With the recent impressive surge in the price of shares of online used-car dealer Carvana (NYSE: CVNA) after the release of a better-than-expect Q1 earnings report, their short sellers have accumulated face-melting losses, with figures nearing $4 billion in one year.

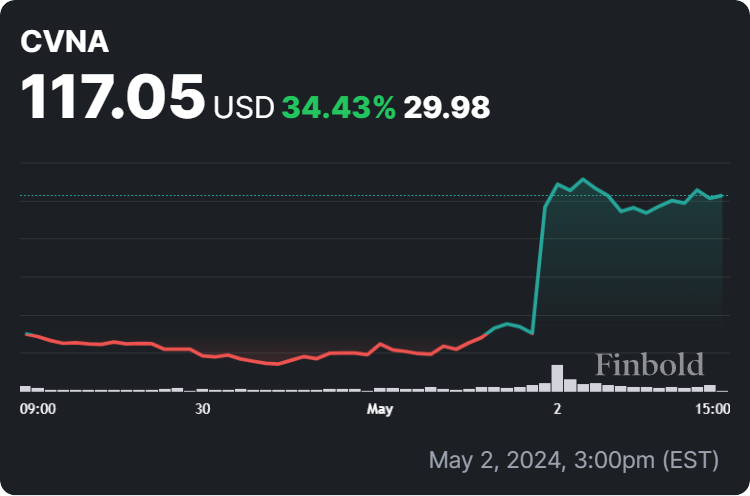

Indeed, Carvana shares surged over 30% in pre-market trading on May 2, catapulting CVNA stock from $87 to $116 after the release of the company’s positive Q1 earnings report, which showed it had managed to avoid losses and turned a profit following restructuring and strategic adjustments.

Carvana stock short-seller losses

As it happens, the skyrocketing CVNA share prices have pushed the stock’s annual advance to surpass 1,500%, extending short-seller losses to a whopping $3.9 billion, with just the recent daily price increase costing them over $860 million in paper losses, according to a Bloomberg report on May 2.

Picks for you

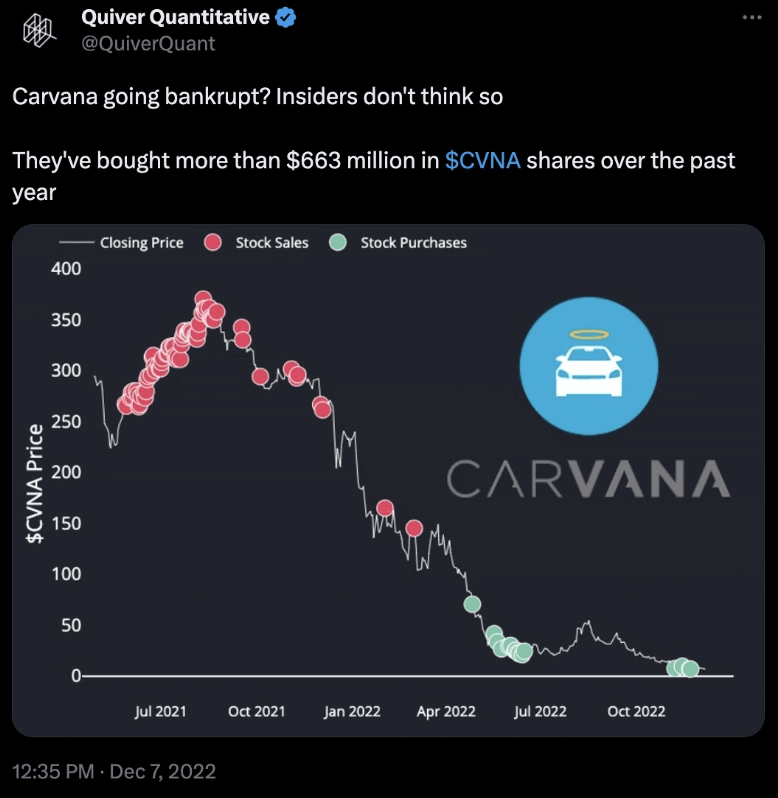

Meanwhile, X user tracking insider trades, Quiver Quantitative, referred to the recent price increase as “ridiculous,” pointing out that, in December 2022, a Carvana bankruptcy looked imminent but that insiders didn’t think so, having bought over $663 million in CVNA shares during the preceding year.

Carvana father-son duo profit

At the same time, the 3,000% surge from historic lows has brought Ernie Garcia II and Ernie Garcia III, the father-son duo behind the company, over $11 billion in combined net worth since December 2022 – the month in which CVNA shares dipped below $4 as Carvana faced significant troubles.

Specifically, the one-day bullish rally for the price of CVNA shares has pushed the older Garcia’s fortune to $10.9 billion from a 2022 low of $3.1 billion, while his son’s net worth climbed to $3.8 billion, according to the data shared by analysts from Bloomberg Billionaires Index.

Commenting on the recent developments, the 42-year-old Ernie Garcia III, Carvana’s CEO who co-founded the company in 2012 with his 67-year-old father and who derives his wealth mostly from his stake in Carvana, told Bloomberg TV:

“2022 and 2023 were a tough run for us. (…) When we went through that period, the team came together, we responded incredibly well and I think this quarter is undoubtedly the best quarter we’ve had in our history.”

Carvana stock price analysis

Currently, the CVNA stock is changing hands at the price of $117.05, which suggests a 33.77% gain in the last 24 hours, an advance of 34.43% across the previous seven days, adding up to the 40.89% increase on its monthly chart, as per the most recent data obtained on May 3.

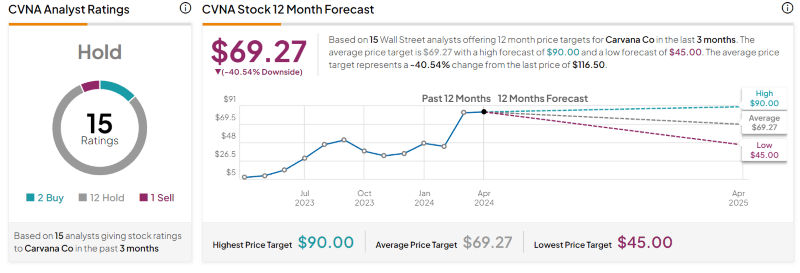

That said, Wall Street experts are still largely undecided on Carvana, with 12 of them rating CVNA stock as a ‘hold,’ only two recommending a ‘buy,’ and one standing by the ‘sell’ recommendation, collectively placing the average price target at $69.27, as per TipRanks data.

Not long ago, Finbold reported on Carvana stock as “coming back from the dead” with an 800% surge over the previous 12 months despite teetering on the edge of bankruptcy with a $6.3 billion in debt, trades at a 110x price-to-earnings (P/E) ratio, and default rates on car loans mimicking the 2008 crisis.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.