The Fed’s anticipated rate cut could make high-yield stocks more attractive compared to bonds. When interest rates fall, existing bonds become less appealing, potentially leading investors towards higher-yielding equities.

Investors are drawn to dividend stocks for several reasons. They provide a reliable stream of income, indicate a company’s financial health, and offer some protection against inflation.

Given these benefits and the shifting investment landscape, Finbold has identified two high-yield dividend stocks with a ‘Strong Buy’ rating for July 2024

HSBC Holdings plc (NYSE: HSBC)

HSBC Holdings plc (NYSE: HSBC) stands out in the financial sector with a market cap of $162.39 billion and an enterprise value of $111.87 billion. Key valuation ratios include a trailing PE ratio of 7.55 and a forward PE ratio of 6.66.

The PEG ratio, indicating potential growth, is an impressive 0.44. HSBC offers a dividend yield of 6.97%, with dividends of $3.05 per share paid over the past year on a quarterly basis.

The company’s payout ratio is 53.51%, and it has seen a dividend growth rate of 45.24% over the past two years.

The sale of HSBC’s Canadian banking operations to the Royal Bank of Canada resulted in a special dividend, boosting investor returns. Since the sale’s completion on March 28, 2024, HSBC’s share price has surged by over 10%.

Additionally, HSBC’s strong position in Asia enhances its appeal. HSBC (China) recently acquired Citi’s (NYSE: C) retail wealth management business, significantly increasing its invested assets and client base.

Despite geopolitical tensions and economic slowdowns, HSBC’s stock trades at a discount with a forward P/E of 7.36. This, combined with robust profit performance and shareholder rewards, makes HSBC a compelling buy.

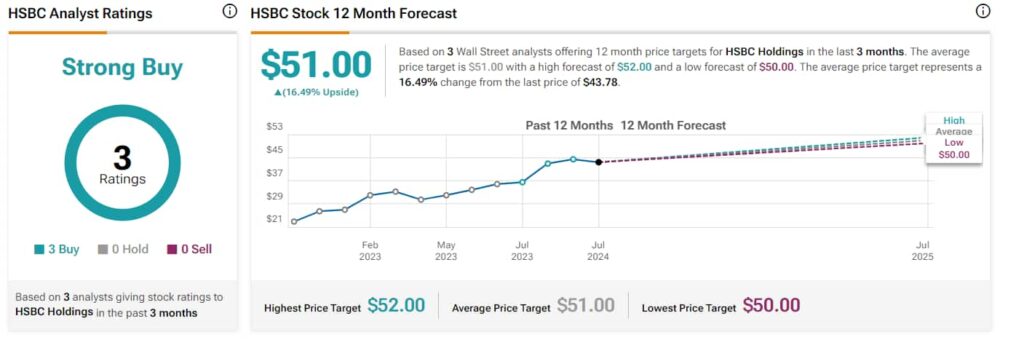

According to the consensus of three Wall Street analysts, the average 12-month price target for HSBC Holdings is $51.00, with a high forecast of $52.00 and a low forecast of $50.00, representing a 16.49% increase from the last price of $43.78 giving it a ‘strong buy’ rating.

Frontline Ltd. (NYSE: FRO)

Frontline Ltd. (NYSE: FRO), a leading contract oil shipping company, operates a fleet of 76 oil tankers. The company has a market cap of $5.24 billion and an enterprise value of $8.38 billion.

Valuation ratios include a trailing PE ratio of 8.23 and a forward PE ratio of 6.69. Frontline boasts a dividend yield of 8.88%, with $2.09 per share paid in the past year on a quarterly basis.

Geopolitical factors, such as risks associated with traveling through the Suez Canal and the dry season affecting the Panama Canal, have increased shipping rates, benefiting companies like Frontline.

In Q1 2024, Frontline reported a 16% year-over-year revenue increase to $578.5 million and an EPS of 81 cents per share, according to sources. Strong oil demand from countries like China, India, and Japan continues to drive business, with FRO shares up nearly 50% in 1 year.

Despite this growth, the stock trades at just 6.6x forward earnings, which is low compared to industry averages and indicates undervaluation.

This low valuation, combined with strong financial performance, makes Frontline a bargain for investors.

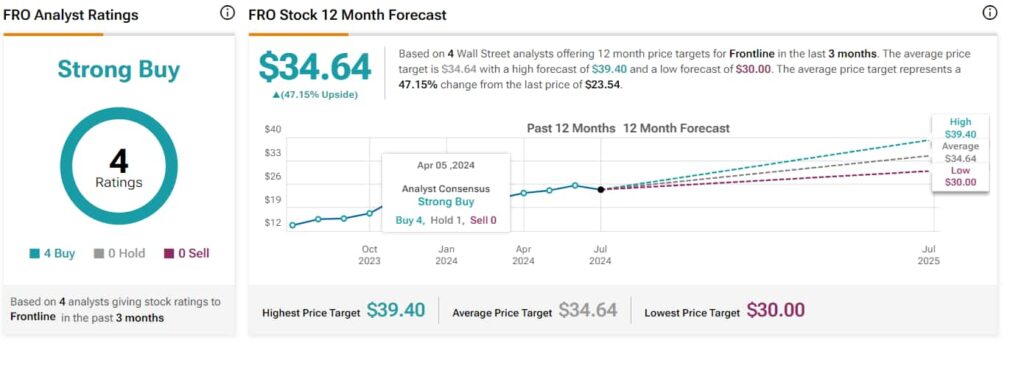

According to four Wall Street analysts, the average 12-month price target for Frontline is $34.64, with a high forecast of $39.40 and a low forecast of $30.00, representing a 47.15% increase from the last price of $23.54, giving it a ‘strong buy’ rating.

In conclusion, both HSBC Holdings and Frontline offer robust dividend yields and strong growth prospects, making them excellent choices for investors seeking high returns.

As markets rise, incorporating these dividend-paying stocks into the portfolio could enhance investment returns and provide a steady income stream.

However, investors should exercise caution and conduct their own research to ensure these investments align with their risk tolerance.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.