As the United States Department of Justice served Nvidia (NASDAQ: NVDA) with a subpoena as part of its probe into the semiconductor manufacturer’s alleged antitrust practices that make it difficult for buyers to switch to other suppliers, it had an expected impact on NVDA stocks.

Indeed, after delivering questionnaires to other technology companies, the DoJ has moved to the next step and started to issue legally binding requests for information that force recipients to respond, according to the people familiar with the investigation, as Bloomberg reported on September 3.

Commenting on the accusations of potentially unfair competitive practices, the company’s representative said in an emailed statement that Nvidia’s market dominance is simply the result of its products’ superior quality and higher performance speeds:

“Nvidia wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them.”

ChatGPT-4o’s Nvidia stock price prediction

In this context, Finbold has tasked ChatGPT-4o, the OpenAI artificial intelligence (AI) model, to provide insights into the possible price of Nvidia stock at the end of 2024, taking into consideration the recent subpoena and its potential effects and the platform has delivered.

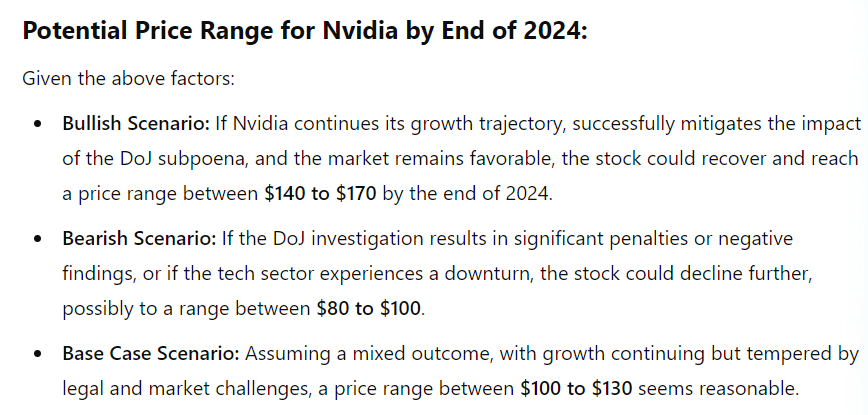

Specifically, ChatGPT has taken into account a “variety of factors, including the company’s fundamentals, market conditions, and external events like the Department of Justice (DoJ) subpoena,” offering three potential scenarios for the Nvidia stock price by the end of 2024.

According to the AI chatbot, the most bullish scenario envisions Nvidia stock price between $140 and $170 by the year’s end, the bearish conditions would lead to a price range between $80 and $100, whereas the base case scenario assumes the price in the area between $100 and $130.

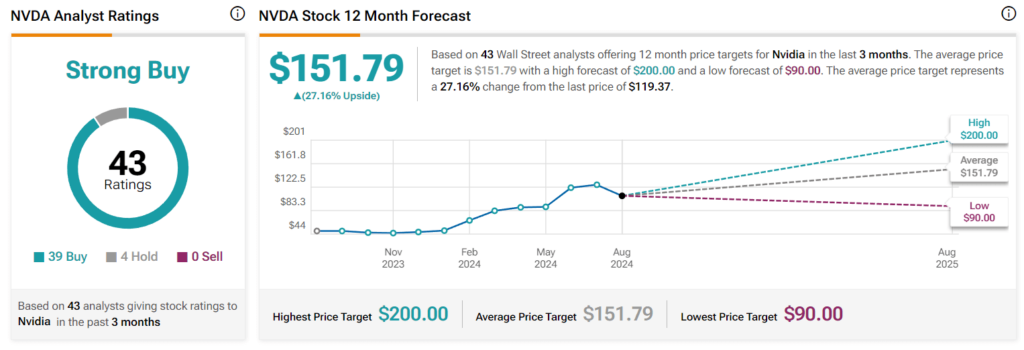

Meanwhile, Wall Street analysts remain firmly optimistic about their NVDA stock prediction, setting their Nvidia stock price prediction 2025 at an average of $151.79, which would indicate a positive change of 27.16% from its current situation, with the overwhelming score of a ‘strong buy.’

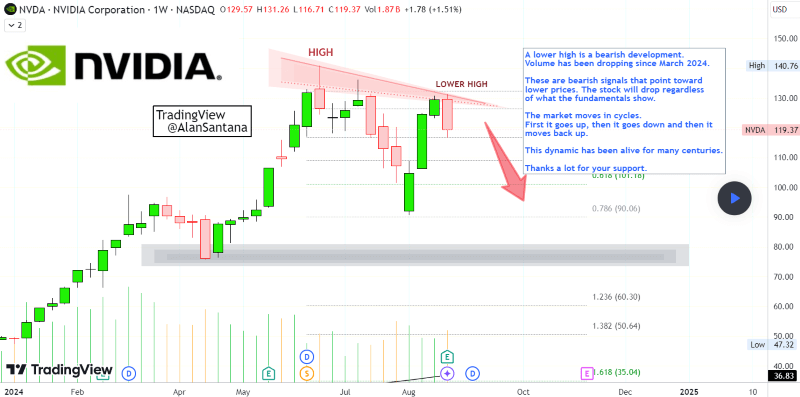

On the other hand, trading analyst Alan Santana recently observed that Nvidia shares might lead the declines in the upcoming bear market and fall in the territory below $100 in the next couple of months, provided the technical analysis (TA) indicators remain uncertain, as Finbold reported on September 2.

Nvidia stock price history

For the time being, the price of Nvidia stock stands at $108, which indicates a decline of 9.53% on the day, adding up to the accumulated 13.61% drop across the past week, and reducing its monthly advance to 7.52% and its year-to-date (YTD) gains to 124.21%, as per data on September 4.

So, why is Nvidia stock going down today? Notably, the main answer to the question of ‘why did Nvidia stock drop?’ is the most recent development in the DoJ’s case against the company, but it can also be the result of investors bracing for the concerning jobs report by the U.S. Department of Labor.

On top of that, fears are rising again that China might invade Taiwan, especially considering the territory’s crucial role in semiconductor and AI trends and it being the home of Taiwan Semiconductor Manufacturing (NYSE: TSM) – one of the leading manufacturers of chips for AI applications supplying Nvidia.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.