Analysts continue to caution that the United States’ economic landscape is showing worrying signs of a potential slowdown. Key indicators that have historically predicted downturns are now aligning in a manner that suggests investors should brace themselves for an imminent recession.

Below are indicators shared by the data-driven research investment platform Game of Trades in a post on X on July 20.

1. Rising initial jobless claims

According to the platform’s analysis, one of the most reliable recession indicators is the trend in initial jobless claims. Historically, an uptick in jobless claims has preceded every recession in the US. For example, initial jobless claims trended higher before the financial crises of 2008, 2001, and 1990.

In 2024, researchers at Game of Trades noted a similar pattern playing out. From January’s low of 190,000 claims, the number has surged to 240,000, a significant 20% increase in just a few months. According to the platform, this rise mirrors past pre-recession periods and could trouble the economy if the trend continues.

“If initial jobless claims are set to rise substantially from here, that really doesn’t bode well for the stock market,” the platform noted.

2. Declining perception of job availability

The second indicator is the declining perception of job availability among the workforce. Over the past year, the number of people reporting that jobs are plentiful has dropped significantly, while those finding jobs hard to come by has increased.

This shift typically occurs about a year before a recession. The platform pointed out that this sentiment reflects growing unease in the labor market, suggesting that more people might find themselves unemployed in the near future, thereby exacerbating economic woes.

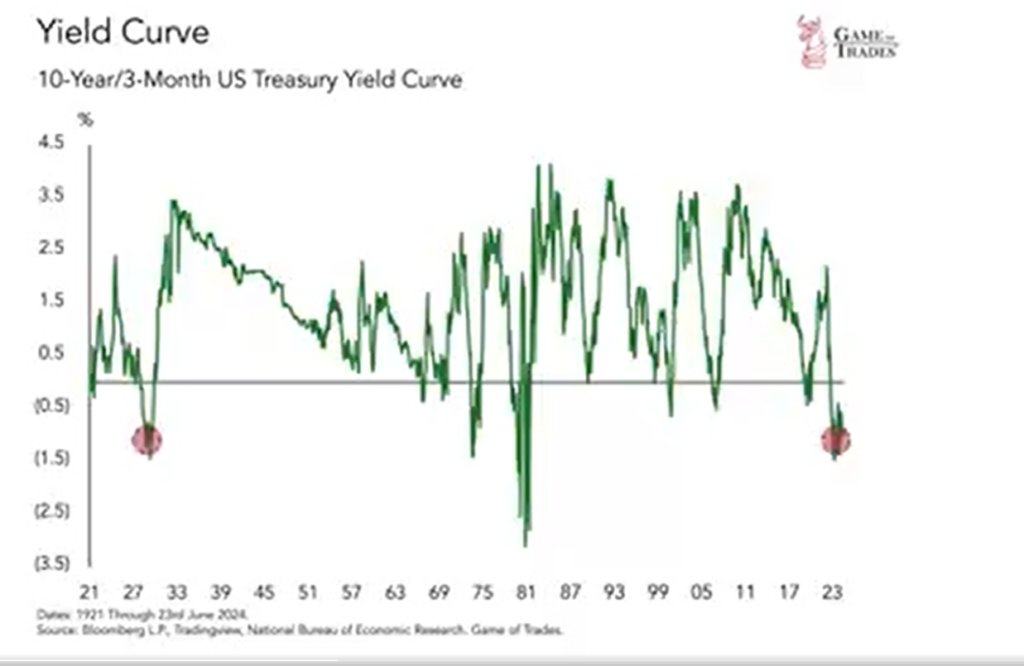

3. Inverted yield curve

The third and perhaps most notorious signal is the inverted yield curve. The analysis noted that this financial phenomenon, where short-term interest rates exceed long-term rates, has been a flawless predictor of recessions in recent economic history.

According to Game of Trades, the yield curve has been inverted for the longest since 1929. Typically, an inverted yield curve precedes a steepening curve, signaling a weakening labor market and rising initial jobless claims. However, despite the recent rise in jobless claims, the yield curve has not yet steepened, indicating that the financial markets have not fully priced in a recession.

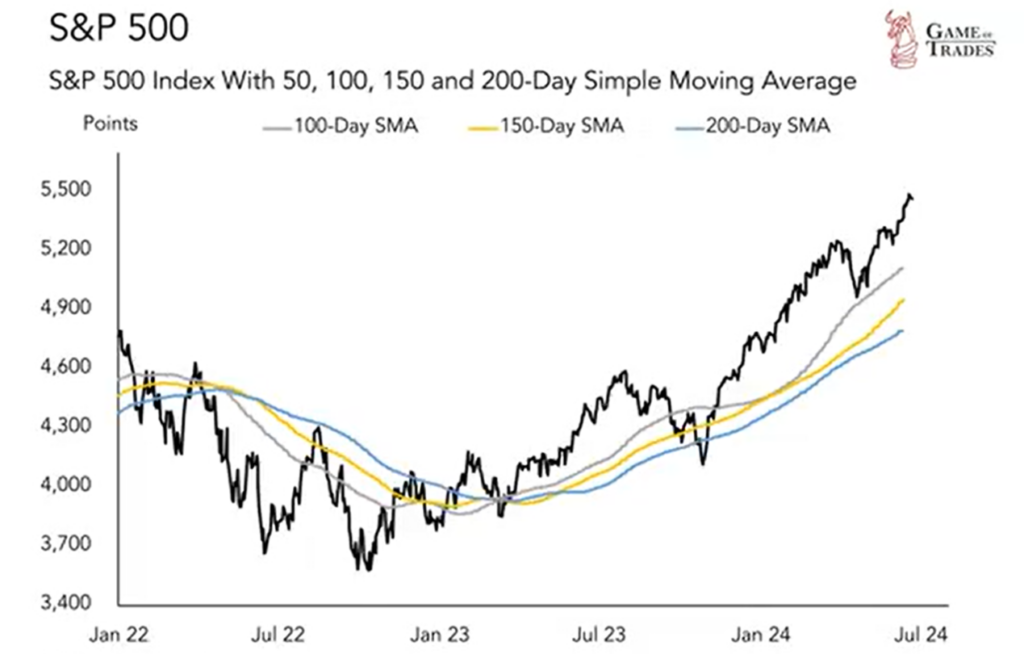

4. Disconnect between economy and financial markets

The fourth indicator is the notable disconnect between economic indicators and financial market performance in the early stages of a downturn. This phenomenon was observed in the lead-up to previous recessions, such as between January 2006 and October 2007 and between October 1988 and January 1990, when the stock market continued to rise despite increasing jobless claims.

Since January 2024, there has been a similar pattern, with the S&P 500 climbing approximately 15% even as jobless claims rose. This disconnect suggests that the financial markets may be underestimating the potential for an economic downturn.

“There’s a disconnect between the economy and financial markets; this is the early phase before the downturn. That’s where we believe we are right now, and in this phase where financial markets are not yet pricing a recession, the stock market is still typically rising,” the platform added.

Amid these signs, attention has shifted to the timing of the recession. Notably, a section of analysts has warned that the downturn might occur in the second half of 2024 after sectors like the stock market and crypto hit new highs.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.