued at nearly $1.17 billion.

This burn is a critical part of a broader strategy to enhance token scarcity and value, raising questions about the future pricing and stability of this key cryptocurrency.

BNB powers the BNB Chain ecosystem, acting as both a utility and governance token across various platforms, including the BNB Smart Chain , BNB L2 solutions, and BNB Greenfield. Its utility extends to enabling transactions and interactions with numerous projects built on these chains, further embedding BNB’s role within the blockchain infrastructure.

Picks for you

Launched in 2017, BNB came with a commitment to halve its total supply to 100 million tokens through a systematic burning process. This mechanism aims to enhance the token’s long-term value and scarcity and operates independently of Binance‘s centralized exchange via an auto-burn formula.

This formula objectively determines the quantity of BNB to destroy each quarter, ensuring transparency and auditability.

Current burn dynamics

This quarter’s token burn was unique as it was conducted directly on the BNB Smart Chain in line with the BNB Chain Fusion project. The burned tokens were transferred to a “blackhole” address, permanently removing them from circulation.

This burn did not include any tokens from the Pioneer Burn Program, which is another mechanism that removes BNB equivalent to the provable lost funds of eligible users on the BNB Chain.

Furthermore, the BNB Chain enhances its burn mechanisms through the Real-Time-Burn of gas fees, which contributes to the token’s deflationary mechanism by reducing the supply incrementally and continuously.

BNB price analysis

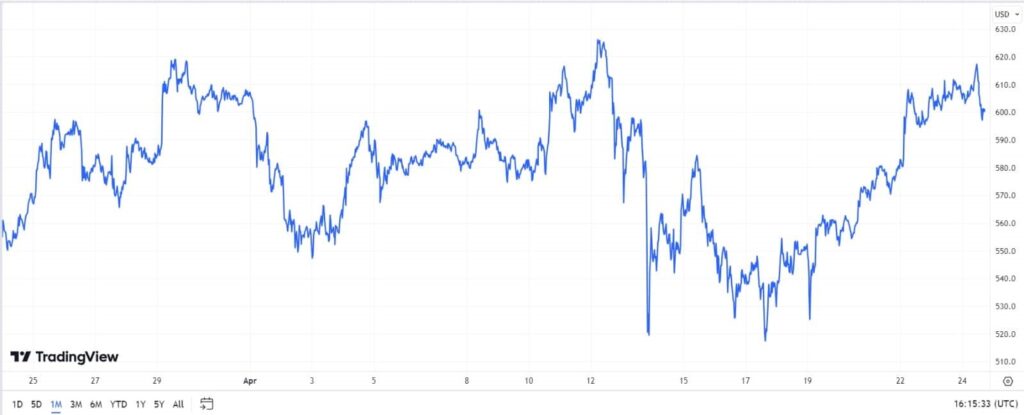

At the moment, the $BNB coin is changing hands at approximately $600, showing a 1.4 % decrease in the last 24 hours.

Throughout April 2024, BNB/USD demonstrated significant volatility, evident from a high of $626.98 and a low of $514.11, reflecting substantial intraday and interday price swings. The resistance level appears around $610, which was tested multiple times during the month, notably peaking near $617.47.

As BNB continues to reinforce its role within its native ecosystem and the broader market, the ongoing strategy to diminish its supply through strategic burns will likely remain a key factor in its valuation and investor interest.

Stakeholders across the crypto-economy are closely monitoring these developments for their implications on BNB’s price and market stability.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.