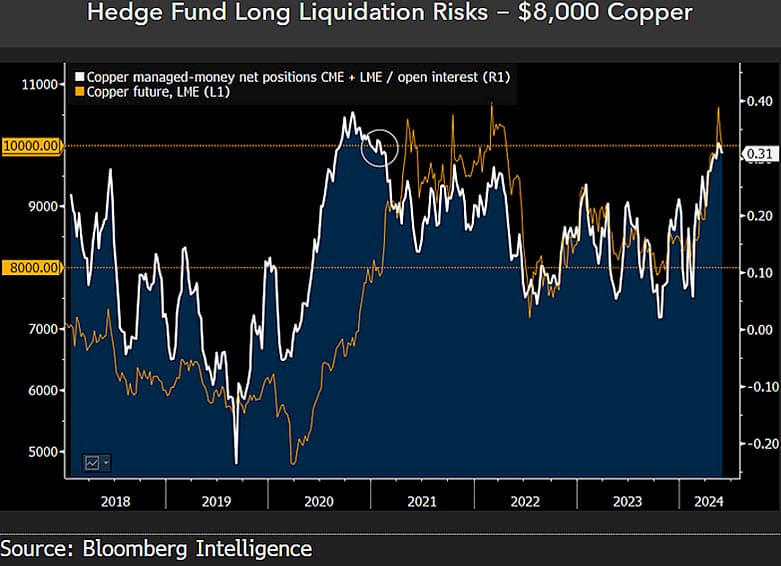

Copper has been on a bull rally with other metals like gold and silver, fueled by worldwide recession fears. The commodity has revisited the $10,000 per ton—its highest level since 2021 and 2022—this time driven mostly by speculation.

In a post on X, Bloomberg‘s senior commodity analyst Mike McGlone spotted the speculative boom in copper’s future markets. According to McGlone, the metal has a different momentum, considering it previously reached this net position amid the Russia-Ukraine escalation.

“Reaching the $10,000-a-ton threshold in 2021-22 on the back of the biggest liquidity pump in history and Russia’s invasion of Ukraine made sense, but this time, speculative futures appeared to be the top driver, and that could be ephemeral.”

– Mike McGlone

Notably, the chart evidences far lower liquidity on copper futures the first time it reached $10,000, suggesting organic demand. Now, the speculative demand on future contracts leads the way and poses a fragile state for the commodity. This is evidenced by the extended net position from hedge funds, weighted by copper’s open interest.

Copper price analysis amid speculative boom

In this context, the senior commodity analyst believes such a high speculative weight could fuel a 20% crash in copper. McGlone forecasts the metal revisiting the $8,000-a-ton price in the lack of industrial or spot organic demand. He blames an extended position from hedge funds on this forecast, which may not be sustainable.

“The most extended net-long managed money (hedgefund) futures positions on copper since 2021 may portend liquidation risks.”

– Mike McGlone

Interestingly, technical analysis indicators from TradingView hint at a neutral momentum for copper futures at $9,838 per ton. In particular, nine indicators suggest a “sell,” nine suggest a “buy,” and eight are neutral—primarily from moving averages.

On a similar stance, Bitcoin (BTC), the leading cryptocurrency known as the “digital gold,” presents a heavy speculative demand weight. Bitcoin registered an all-time low transaction volume, and its spot trading volume faded amid an increased speculative volume on BTC futures and exchange-traded funds (ETFs), as reported by Finbold on June 2.

Like any speculative market, commodities can also present high volatility, especially as uncertainty takes over in finance markets. Thus, investors must look for different analyses and indicators to make better decisions and build their positions accordingly.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.