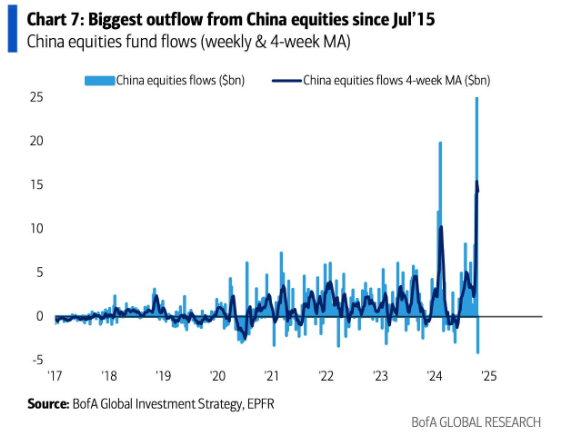

The Chinese stock market has experienced one of the most historic capital outflows at a time when the sector has been on a rollercoaster in recent weeks in reaction to government stimulus packages.

Specifically, the market saw a weekly outflow of $4.1 billion, the largest in over nine years, marking a critical moment for most equities searching for stability, according to Bank of America Global Investment Strategy data shared by Barchart on October 19.

The data shows a clear trend of increased volatility and negative sentiment in 2024 since 2021. Before this period, fund flows were relatively stable.

These outflow figures emerged in the wake of cooling bullish momentum from the early October rally, initiated after the government announced stimulus packages to boost the equities market.

Impact of government stimulus package

On October 18, China’s central bank also launched two funding schemes to inject $112.38 billion into the stock market through newly created monetary policy tools. The plan is part of a broader strategy by the People’s Bank of China (PBOC) to support the “steady development” of capital markets.

After the initial stimulus package announcement on September 24, the country’s stock market rallied over 20% in five trading days, led by key technology giants. However, equities later corrected 12% as follow-up fiscal stimulus announcements failed to materialize.

Despite this, the overall momentum has recently elevated the Chinese stock market to rank among the best-performing global stocks.

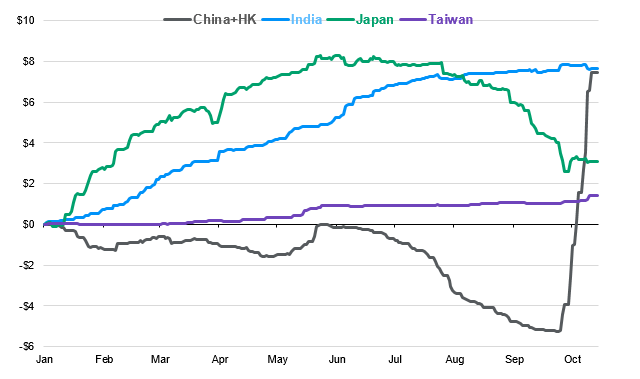

Elsewhere, data shared by Chief Market Strategist Gabriela Santos indicated that, despite the record weekly outflows, the stimulus announcement partly contributed to a spike in net inflows into Chinese equities, reaching $12.7 billion from September 24 to October 14.

To this end, she noted that the Asian economic giant might continue to see additional inflows from foreign investors as they turn away from other regions, such as Japan and India.

However, she cautioned that continuing this trend will depend on additional fiscal stimulus and structural reforms by authorities.

“Since the announcement [stimulus package], the tide has turned – with net flows turning positive after outflows to start the year. In the short-term, we may continue to see this reversal of flows towards China and away from previous winners in Asia (Japan, India); however, the continuation of this trend will depend on additional fiscal stimulus and structural reforms in China,” she said.

Before the government intervention, the market was dragged down by a weakening economy, a property crisis, weak consumption, and escalating geopolitical tensions. As a result, foreign investors pulled out a record $15 billion from equities in the second quarter, missing out on the opportunity to benefit from the recent momentum.