After months of uncertainty regarding the possible onset of a recession in the United States, market sentiments are now pointing to a reversal, expecting economic stability for the remainder of 2024.

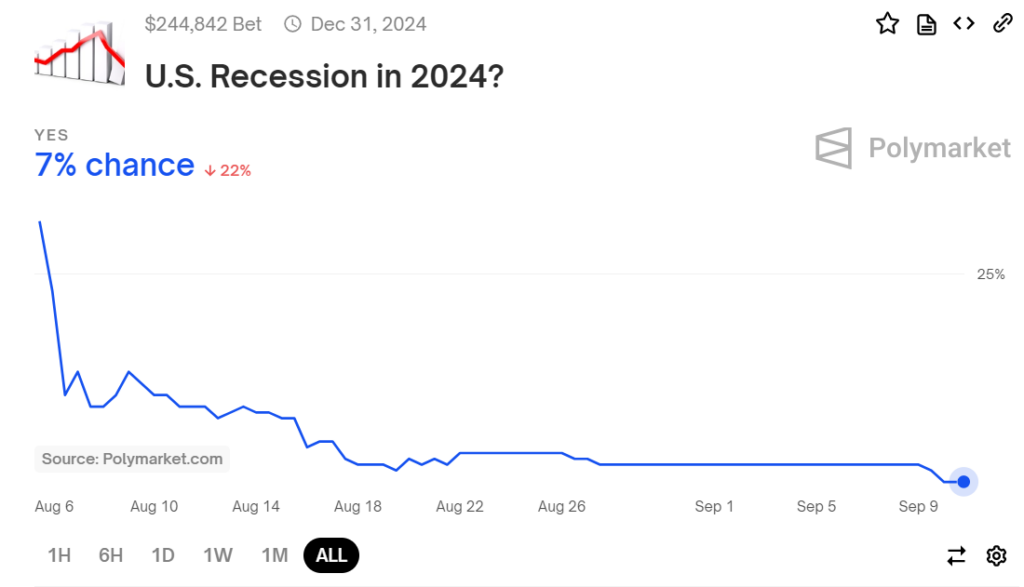

In this case, based on the possible economic outlook highlighted in the prediction market, the odds of a recession in 2024 have been plunging in recent weeks. Data obtained from the prediction platform Polymarket shows that on September 9, 2024, the chances of an economic downturn had dropped to an all-time low of 7%.

The rate peaked on August 5, when the figure stood at 30%. The bet, set to expire on December 31, 2024, has attracted a stake of almost $245,000.

The recession will be realized if the U.S. records two consecutive quarters of negative gross domestic product (GDP) growth in 2024. Indeed, the chances of a downturn have dropped despite showing signs of weakness stemming from disappointing jobs data for August.

Indeed, the data pointed to the Federal Reserve’s possible interest rate cut in September, with the markets uncertain regarding the exact value. The expectation is that the institution will lower by 25 basis points.

Notably, a section of the market believes that the rate will likely alter the possibility of a recession. Some analysts have maintained that there is a chance of a slowdown, but no consensus exists regarding the timings.

Analysts take on U.S. recession

In the meantime, experts such as economist Peter Schiff maintain that a Fed rate cut will not stop the recession. In an X post on September 10, Schiff suggested that based on economic patterns, the U.S. might already be in a downturn awaiting official confirmation.

“The Fed’s rate cuts won’t prevent a recession. In fact, the U.S. economy has likely been in a recession for some time, though it hasn’t been officially confirmed yet. While short-term rates may fall, long-term rates and inflation will rise, along with unemployment. Game over,” he said.

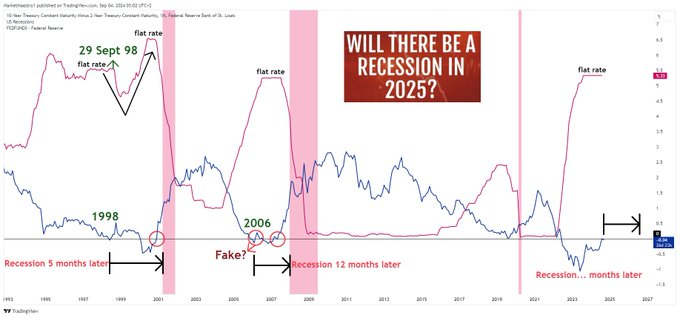

At the same time, an economist with the pseudonym Market Maestro noted in an X post on September 4 that based on historical patterns, the next recession, following the recent inverted yield curve and potential Fed rate cuts, may emerge within the next 12 to 24 months. This places the target of a next market downturn at least in 2025.

However, he noted that there remains a big chance that the markets might see a soft landing if conditions stabilize or Fed policies effectively mitigate economic slowdown risks.

On the other hand, Henrik Zeberg has maintained that investors should anticipate a recession, which he believes is guaranteed. In the previous market outlook, the macroeconomist projected that before the recession, both the stock and cryptocurrency markets would experience a significant rally before crashing while maintaining that the Fed is late to the rescue.

After experiencing a disastrous first week of September, equities and cryptocurrencies exhibit near-term bullishness, reviving optimism of stabilizing conditions. In summary, the chances of a recession now hinge on the impact of the upcoming Fed interest rate cut.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.