The cryptocurrency market experienced a significant sell-off after unexpected U.S. employment data showed 272,000 new jobs in May, far exceeding the estimated 185,000.

This suggests the economy is handling higher interest rates well, reducing the likelihood of rate cuts, which impacts investments in cryptocurrencies.

Additionally, GameStop (NYSE: GME) share price fell by 40% after the company reported a $32.3 million loss on $882 million in revenue and announced plans to sell $175 million in shares, adding to market uncertainty.

Picks for you

Bitcoin (BTC) saw a sharp drop from its two-month high near $72,000. According to CoinMarketCap data, the entire cryptocurrency market saw a downtrend.

The market plunge led to $411.05 million in liquidations, with the largest single order of $409.51 million on the crypto exchange OKX. Of this, $56.8 million were long Bitcoin positions.

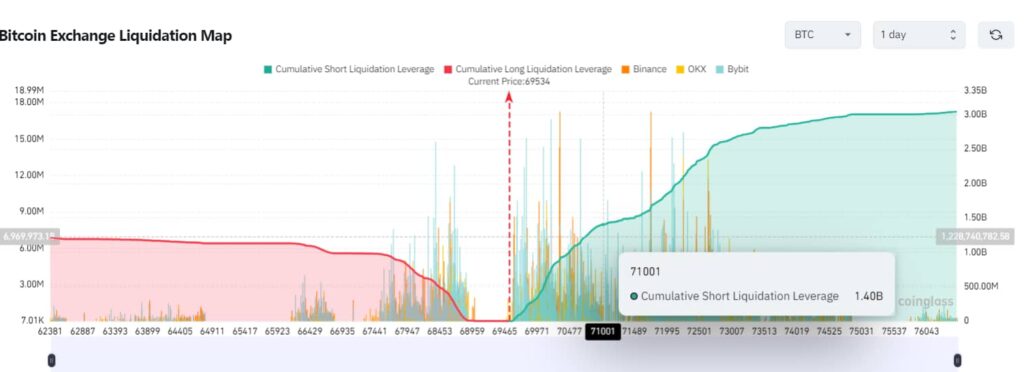

Traders are now hedging their bets, anticipating further price declines. If Bitcoin returns to $71,000, it could wipe out $1.40 billion in short positions, indicating futures traders expect continued volatility.

Opportunities amid liquidations

Despite the downturn, some traders view the sell-off as a brief shakeout rather than a prolonged bearish trend.

Pseudonymous crypto trader il Capo of Crypto described the market reaction as a “shakeout,” a period where investors quickly sell off assets due to uncertainty.

This sentiment was echoed by other analysts who pointed to significant liquidations in Bitcoin and Ether (ETH) futures as a potential silver lining.

This leverage flush could set the stage for a more stable market as speculative positions are cleared out.

Analysts are closely watching key support levels to gauge the market’s next move. The monthly open around $67,500 is seen as a crucial level for Bitcoin to maintain its bullish bias.

Analyst Predictions: Buying opportunity amid the dip

Despite the current volatility, some market experts believe this dip represents a buying opportunity.

Markus Thielen, head of research at 10x Research, highlighted the mixed nature of the employment data and suggested that the next Consumer Price Index (CPI) report could be pivotal. If CPI year-on-year is 3.3% or lower, it will likely push Bitcoin to new all-time highs.

Pseudonymous trader Kaleo also remains optimistic, suggesting the market’s peak is still far off.

Similarly, trader Jelle saw the market dip as a minor setback before a potential rebound, indicating a quick turnaround trade. At press time BTC was changing hands at $69,364.00.

As traders and investors navigate this turbulent period, the broader sentiment leans towards a bullish continuation, with the recent sell-off viewed as a temporary shakeout rather than a sustained downturn.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.