The energy sector has experienced a remarkable turnaround, driven by a confluence of factors, including post-pandemic recovery and geopolitical tensions. The combination of reduced investments during the pandemic and the Russia-Ukraine conflict has created a supply-demand imbalance, pushing oil and natural gas prices to new heights.

Moreover, U.S. crude oil production is projected to set new records, with a significant boost from the Permian Basin.

With West Texas Intermediate crude trading around $77 per barrel and natural gas prices surging recently due to forecasted extreme heat, now is an opportune moment for investors to consider energy stocks.

In this context, Finbold analyzed ongoing trends and identified two stocks in the energy sector with strong buy ratings for the upcoming months. These stocks are poised to benefit from robust market fundamentals and growing demand in the energy sector.

Schlumberger Limited (NYSE: SLB)

Schlumberger Limited (NYSE: SLB) is a global leader in oilfield services, providing technology for reservoir characterization, drilling, production, and processing across more than 120 countries.

Despite a year-to-date stock price decline of over 6%, Q1 2024 revenue increased by 13% year-over-year to $8.71 billion, driven by an 18% rise in international markets despite a 6% decline in North America.

The Permian Basin is set to be a key growth driver, with production expected to hit a record 6.4 million barrels per day by the end of 2024, up from 6.1 million in 2023. This growth is driven by increased drilling efficiencies and a stable number of rigs in the region.

Schlumberger’s forward P/E ratio of 15.9x, slightly above the sector median of 12.18x, is justified by its industry-leading position, technological edge, and strong market presence.

According to sources, UBS reaffirmed its buy rating and $67 price target, following Q2 2024 earnings that surpassed expectations with an adjusted EPS of $0.85 and an EBITDA margin of 25%.

The company’s planned $7.8 billion acquisition of ChampionX is expected to enhance its production and intervention solutions portfolio, generating $400 million in annual pretax savings within three years post-closing.

Additionally, Schlumberger offers a dividend yield of 2.26%, reflecting a commitment to returning value to shareholders. With robust financials and a positive growth outlook, Schlumberger presents a compelling investment opportunity.

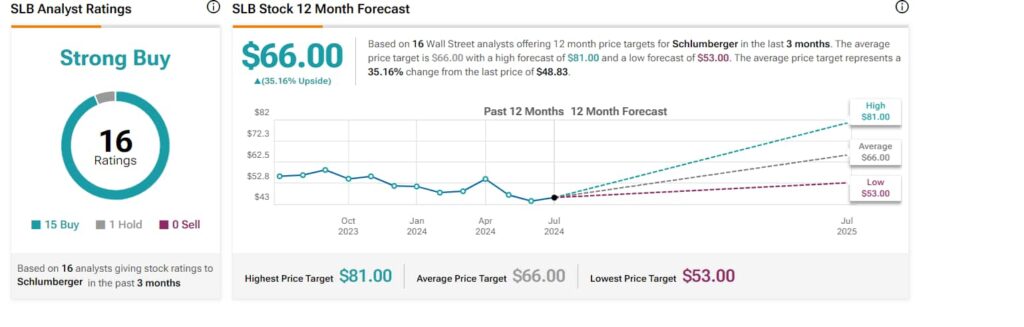

Wall Street analysts project an average price target of $66, with a high forecast of $81, representing a potential upside of 37.61% from the current price of $48.33, giving it a strong buy rating.

Shell plc (NYSE: SHEL)

Shell plc (NYSE: SHEL), a global energy leader based in the UK, is known for its strategic partnerships and robust financial performance.

Currently trading at 14 times forward earnings with a 3.69% dividend yield, Shell’s stock has seen a 16% increase over the past year. The company has boosted its quarterly dividend by 4% and launched a new $3.5 billion stock buyback program.

Upcoming second-quarter results, expected on August 1, forecast earnings of $1.82 per share on revenues of $88.6 billion.

In the previous quarter, Shell reported earnings per ADS of $2.38, surpassing estimates despite lower-than-expected revenues due to decreased natural gas prices.

For Q2, Shell anticipates a $2 billion impairment from halting its Rotterdam biofuels facility and divesting its Singapore refinery. The Renewables and Energy Solutions segment is expected to range between a $500 million loss and a $100 million profit.

Wall Street analysts project a 12-month average price target of $84.30, with a high forecast of $90, representing a 17% potential upside from the current price of $72.05, with a strong buy rating.

With solid earnings, strong shareholder returns, and strategic growth initiatives, Shell is well-positioned for continued success, making it an attractive buy for investors seeking exposure to the energy sector.

For investors and traders looking to capitalize on the resurgence in the energy sector, Schlumberger and Shell offer compelling opportunities.

As global energy demand continues to rise, these two stocks are well-positioned to deliver significant returns, making them worthy additions to any investment portfolio.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.