Bitcoin (BTC) is the leading cryptocurrency whose core value lies in being secure and uncensorable money powered by a decentralized network of miners, reaching consensus over its users’ transactions.

However, experts have challenged Bitcoin’s long-term security model and decentralization status over the years, warning of gradual proof-of-work centralization.

A study published by pseudonymous analyst b10c (@0xb10c, on X) suggests that mining operations centralization could be worse than ever. The analyst shared insights on April 17 that point to Bitmain dominating Bitcoin mining operations among multiple pools, raising concerns.

Is Antpool centralizing mining operations of other large Bitcoin pools?

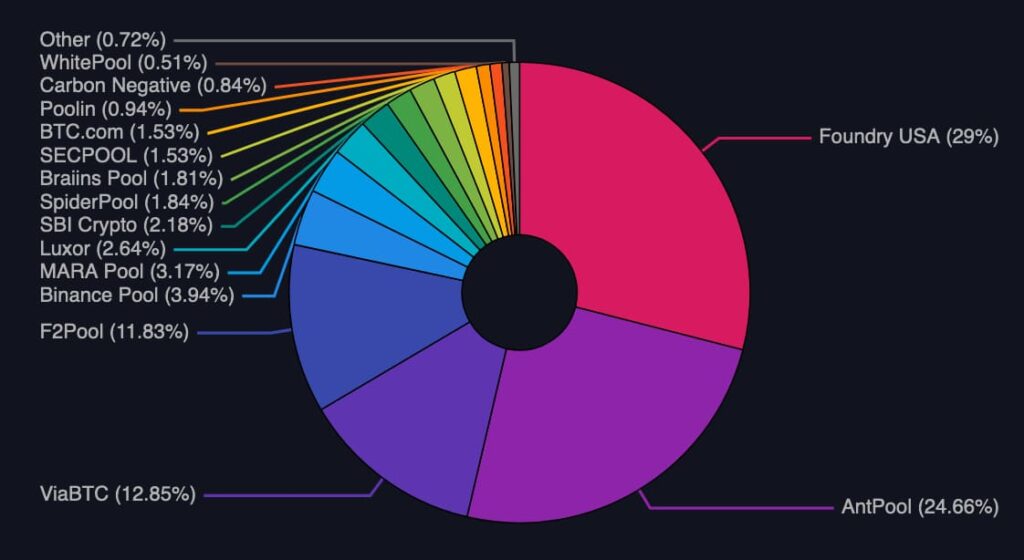

The analyst identified that five of the most relevant Bitcoin mining pools might use the same block template as Antpool. In particular, these are BTC.com Pool, Binance Pool, Poolin, EMCD, and Rawpool. They sum up to over 31% of Bitcoin’s hashrate and discovered blocks in the last six months. Antpool is the second-largest single pool, with 24.66% of the network’s share.

Basically, a block template is what a miner uses to add transactions to a block, confirming them in the network. The template can sometimes be similar when transactions with the highest fees are included first.

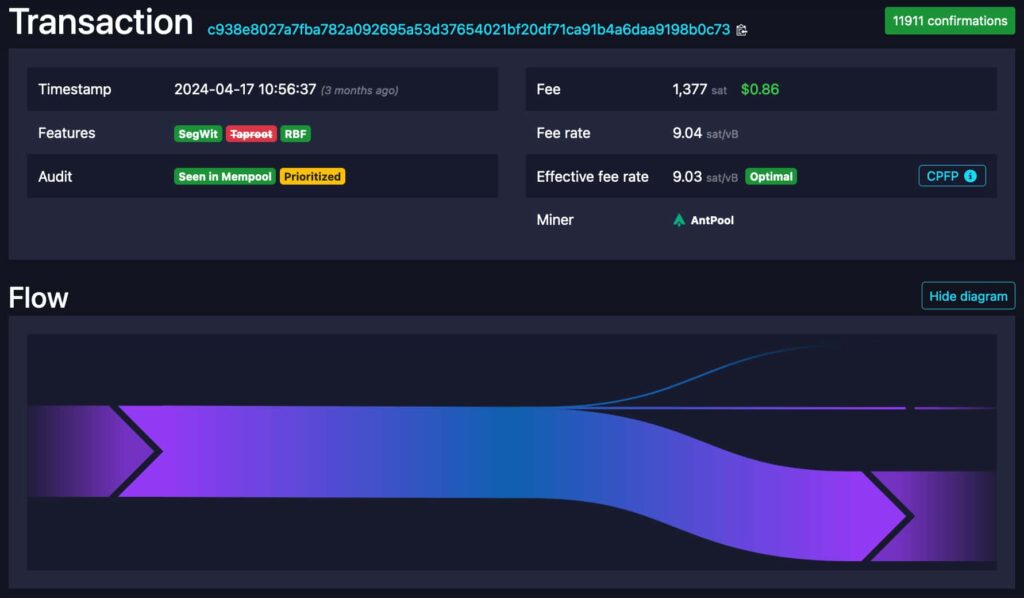

However, b10c found a pattern for what he is convinced are manually added transactions for the first transaction in each block of these pools after the coinbase transaction. A coinbase refers to the transaction that carries the block subsidy, created by and paid to the miner who signs the block.

“Here, branch0 is the txid of the first transaction in the block after the coinbase. In the AntPool/Binance/BTCcom/.. template, it’s a manually prioritized transaction paying 9.03 sat/vbyte. Many of the other pools didn’t prioritize a transaction and included the highest feerate transaction paying 301 sat/vbyte. ViaBTC prioritized another transaction and has a vastly different template.”

– b10c (@0xb10c, on X)

Comments around the study

Protos Staff reported about the study on May 2, while a few worried enthusiasts joined the conversation on social platforms. Among them, Casey Rodarmor commented on the case, mentioning a “not great” scenario for Bitcoin mining decentralization.

“For years, rumors have circulated that Bitcoin’s largest mining machine manufacturer has secretly centralized a majority of Bitcoin’s hash power. The theory is down to more than a simple observation of the logo stamped on most mining cases.”

– Protos Staff

“Many large pools which were previously thought to be independent now seem to be mere proxies for AntPool, with the same transaction selection policies.”

– Casey Rodarmor

Mononaut, the owner of mempool.space, made a similar discovery, spotting that these six pools, besides sharing the same block template, also share the same custodian for the received block rewards. Additionally, two other pools have joined the likely pool hub in this aspect: Braiins and SECPOOL. This adds 3.34 percentage points more hashrate to the centralization group of pools, nearing 35% in total.

Why is this relevant if ‘miners can migrate to other pools?’

Usually, the most passionate Bitcoin advocates will argue that pool centralization does not matter because miners can migrate from one pool to another, preventing centralization.

Nevertheless, the scenario gets trickier when pools unite in closed-door agreements, as these studies have found out.

Furthermore, the mining pool coordinator performs the activities expected of a Bitcoin miner at a protocol level.

The pool (1) consolidates the proof-of-work of delegating machines owned by itself or a third party; (2) uses the delegated hashrate to find a valid block; (3) creates the block template by adding transactions; (4) broadcasts the block to the network; (5) collects the block reward and distribute the payments to its workers.

It is also notable that Antpool is a subsidiary of Bitmain, Bitcoin’s largest ASIC manufacturer, based in Beijing, China.

Some experts believe that the implementation of Stratum V2 will help address this issue, but the software is not yet running and will depend on the adoption of these pools and miners, which is not guaranteed.

Bitcoin investors are now watching these developments, which could impact the cryptocurrency’s underlying fundamentals. As of this writing, BTC traded at $58,000, recovering from a major crash.