Cardano (ADA) has etched out a niche as a particularly developer-friendly blockchain ecosystem.

The increasing adoption of its Plutus-based smart contracts remains a key benchmark for evaluating Cardano’s long-term prospects.

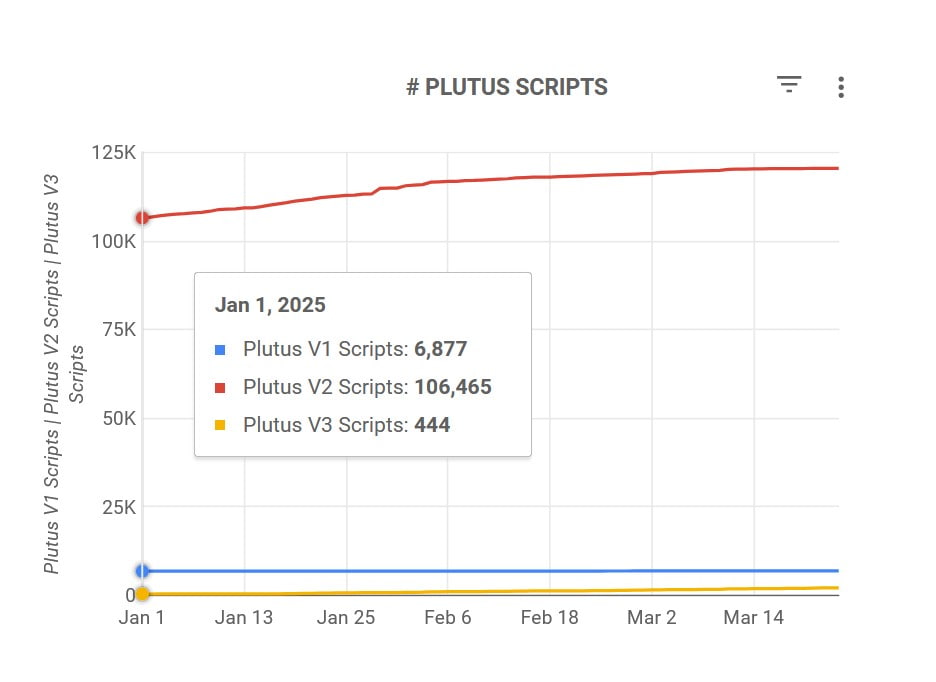

At the beginning of the year, the ecosystem had 6,877 Plutus V1 scripts, 106,464 Plutus V2 scripts, and 444 Plutus V3 scripts, for a total of 113,786, according to data retrieved by Finbold from Cardano Blockchain Insights.

So, how has the ecosystem fared since the beginning of the year?

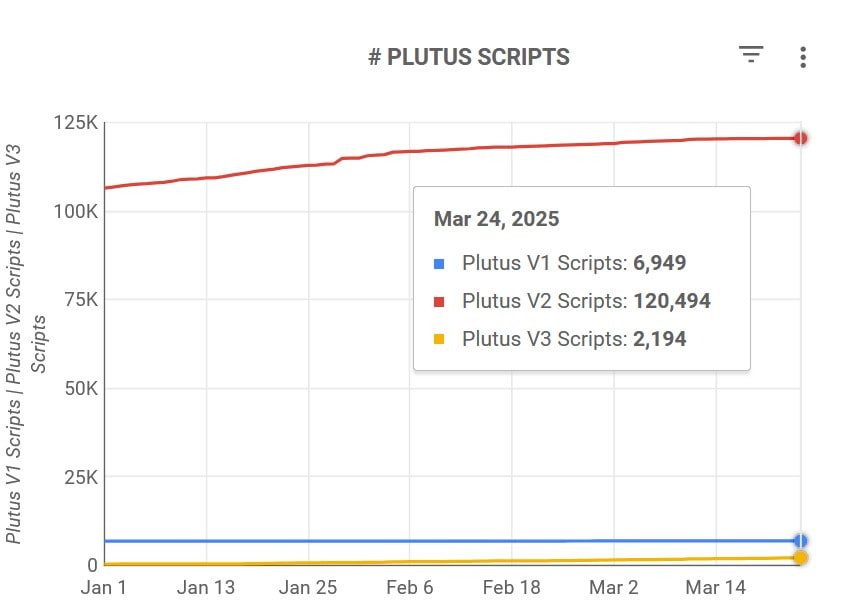

It is thriving — by press time on March 25, the number of Plutus V1 scripts had increased to 6,949, while Plutus V2 scripts now number 120,494. However, Plutus V3, the latest iteration of Cardano’s smart contracts, saw the biggest uptick in number, having marked an almost fivefold increase.

On the whole, the ecosystem now boasts 129,637 smart contracts — 15,851 more than at the beginning of the year.

This bodes quite well for Cardano — the Plutus V3 upgrade, apart from providing advanced interoperability and security features, went a long way in reducing development costs.

Cardano’s bid to attract developers looking for cost-effective solutions geared toward everything from decentralized finance (DeFi) and non-fungible tokens (NFTs) to decentralized applications (dApps) seems to be paying off.

Cardano has dipped, but smart contract growth hints at growth potential

This latest development hasn’t gone unnoticed by investors, either. First, let’s backtrack and take a look at some key developments relating to Cardano’s price action since the start of the year.

Back in late January, Finbold noted a technical setup that suggested that ADA could see prices increase by as much as 40%. While the asset did end up experiencing a strong rally, up to a year-to-date (YTD) high of $1.14 on March 2, prices did not meet the proposed target — and the rally was driven by President Trump’s announcement that the strategic crypto reserve would include Cardano.

Soon after, however, volatility on account of tariffs drew investors away from high-risk assets, and the cryptocurrency market, ADA included, saw sharp pullbacks.

By press time, Cardano was changing hands at a price of $0.762, having marked a 4.41% gain in the last seven days which has brought year-to-date (YTD) losses down to 12.31%.

Thus far in 2025, the token has underperformed the wider crypto market — but it is obvious that its main draw, being utility, is still garnering healthy growth for the wider ecosystem. Increasing regulatory clarity, as well as the advent of the strategic reserve, present strong bullish catalysts.

At the same time, Grayscale’s Cardano exchange-traded fund (ETF) filing, which will most likely receive confirmation by August 25, signals a strong degree of institutional interest. The project has quite an ambitious roadmap for 2025, and OpenAI’s most advanced models, when queried by Finbold, set price targets that imply significant upside, even in neutral to mildly bearish market conditions.

Featured image from Shutterstock