The new year offers investors another opportunity to stake a claim in companies with strong growth potential. As economic conditions evolve, sectors such as healthcare, artificial intelligence, and e-commerce continue to drive innovation, making a carefully curated $1,000 portfolio an excellent starting point for the year ahead.

By combining high-growth stocks, reliable dividend payers, and a defensive pick, investors can strike a balance between capital appreciation and stability.

The Federal Reserve’s recent 25-basis-point rate cut has created a favorable climate for growth-oriented sectors that benefit from lower borrowing costs while simultaneously enhancing the appeal of dividend-paying stocks as an attractive alternative to low-yield fixed-income investments.

Picks for you

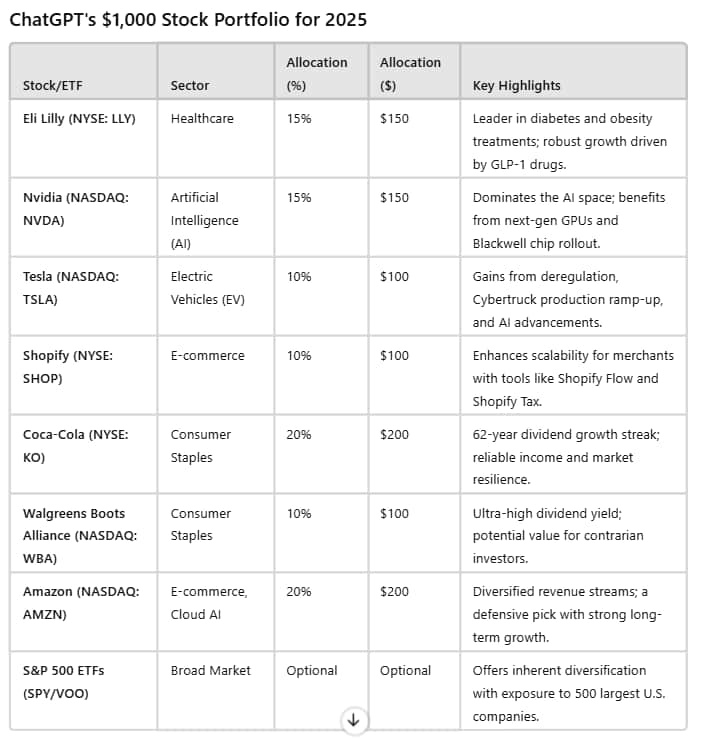

Leveraging insights from OpenAI’s ChatGPT, Finbold has curated a $1,000 stock portfolio designed to capture growth opportunities in key industries while maintaining stability through diversified income sources.

Allocating $1,000 in the stock market

Growth stocks dominate 50% of the allocation, targeting high-potential sectors such as healthcare, AI, and e-commerce.

ChatGPT-4o assigned 15% of the portfolio, or $150, to Eli Lilly (NYSE: LLY). The pharmaceutical giant has become a leader in diabetes and obesity treatments, with its GLP-1 drugs, such as Mounjaro and Zepbound, driving explosive revenue growth.

With its strong market position and robust earnings outlook, Eli Lilly is positioned to capitalize on the growing demand for advanced healthcare solutions in 2025.

Nvidia (NASDAQ: NVDA) also secured a 15% allocation, equivalent to $150. According to ChatGPT-4o, Nvidia remains the cornerstone of the AI space, benefiting from surging demand for its next-generation GPUs. With the rollout of its Blackwell chips expected to boost performance across AI and data center applications, Nvidia continues to dominate the semiconductor industry.

Another 10% allocation, or $100, went to Tesla (NASDAQ: TSLA), which is set to benefit from deregulation efforts under the Trump administration and a ramp-up of its Cybertruck production in 2025.

The company’s focus on cost reductions, new market expansions, and advancements in AI, including the Optimus robot, further strengthens its growth potential.

Shopify (NYSE: SHOP), a leader in e-commerce, also commands 10%, or $100. Shopify’s innovative tools, such as Shopify Flow and Shopify Tax, enhance merchant scalability and attract enterprise clients, reinforcing its stronghold in the digital retail space.

For dividend stability, ChatGPT-4o assigned 20%, or $200, to Coca-Cola (NYSE: KO). With its impressive 62-year dividend growth streak and strong global brand, Coca-Cola continues to deliver reliable income and market resilience.

Another dividend stock, Walgreens Boots Alliance (NASDAQ: WBA), received 10%, or $100, of the portfolio. Despite ongoing restructuring challenges, its ultra-high dividend yield provides a potential opportunity for contrarian investors.

Rounding out the portfolio, Amazon (NASDAQ: AMZN) received a 20% allocation, or $200. ChatGPT-4o highlighted Amazon’s diversified revenue streams across e-commerce, cloud computing, and AI, which make it a reliable choice for both stability and long-term growth.

ChatGPT-4o also highlighted the importance of broad market diversification. To achieve this, a portion of the portfolio could be allocated to S&P 500 ETFs, such as the SPDR S&P 500 ETF (SPY) or Vanguard S&P 500 ETF (VOO), depending on risk appetite. These ETFs replicate the index’s performance, providing a reliable backbone to the portfolio.

By focusing on high-growth sectors like healthcare, AI, and EVs, while anchoring stability through dividend stalwarts, the portfolio provides a foundation for steady returns in an evolving market.

The inclusion of Amazon as a defensive pick and the S&P 500 for broad market exposure adds an extra layer of resilience, ensuring a comprehensive strategy for navigating the year ahead. Whether the goal is capital appreciation or consistent income, this portfolio offers a well-rounded roadmap for seizing opportunities in 2025.

Featured image via Shutterstock