The stock price of electric vehicle (EV) manufacturer Tesla (NASDAQ: TSLA) is actively seeking catalysts to reverse the losses incurred in 2024.

Notably, the company has grappled with underlying challenges, including significant setbacks in autonomous driving technology, heightened competition, and diminished demand for electric vehicles.

The challenges were highlighted by the notable downturn in car sales during the first three months of 2024. According to an earnings report, the company delivered 387,000 cars during that period, marking a 20% decrease from the previous quarter and an 8% decline year-over-year, significantly falling short of Wall Street’s projections.

While the stock has displayed bullish sentiments in the short term, gaining almost 1% over the last five days, TSLA continues to trade in the red zone on a year-to-date basis, plummeting over 30% with a valuation of $171 as of press time.

However, any prospects of a resurgence have been dampened following the revision of Tesla’s target by the Bank of America (NYSE: BAC). According to a note issued by the bank, the price target has been adjusted to $220, representing a 21% decrease from its previous target of $280. Should the target be achieved, it indicates a potential upside of 28% from the current valuation.

Indeed, the company has implemented several strategies to revamp its fortunes, such as initiating price cuts amidst growing competition from China, and investing in new markets seems to be the next ideal target.

Impact of Tesla’s potential entry into India

Currently, investors are focusing on the outcome of the meeting between CEO Elon Musk and Indian Prime Minister Narendra Modi.

The meeting, scheduled to occur on April 22, will reportedly witness Musk announcing plans to invest in and open a new factory in the country. It’s worth noting that the two last met in June.

Tesla had lobbied India to lower import taxes on electric vehicles while contemplating setting up a factory there. Notably, in March 2023, India enacted a new EV policy, slashing import taxes from 100% to 15% on specific models if a manufacturer invests a minimum of $500 million and establishes a factory in the country.

Such an expansion would align with BoFA’s outlook for Tesla stock. In its notes, the bank stated that to change its trajectory, Tesla will need to tap into new geographical markets to generate additional sales with its current product portfolio or without further reducing prices.

Tesla’s potential entry into the Indian market has significant implications for its stock. India’s growing economy and electric vehicle market, along with policy changes, offer promising growth prospects.

Establishing a manufacturing facility in India could also reduce Tesla’s costs, potentially boosting profit margins and stock valuations. India’s EV market, though small, is expanding. Moreover, as the world’s largest greenhouse gas emitter, India aims to achieve net-zero emissions by 2070, aligning with Tesla’s sustainability goals.

Analysts take on TSLA stock

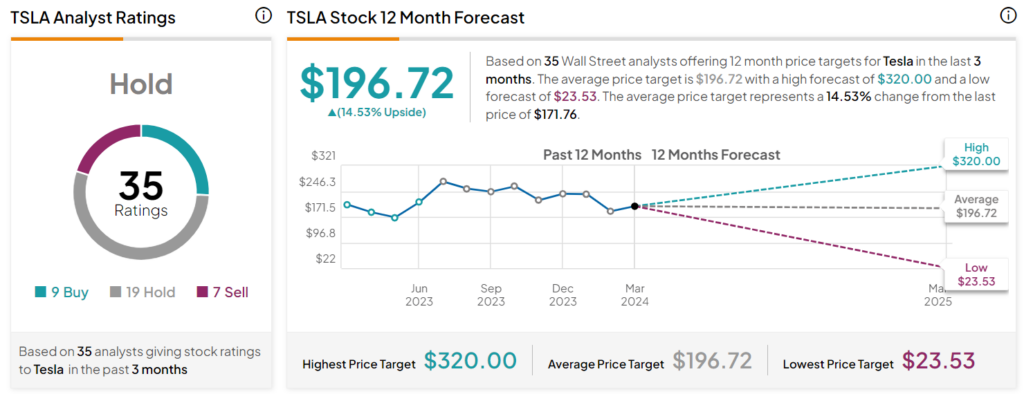

Meanwhile, analysts at TipRanks anticipate an upside to Tesla’s stock over the next 12 months.

As of April 11, data from 35 analysts indicates an average TSLA price target of $196.72, with a high forecast of $320 and a low forecast of $23.53. This average price target represents a 14.53% increase from the current price.

Ultimately, Tesla’s success in India will hinge on consumer adoption of electric vehicles, which will be influenced by factors such as pricing and infrastructure development.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.