Note: The Next day after we have released this article CME Group has pulled down a video where the Chief Economist took a pro-Bitcoin stand. Read more about it and see the full video here.

Since its inception over a decade ago, Bitcoin has been striving to gain mainstream adoption and investment. In recent months, the crypto market has developed considerably with more institutional investors, financial institutions and governments exploring the nascent industry.

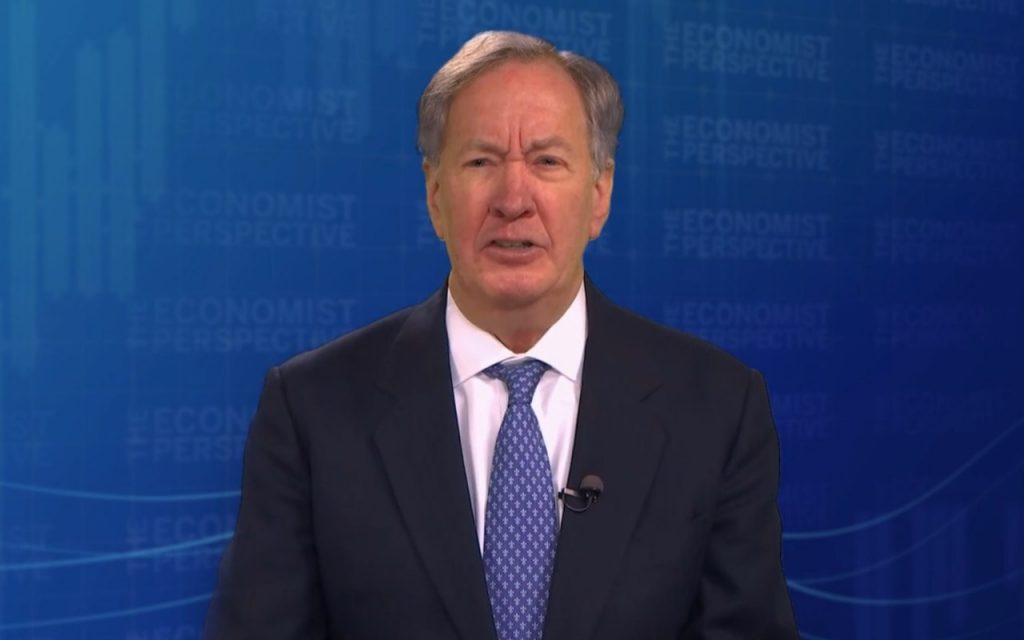

Many now wonder how Bitcoin can fit into a portfolio without compromising stability due to its volatility. The token has been much more volatile to serve as a dependable store of value, as explained in a video released on February 10, by CME’s Chief Economist, Bluford Putnam.

So far, bitcoin has not shown any consistent correlation to macroeconomic factors and the standard portfolio assets like equities and fixed incomes. If it does not relate to these factors and assets, it can serve as a dependable portfolio diversification tool.

Underlying Factors

It is counter-intuitive to add highly volatile exposure to a portfolio and expect a portfolio risk to minimize. The lack of correlation comes into play since Bitcoin’s volatility is high. An allocation of about 2% of the entire portfolio may reduce the risk if the lack of correlation holds.

A small allocation of bitcoin to a 60:40 equity fixed income portfolio revealed a modest risk reduction in a 2019 study. The portfolio potential for diversification also arises in how bitcoin prices might behave in the case that geopolitical events destabilize the traditional markets, creating uncertainty.

For instance, the coronavirus affected market psychology in the week of January 20. Bitcoin prices rallied along with other established flight to quality exposures like US treasuries and gold. The rally continued to increase in intensity as the virus worries escalated.

Bitcoin gained almost 39% in January 2020, registering the best start of a year since 2013. It is quite early to determine whether the volatility and high-risk exposure like Bitcoin can gain ground in the space of portfolio diversification and risk management.

But, it is an exciting concept that deserves further study and a lot of experience. If a precise strike of balance is discovered, then bitcoin can become a dependable portfolio diversification solution for many investors.

Featured image via CME Group website

Wondering what Bitcoin halving event will bring for the industry? Check our related story where the experts have their say on the upcoming halving event.