The Bitcoin (BTC) mining race intensified between China and the United States, recently dominated by the former in a shift. AntPool mined nearly one-third of all newly issued BTC in the last 24 hours, concentrating block production and mining rewards.

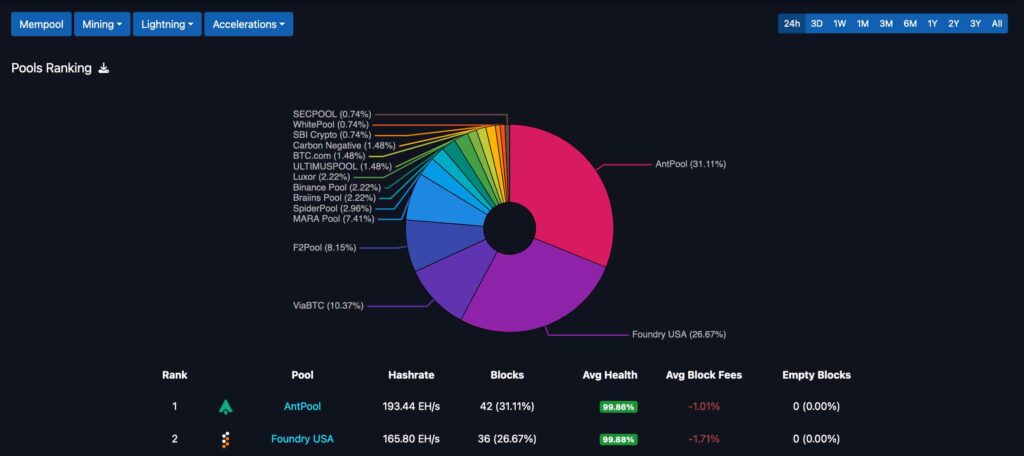

Finbold retrieved data from mempool.space on September 22, accounting for Bitcoin’s daily block discovery among mining companies and pools. By the time of this writing, AntPool had mined 42 blocks out of 135, while Foundry USA discovered 36.

Notably, the first two leaders have been dominating the mining race for years, putting a significant distance against their competitors. ViaBTC, for example, mined only 10% of the blocks in this period, while F2Pool and MARA got less than that.

Picks for you

The state of Bitcoin mining has raised centralization concerns among experts, researchers, and developers, as Finbold reported.

Bitcoin mining centralization concerns and consequences

These concerns reached a point where a Bitcoin Core developer, Luke Dash Jr., warned of BTC transactions requiring at least two hours to be considered secure – making the current market standards of 30 to 60 minutes an outdated safety measure.

However, the Bitcoin mining centralization could be even worse than what surface data suggests, according to a reputable BTC researcher. A study published by pseudonymous analyst b10c (@0xb10c) in April indicates that AntPool centralizes most mining activity beyond block discovery.

Together with an investigation by Mononaut, the analysts found data showing that at least six Bitcoin mining pools share both the same custodian and block template to AntPool, suggesting closed-door agreements hardly spotted at first glance.

AntPool is a Beijing-based company in Continental China that is also a subsidiary of BitMain, Bitcoin’s largest mining equipment manufacturer.

Bitcoin long-term mining scene: United States vs. China

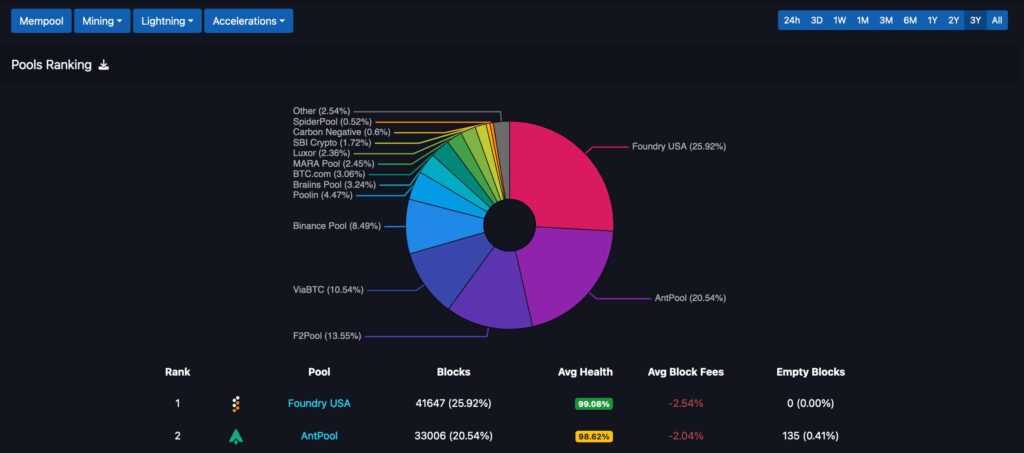

Conversely, Foundry USA, based in the United States, leads the long-term Bitcoin mining race.

The mining pool backed by the Digital Currency Group (DCG) mined 41,647 blocks out of over 160,000 blocks. This represents over a quarter of all issued BTC in the last three years, followed by Antpool, with 20.5%.

Just like AntPool, Foundry USA demands a KYC process from its miners – effectively filtering participation according to each country’s regulations.

All in all, the Bitcoin mining race intensifies between the two leading world economies, the United States and China. While the North American representative leads the long-term scene, the Chinese company AntPool grows its presence in the short term.

From an investment perspective, Bitcoin mining centralization could challenge the cryptocurrency’s value proposition, potentially impacting the price of BTC on the market.