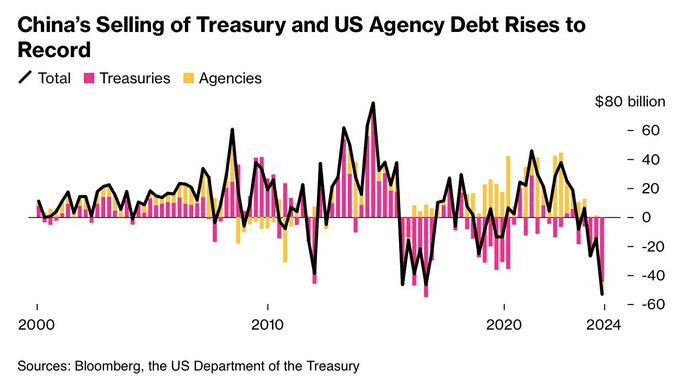

As the economic relations between China and the United States continue to draw investor interest, the East Asian nation has been consistently offloading substantial amounts of U.S. Treasuries and agency debt, and this figure has reached a staggering $74 billion in the last seven months alone.

Specifically, China had dumped $21 billion in U.S. Treasuries and agency bonds in late 2023, adding up to the record-breaking $53.3 billion in the first quarter of 2024 and bringing the total amount to over $74 billion in the past seven months, as per combined data shared by Bloomberg during this time.

China reassesses policies

Indeed, the recent moves by China, traditionally a major holder of U.S. debt, suggests that the country has changed its global investment patterns and diversification practices, possibly as part of reassessing its holdings amid geopolitical tensions, as Finbold reported on May 16.

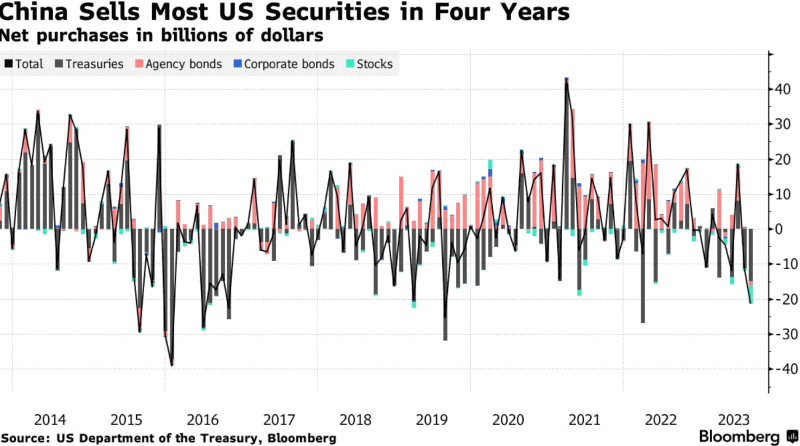

As a reminder, Bloomberg reported back in October 2023 on Chinese investors offloading the most US bonds and stocks in four years in August that year, with the bulk of their $21.2 billion of sales belonging to Treasuries and US equities, citing information from the U.S. Department of the Treasury.

Earlier, in April 2024, Finbold reported on China’s gold reserves surging by over 225 tonnes in 2023 alone, as the nation consistently grew its holdings of the precious metal for 17 months in a row, and economic tensions against the U.S. continued to escalate.

Notably, U.S. President Joe Biden has recently declared sweeping tariff hikes on various Chinese imports as part of a broader strategy to battle what his administration sees as unfair trade practices by the East Asian country, and his rival in the presidential race, Donald Trump, announced similar if elected.