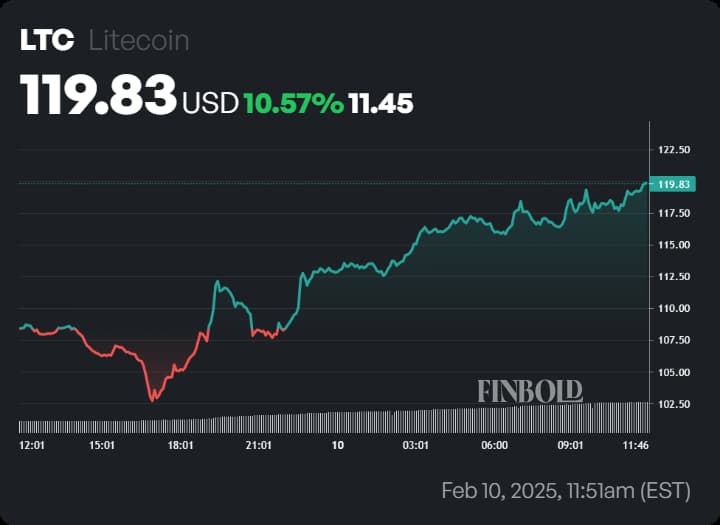

After experiencing a sharp downturn earlier this month amid broader market turbulence, Litecoin (LTC) has rebounded strongly. The cryptocurrency has climbed nearly 10% in a day, trading at $119 at press time, as growing speculation over a potential exchange-traded fund (ETF) drives renewed investor interest.

With regulatory momentum growing, analysts and traders are closely watching Litecoin’s next move as anticipation builds around its potential for further gains.

ChatGPT sets Litecoin price for Q1 2025

To assess Litecoin’s potential in early 2025, Finbold analyzed market data and consulted OpenAI’s advanced ChatGPT-4o model for insights.

According to ChatGPT-4o, Litecoin is projected to trade between $130 and $135 by the end of Q1 2025, provided market conditions remain favorable.

However, the AI model notes that delays in ETF approval or broader market weakness could stall momentum, keeping LTC below key resistance levels.

Key factors driving Litecoin’s momentum

Much of Litecoin’s recent price momentum stems from growing expectations that a Litecoin ETF could be approved in the coming months.

Nasdaq has formally filed 19b-4 applications with the U.S. Securities and Exchange Commission (SEC) to list and trade the CoinShares Litecoin ETF, alongside a similar fund for XRP.

Bloomberg ETF analyst Eric Balchunas suggested earlier this year that Litecoin could be among the first crypto ETFs to receive approval under the next administration.

Moreover, Polymarket currently assigns an 80% probability to a Litecoin ETF gaining approval this year, highlighting traders’ growing confidence in a potential launch.

ChatGPT-4o highlights that an ETF approval could push Litecoin toward the upper end of its projected range of $135.

Regulatory clarity and institutional interest

Litecoin benefits from a clear regulatory status, unlike many other cryptocurrencies facing regulatory scrutiny.

The Commodity Futures Trading Commission (CFTC) has classified LTC as a commodity in its lawsuit against crypto exchange KuCoin, meaning it is not subject to SEC securities regulations.

ChatGPT-4o notes that this regulatory clarity makes Litecoin a more attractive investment option for institutional players.

However, the AI model also points out that while regulatory stability helps reduce downside risks, it may not be enough on its own to drive significant price gains unless accompanied by major institutional inflows.

Derivative data signals increasing bullish sentiment

When provided with additional derivatives data from CoinGlass, the AI model notes that Litecoin’s long-term outlook appears increasingly bullish.

Trading volume has surged 246.45% to $1.86 billion, while open interest has climbed 19.89% to $617.78 million, indicating heightened market activity and growing investor interest. The long/short ratio on Binance and OKX remains above 1, indicating a stronger bias toward long positions.

Conclusion

While ChatGPT-4o’s projections reflect growing optimism surrounding a potential ETF approval, with strong derivatives data and regulatory clarity adding to Litecoin’s bullish outlook, broader market conditions and macroeconomic factors will ultimately determine whether these targets can materialize.

Investors should closely monitor these key developments in the ecosystem to assess whether Litecoin can sustain its rally toward the projected $130 to $135 range by Q1, 2025.

Featured image via Shutterstock