Brazil’s Central Bank (BCB) has unveiled a proposal to effectively ban the transfer of stablecoins to self-custody wallets. This happens amid the Brazilian Real (BRL) hitting an all-time low against the US Dollar (USD), raising local economic concerns, as Finbold reported.

The draft regulation aims to tighten control over cryptocurrency operations, in particular foreign-backed stablecoins, aligning them with traditional financial regulations.

Brazil’s Central Bank targets stablecoins and self-custody

On November 29, the BCB released a public consultation proposal to include virtual asset service providers (VASPs) in the foreign exchange (forex) market regulations. The move specifically targets stablecoins pegged to foreign currencies, like the USD-backed Tether (USDT), which is widely used in Brazil.

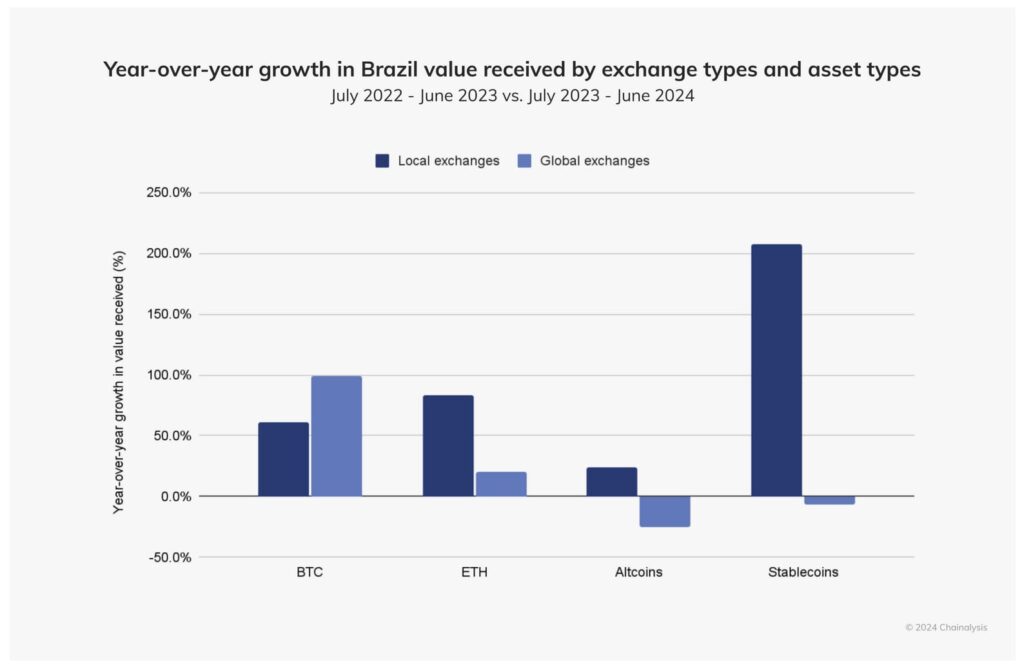

Notably, a Chainalysis study from October 2024 highlights an impressive growth in stablecoins’ value received by local exchanges in Brazil. The volume of stablecoins in Brazilian exchanges from July 2023 to July 2024 surged by more than 200% over the last period.

According to the proposal, VASPs would be prohibited from transferring stablecoins to self-custodial wallets like Ledger or MetaMask. Instead, all operations would need to occur within regulated platforms. Livecoins, a local crypto media outlet, reported on the matter on X.

The BCB emphasizes that only authorized VASPs can operate in the foreign exchange market, and they must collect detailed customer information, including transaction purposes and counterparties.

“These measures aim to enhance legal security and allow the development of new business models, increasing market efficiency,” the BCB stated in its note.

BRL collapse spurs regulatory actions

Interestingly, the BRL has reached a historic low in the forex market, trading at R$6.11 per USD. This surpasses the previous record from May 2020, during the early stages of the COVID-19 crisis. Moreover, the currency’s collapse intensified after Finance Minister Fernando Haddad announced cost-saving plans that failed to convince foreign investors.

Consequently, the weakening Brazilian Real has raised concerns about economic stability, potentially leading to the increased control attempt over stablecoins. The Central Bank cites “instability” as a reason for stricter regulations on foreign-backed currencies that work as a more accessible alternative for the Brazilian people.

While the regulator claims it aims to mitigate risks related to consumer protection, illicit activities, and fiscal integrity, critics argue that the measure will have the opposite effect.

Industry reacts to proposed stablecoins ban to self-custody wallets

The crypto community in Brazil has expressed significant concerns over the proposed ban on the self-custody of stablecoins. Legal expert Pedro Torres criticized the measure, arguing that it infringes on constitutional rights.

“The ban on self-custody of stablecoins violates fundamental principles like free enterprise and property rights,” Torres told Livecoins. “It undermines the very essence of decentralization and user autonomy that cryptocurrencies offer.”

Industry analysts warn that restricting self-custody could hinder Brazil’s burgeoning crypto sector. Stablecoins account for 70% of all crypto transactions between domestic and international platforms in the country. With over $90 billion in digital assets traded between July 2023 and June 2024, Brazil has emerged as a Latin American leader in cryptocurrency adoption.

The public consultation on the proposal is open until February 28, 2025. The Central Bank invites feedback on several key questions, including the necessity of additional limits for VASPs and mechanisms for valuing transacted virtual assets in sovereign currency terms.

In closing, the Central Bank’s proposal marks a pivotal moment for cryptocurrency regulation in Brazil. As the BRL struggles against the USD, authorities are seeking to tighten control over digital assets to allegedly protect economic stability and investor interests.

However, the proposed restrictions on stablecoin transfers to self-custody wallets have sparked debate about user rights, intervention in foreign exchange markets, and the future of crypto innovation in the country. The coming months will be crucial as stakeholders provide input and the BCB considers adjustments to its regulatory approach.

Featured image from Shutterstock.