After gold suffered its most significant drop in over a month amid declining expectations that the United States Federal Reserve was planning to make any large interest rate cuts, a popular artificial intelligence (AI) model has offered its potential price range for the end of 2024.

Indeed, the price of spot gold currently stands at $2,617.06, which indicates a decline of 0.26% on the day, a 1.44% drop across the past week, making a modest recovery after dipping more than 1% on October 8, but still falling well short below its all-time high (ATH) of $2,708.70 on October 1.

ChatGPT’s gold price prediction: $2,100 – $2,600

In this context, Finbold has asked OpenAI’s popular AI model, called ChatGPT-4o, for insights on the possible price range for the yellow metal by the end of 2024, and it has delivered some projections based on key market factors and other influential elements.

Specifically, ChatGPT-4o has highlighted the “ongoing geopolitical risks, such as the conflicts in Ukraine and the Middle East,” as the factors that “continue to drive demand for gold as a safe-haven asset,” suggesting that gold prices would continue rising through the end of 2024.

Furthermore, the generative AI chatbot has offered several prognoses by renowned experts, including the team at JP Morgan (NYSE: JPM), which “projects gold prices averaging $2,500 per ounce by Q4 2024, citing structural drivers like inflation hedging, central bank buying, and geopolitical concerns.”

Additionally, ChatGPT referred to the UBS (NYSE: UBS) team’s view that “gold could reach $2,600 per ounce by the end of 2024, up from earlier estimates,” while analysts from Kitco expect a slightly less bullish range of $2,100 to $2,300 per ounce by the end of 2024.

Analysts’ gold price prediction

Meanwhile, David Meger, director of metals trading at High Ridge Futures, highlighted gold’s recent retracement as the result of the “change in outlook in regards to interest rates,” arguing that bond yields have soared and that expectations of further extensive interest rate cuts have gone down.

At the same time, Kitco’s Gary Wagner explained that “the pace of the decline has accelerated, confirming that gold is experiencing a genuine correction rather than a mere consolidation,” adding that the reasons included dollar strength and its status as a “go-to safe-haven asset amid geopolitical uncertainties.”

“Also, the resurgence in dollar value is closely tied to shifting expectations regarding upcoming Federal Reserve interest rate decisions.”

In fact, he believes that the previous speculation of a considerable 50 basis point rate cut at the November Federal Open Market Committee (FOMC) meeting has subsided to zero due to market sentiment undergoing a dramatic transformation in recent weeks.

On the other hand, Wagner noted that “many analysts believe that the long-term outlook for gold remains positive,” taking into account the fundamental factors that triggered gold’s significant rally this year, “including economic uncertainties and geopolitical tensions.”

Gold price analysis

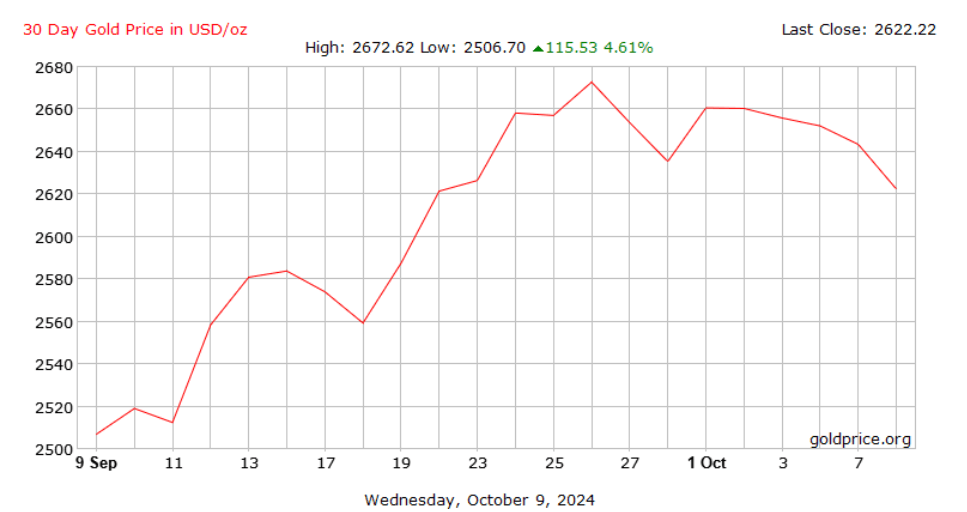

For the time being, gold is changing hands at the price of $2,615 per ounce, down 0.26% on the day, as well as declining 1.44% across the past week while still recording a 4.61% gain on its monthly chart, according to the most recent data retrieved on October 9.

All things considered, gold is in a bit of a rough spot at the moment, but both experts and AI models agree on one thing – it does have the potential to increase or at least retain the status quo on its price by the end of the year. However, doing one’s own research is critical as trends can change.