Apple Inc. (NASDAQ: AAPL) wrapped up 2024 on a high note, delivering an impressive 34% annual gain and significantly outperforming the S&P 500 Index’s (SPX) 25% return.

Despite this impressive performance, iPhone sales, the company’s largest revenue driver, have shown limited growth in recent years, leaving its overall revenue trajectory relatively stagnant.

While ambitious projections of a $4 trillion market cap fueled optimism tied to Apple’s push into artificial intelligence (AI), the outlook has left investors divided, questioning where the company’s stock will stand by the end of 2025.

At press time, AAPL shares are trading at $244.27. While the stock has dropped 4% over the past week, it remains up 3.3% for the month, reflecting mixed market sentiment.

ChatGPT prediction for Apple stock price in 2025

To explore Apple’s outlook for 2025, Finbold consulted ChatGPT-4o, which forecasts that the company’s stock could reach $300 by the end of 2025, reflecting Apple’s ability to adapt to varying market conditions and navigate upcoming challenges.

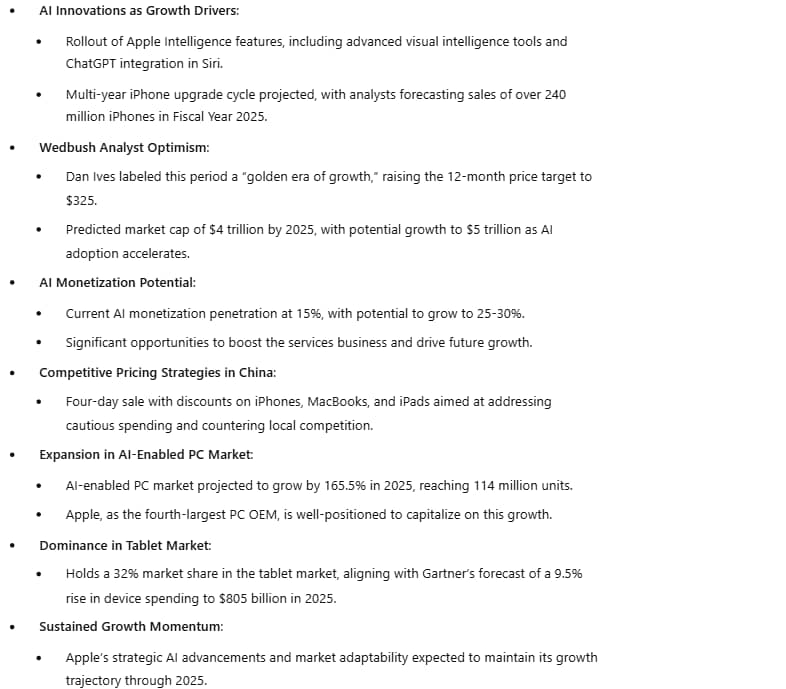

The AI model identifies Apple’s strategic pivot toward artificial intelligence as a game-changer, marked by the rollout of Apple Intelligence features, including advanced visual intelligence tools and integration of AI-powered functionalities like ChatGPT in Siri.

These advancements are projected to drive a multi-year iPhone upgrade cycle, with analysts predicting sales of over 240 million iPhones in Fiscal Year 2025.

This shift prompted Wedbush Securities analyst Dan Ives to call this a “golden era of growth” for Apple, raising his 12-month price target to $325, the highest on Wall Street, and forecasting a $4 trillion market cap by 2025, with potential growth to $5 trillion as AI adoption accelerates.

Pricing strategies and potential monetization

The AI model also highlights Apple’s focus on pricing strategies in China, where the company is offering discounts on its latest iPhone models during a four-day sale to counter fierce competition from local competitors.

These discounts, coupled with price cuts on older iPhones, MacBooks, and iPads, as the AI tool notes, are a move to address a cautious spending environment in China’s slowing economy.

Moreover, ChatGPT highlights Apple’s potential to effectively monetize its AI offerings, which could significantly boost its services business and drive future growth.

This view aligns with insights from Dan Ives, who estimates that Apple’s AI monetization is currently only 15% penetrated, with the potential to expand to 25-30%.

According to Ives, such advancements could propel Apple to an extraordinary $5 trillion market cap within the next 12–18 months, further solidifying its position as a tech industry leader.

Expansion in the AI-enabled PC and Tablet markets

ChatGPT also highlights Apple’s strong positioning in the AI-enabled PC market, which is projected to grow by an impressive 165.5% in 2025, reaching 114 million units. As the fourth-largest PC OEM, Apple is well-positioned to capitalize on this surge

Furthermore, its dominance in the tablet market is also expected to grow in line with Gartner’s prediction of a 9.5% rise in device spending to $805 billion, driven by growing consumer demand for AI-powered features.

These factors will likely sustain Apple’s growth momentum and support its stock performance throughout 2025.

Featured image via Shutterstock