Some of us might be due for a windfall in the form of a $1,400 IRS payment. Today is Tax Day, and on top of that, the last day that you can apply to claim a recovery rebate credit for 2021.

Confused? During the pandemic, the government sent out several rounds of stimulus checks. Seeing as how many Americans did not file for 2021 taxes — either due to low income or loss of labor, they did not file for this particular check — but they do qualify.

If you’re not facing immediate and necessary expenses, putting that $1,400 IRS payment to work in the financial markets is probably a prudent decision. Even if you don’t qualify for the payment, taking the time to consider what you would do with an unexpected windfall offers a good sounding board that can help

ChatGPT would invest the $1,400 IRS payment in AI and healthcare

When queried on the topic by Finbold, OpenAI’s flagship model, ChatGPT-4o, selected two high-profile businesses in sectors that are not correlated with one another — artificial intelligence (AI) and healthcare.

To be more precise, the large language model (LLM) singled out Super Micro Computer stock (NASDAQ: SMCI) and Eli Lilly stock (NYSE: LLY) as potentially high-growth investments, and suggested an equal allocation between the two.

Super Micro Computer (NASDAQ: SMCI)

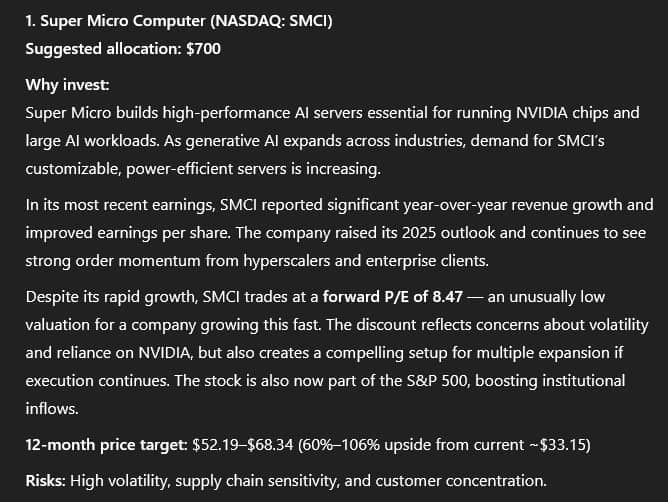

In terms of the former, ChatGPT reflected on Supermicro’s crucial position as a hardware supplier and high-performance server builder, particularly as it relates to Nvidia chips.

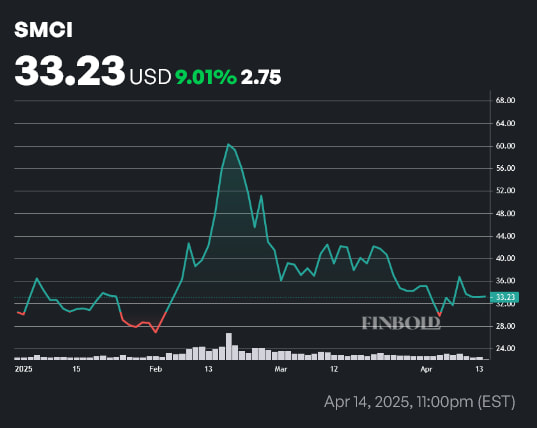

At press time, SMCI stock was changing hands at a price of $33.23, with a 9.01% gain on the year-to-date (YTD) chart.

The AI model noted that the semiconductor company’s last earnings call saw a 103% increase in year-over-year (YoY) revenue growth as well as a doubling of earnings per share (EPS).

Lastly, OpenAI’s LLM reflected on the presently low valuation of SMCI stock. As of April 15, Super Micro stock trades at a forward price-to-earnings (P/E) of just 7.8.

While this reflects concerns regarding volatility (owing to the fact that SMCI shares almost got delisted last year) as well as overreliance on Nvidia, ChatGPT is confident that, despite supply chain sensitivity, Super Micro stock can reach levels between $52 and $69 in 12 months, which equates to a 60% to 106% rally. Taking $700 out of the $1,400 IRS payment and investing it in SMCI stock would provide a $420 to $742 profit, should ChatGPT’s price targets be met.

Eli Lilly (NYSE: LLY)

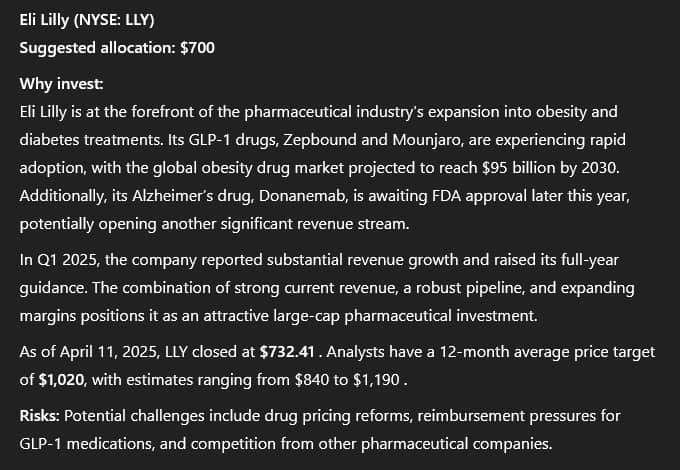

Eli Lilly is a pharmaceutical giant — and while most of the attention is focused on its GLP-1 drugs, the business maintains a robust pipeline of diverse treatments.

At press time, LLY shares were changing hands at a price of $759, after having marked a 1.68% loss since the start of the year.

OpenAI’s flagship model suggested allocating half of the $1,400 IRS payment to invest in LLY stock on account of Q2’s standout results, which saw full-year guidance being raised by $4 billion.

In addition, ChatGPT noted strong growth in the weight loss drug market, as well as potential FDA approval for Donanemab, an Alzheimer’s disease treatment, later this year, as potential catalysts for the healthcare company.

Despite not setting a price target of its own, the LLM highlighted that the average 12-month price forecast for Eli Lilly stock sits at $1,020, a figure that implies a 35.45% upside.

Featured image via Shutterstock