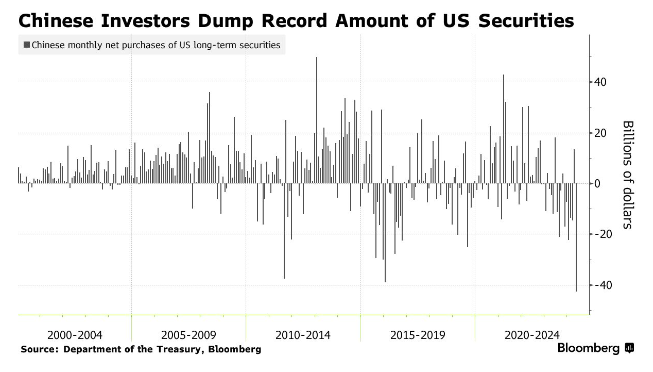

In May, Chinese investors sold a record amount of U.S. stocks and bonds, marking a significant shift in the financial landscape between the world’s two largest economies.

According to the latest data from the U.S. Department of the Treasury, funds from China offloaded a net $42.6 billion worth of long-term securities, which included Treasury, agency, corporate bonds, and equities, for a total of over $80 billion in the past five months.

This brought the total sales for the first five months of the year to $79.7 billion, setting an all-time high for January-May. This massive sell-off is attributed to rising diplomatic tensions and uncertainties surrounding the upcoming United States presidential election.

How will China’s sales impact the treasury and stock market?

The divestment by Chinese investors was primarily focused on U.S. Treasuries, which accounted for more than half of the sales, followed by agency debt and stocks.

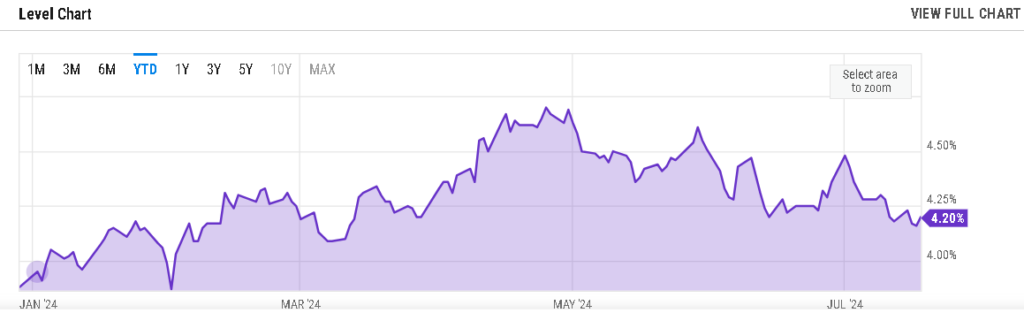

As a result, the benchmark Treasury 10-year note yield climbed to its highest level of 4.70% since November on April 25. China, one of the largest foreign holders of Treasuries, has its investment moves closely watched by bond investors and geopolitical strategists.

The increasing tensions between China and America have sparked speculation that Beijing may shift its foreign reserves away from U.S. assets, potentially putting additional upward pressure on yields.

Chinese investors are more inclined to diversify from U.S. assets

Chinese investors have several reasons to diversify away from U.S. assets, including an overvalued dollar, high U.S. equity valuations compared to Chinese equities, and a need for liquidity due to deleveraging, according to Wei Liang Chang, a macro strategist at DBS Bank.

The government data, however, have limitations as U.S. securities held in custodial accounts in third countries do not appear to be China’s holdings.

Since 2017, China’s holdings of Treasury notes and bonds have dropped by $440 billion, while securities held in Belgium, seen as custodial accounts for China, increased by $159 billion.

The potential Federal Reserve policy easing and a weaker dollar could make local securities more attractive to Chinese investors, discouraging them from holding too many dollar assets, as Ken Wong, an Asian equity portfolio specialist at Eastspring Investments, pointed out.