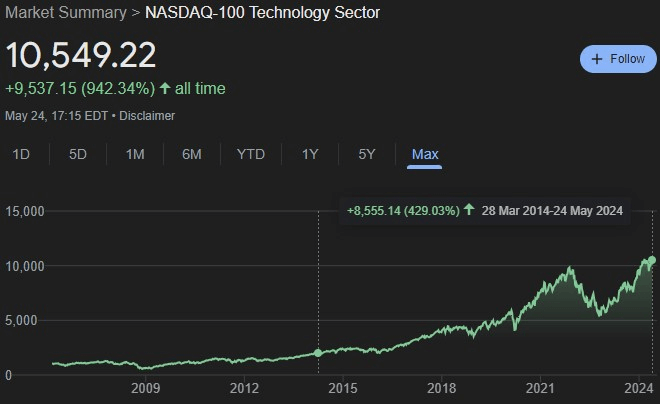

Technology stocks have significantly outperformed the broader market over the last decade. The Nasdaq-100 Technology Sector Index gained 429% during this period, compared to a 178% rise for the S&P 500 index.

This outperformance is unsurprising, as tech companies often capitalize on disruptive trends, enabling them to grow substantially.

Top tech stocks like Nvidia (NASDAQ: NVDA) have far outpaced the Nasdaq-100’s performance over the past decade, substantially boosting long-term investors’ portfolios.

While it may be challenging for Nvidia shares to replicate its remarkable 10-year gains in the next decade, buying and holding this tech giant’s stock as part of a diversified portfolio remains a smart long-term strategy.

Nvidia still has tremendous growth opportunities in multiple markets, making it an ideal choice for investors aiming to build a million-dollar portfolio.

Nvidia’s diversification made it the giant it is today

Nvidia has made remarkable strides over the past two decades. Initially, it primarily sold graphics processing units (GPUs) for gaming PCs and workstations.

Today, its hardware and software power computationally intensive applications in data centers, advanced driver-assistance systems, factories, and digital twin creation. Artificial intelligence (AI) is the company’s biggest catalyst.

Finances that are unmatched on the stock market

Nvidia’s revenue and earnings have surged recently as customers eagerly purchase its AI chips. The company reportedly holds an impressive 92% share of the AI chip market, expected to generate $305 billion in global revenue by 2030, up from $29 billion in 2022. This dominant position should continue to drive significant growth.

Last fiscal year, Nvidia’s data center business generated $47.5 billion in revenue. If Nvidia remains a leader in this market, this figure could be much higher by 2030. Moreover, the demand for PCs capable of running AI software locally is projected to grow at an annualized rate of 44% through 2028, according to Canalys.

This growth should boost demand for Nvidia GPUs in laptops and desktops, potentially revitalizing its gaming business alongside data center expansion.

With earnings that beat expectations yet again and the NVDA stock price soaring to $1,100, Wall Street analysts reassessed their targets. The highest target is set at $1,400, which now seems too low for the potential of NVDA shares.

Overall, Nvidia management projects an addressable market worth $1 trillion. The company is poised for significant growth since Nvidia generated just under $61 billion in revenue last year.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.