The electric vehicle (EV) market continues to thrive in 2024, driven by substantial growth and innovation within the industry. Despite a temporary slowdown in demand in the U.S., Europe and China remain strong markets for EVs, with global registrations reaching nearly 14 million in 2023, according to a report by the International Energy Agency.

Recently, the EV theme has regained momentum, with major stocks like Tesla (NASDAQ: TSLA) and Rivian Automotive (NASDAQ: RIVN) experiencing robust price action following impressive delivery numbers.

Among the many promising EV stocks, two stand out as good investment opportunities this July – Li Auto (NASDAQ: LI) and Nio (NYSE: NIO). These companies are well-positioned to benefit from the ongoing growth and maturation of the EV market.

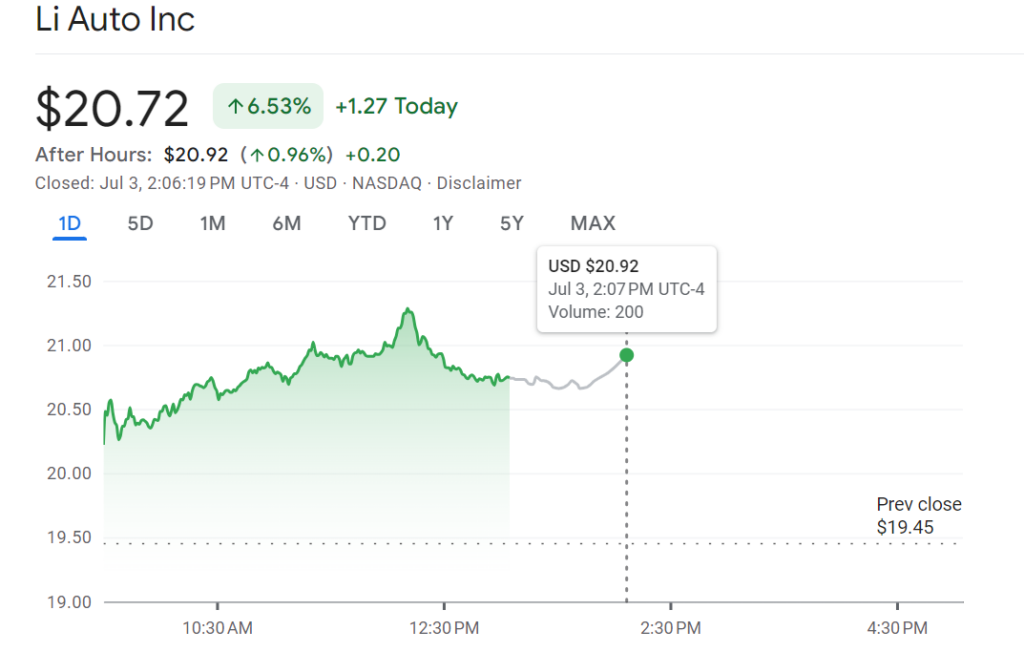

Li Auto (NASDAQ: LI)

Li Auto has demonstrated remarkable growth, standing out in a sector where many American counterparts are experiencing a slowdown. In the first quarter of this year, Li Auto’s vehicle revenue surged by 32.3% year-over-year (YOY) to $3.4 billion.

Additionally, the company’s delivery numbers soared by 52.9%, reaching 80,000 by the end of the quarter.

Furthermore, Li Auto’s strategic partnership with Nvidia (NASDAQ: NVDA) to incorporate DRIVE Thor centralized vehicle computers is set to enhance vehicle performance and autonomous driving capabilities.

Li Auto boasts a market cap of $19.4 billion and an enterprise value of $15.6 billion, with a current price of $20. The company’s strong financial position includes $8.75 billion in cash and short-term investments. Li Auto’s valuation ratios, such as a forward P/E of 22.85 and a PEG ratio of 1.18, indicate substantial growth potential.

Nio Inc. (NYSE: NIO)

Nio Inc., priced at $4.87, has shown significant growth among Chinese EV stocks, with a 233.8% increase in vehicle deliveries in May, totaling 20,544. Year-to-date deliveries reached 66,217, marking a 51% YOY increase, according to reports.

Nio’s partnership with Lotus Technology aims to standardize charging and battery swapping, enhancing recharging convenience. Their subscription-based battery swapping model allows for easy replacement of drained batteries, alleviating range and charging station concerns.

Founded in 2014, Nio has become a leading EV maker in China, delivering 43,854 vehicles year-to-date in 2023, a 15.8% YOY increase.

Nio Inc., with a market cap of $8.7 billion and an enterprise value of $7.3 billion, also presents a compelling investment case. The company’s valuation ratios, including a price-to-sales (P/S) ratio of 0.84 and a price-to-book (P/B) ratio of 1.79, reflect its strong market position.

Overall both Li Auto and Nio are poised to benefit from the expanding EV market, making them strong candidates for investment this July. Investors looking to capitalize on the growth of the EV sector can consider adding these stocks to their portfolios.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.