In recent months, leading technology companies have dominated the stock market, mainly due to their ventures into the artificial intelligence (AI) sector. Although semiconductor giant Nvidia (NASDAQ: NVDA) is the clear winner in this sector as the world’s most valuable company, other stocks are jostling to emulate NVDA’s success.

In this line, Broadcom (NASDAQ: AVGO) and Qualcomm (NASDAQ: QCOM) have shown significant promise, particularly in the AI and semiconductor sectors. Indeed, they might present an opportunity for investors who missed out on Nvidia.

Notably, Finbold turned to OpenAI’s latest and most advanced AI tool, ChatGPT-4o, to gather insights regarding which stock might be the better option. Below is how the tool evaluated each equity.

Picks for you

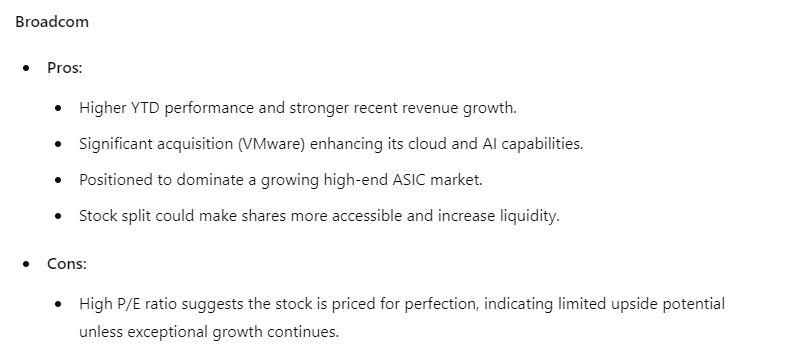

Broadcom stock

The AI tool acknowledged that Broadcom has had an impressive performance, with its stock up 47% year-to-date. The company has reported robust revenue growth, with Q1 revenue increasing by 34% and Q2 revenue by 43% year-over-year (YoY). Even excluding the contribution from VMware, which Broadcom acquired for $69 billion in November 2023, Q2 revenue still grew by 12%.

ChatGPT-4o noted that this acquisition has significantly bolstered Broadcom’s capabilities in cloud software, positioning it to dominate the high-end application-specific integrated circuit (ASIC) market, projected to grow to $30 billion.

At the same time, the tool pointed out that one of the most anticipated events for Broadcom is its upcoming 10-for-1 stock split, expected to enhance liquidity and make shares more accessible to a broader range of investors. Indeed, the split comes on the heels of Nvidia’s decision to split its stock.

However, the company’s current price-to-earnings (P/E) ratio of 52 suggests a high valuation, indicating that the stock might be priced for perfection.

Overall, ChatGPT-4o concluded that Broadcom’s strong presence in AI hardware and network infrastructure further solidifies its market position, with JPMorgan viewing the company as a dominant player in the custom chips market.

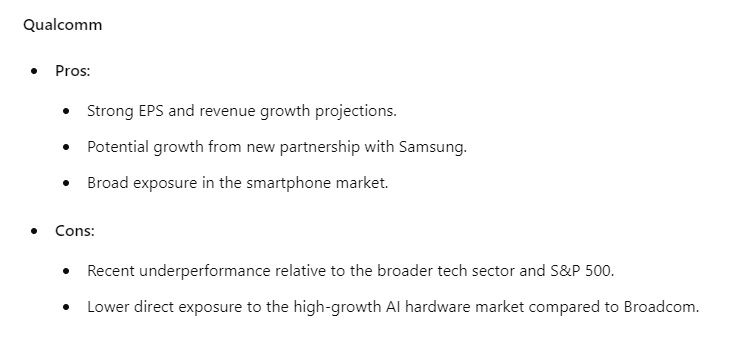

Qualcomm stock

On the other hand, Qualcomm has also seen a notable performance, with its stock up 42% year-to-date. Despite this rally, ChatGPT-4o acknowledged that the company has underperformed in the broader tech sector and the S&P 500 over the past month.

The company is expected to report earnings per share (EPS) of $2.25, representing a 20.32% growth YoY and projected revenue of $9.19 billion, up 8.74% YoY. However, Qualcomm’s potential partnership with Samsung to become the exclusive chip provider for the Galaxy S25 could drive significant growth, strengthening its position in the smartphone market.

Ultimately, the AI platform noted that Qualcomm remains a significant player in the AI sector, though its involvement is less direct than Broadcom. Its broad exposure in the smartphone market and potential new partnerships offer growth opportunities.

However, the company’s recent underperformance relative to the wider tech sector and lower direct exposure to the high-growth AI hardware market are notable concerns.

ChatGPT’s verdict

In conclusion, ChatGPT-4o noted that Broadcom and Qualcomm present solid investment opportunities with strong growth potential, particularly within the AI sector. However, Broadcom appears to have a more robust immediate outlook due to its impressive revenue growth, strategic acquisition of VMware, and potential to dominate the high-end ASIC market.

The upcoming stock split could also boost liquidity and investor interest. Given these factors, Broadcom (AVGO) may be the better buy in 2024, especially for investors seeking direct exposure to AI infrastructure and hardware with a company demonstrating robust growth and strategic expansion.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk