Semiconductor companies have seen stellar performance over the last two years, owing to the revolutionary potential of widespread AI adoption.

This is most apparent with stock market darling Nvidia (NASDAQ: NVDA), which has seen year-to-date (YTD) returns of 188.08%. At press time, NVDA shares are trading at $138.76, having registered a 3.61% loss over the last week due to market uncertainty.

The chipmaker is now worth roughly 12% of the United States GDP, and worries around valuations are widespread. If AI is indeed in a bubble, Nvidia could be due for a sharp correction.

Picks for you

One specific risk factor came about as the result of Super Micro Computer’s (NASDAQ: SMCI) downfall. The company, a key customer for Nvidia, could be delisted due to regulatory noncompliance by November 16 — which could in turn lead to an NVDA selloff, but steps have already been taken to preempt such an occurrence.

Why Nvidia stock is threatened by SMCI

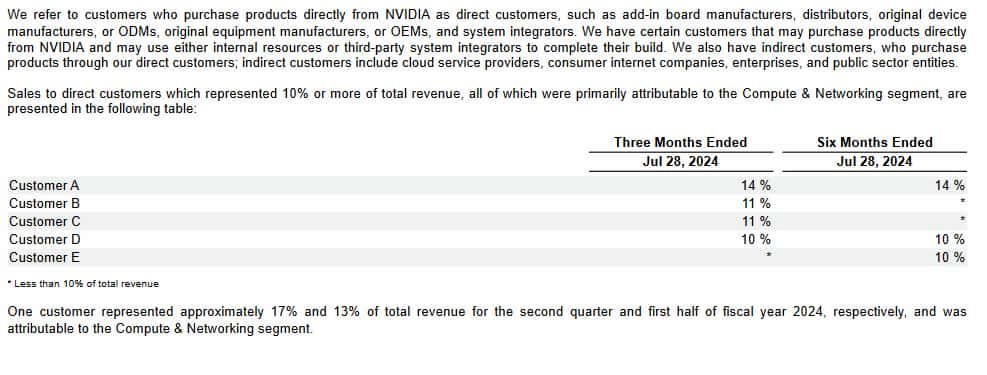

Nvidia does not directly name its biggest customers in the 10-Q filing that the business submits to the SEC on a regular basis. However, even a cursory review of the latest filing reveals that the semiconductor titan’s revenue is highly concentrated, with 46% of total revenue coming from just 4 customers.

Although it would be irresponsible to speculate which of these 4 — if any, is SMCI, Bloomberg supply chain analysis dating to August suggests that Super Micro Computer accounts for nearly 9% of NVDA’s revenue.

After a blistering August 27 report from Hindenburg Research was released, alleging widespread accounting fraud and noncompliance, the company announced that it would delay the filing of its annual 10-K report to the Securities and Exchange Commission (SEC). As soon as markets caught wind of this, SMCI stock price fell by 30%.

Then, on October 30, it was revealed that SMCI’s auditor, Ernst & Young (EY) had resigned six days prior — leading to yet another 30% crash.

As it currently stands, SMCI could be delisted on November 16 — just four days ahead of Nvidia’s Q3 2025 earnings report. If a once-major semiconductor player is delisted from the NASDAQ, that would lend plenty of credence to the thesis that skyrocketing AI spending, which investors are already wary of, was a mistake.

Can Nvidia successfully pivot away from SMCI?

Nvidia has consistently been intensifying its collaboration with Super Micro Computer — with SMCI-related orders amounting to 25% of the total supply. On the face of it, this would appear to be an unsurmountable problem — but Nvidia is reportedly shifting orders away from SMCI to other crucial customers, per DigiTimes Asia.

The fact remains that, as stated by NVDA CEO Jensen Huang, demand for the latest line of Blackwell architecture is ‘insane’ — with chips reportedly being sold out for the next 12 months. With no shortage of demand and major AI players stating that spending will increase throughout 2025, it would appear as if Nvidia can more than make up for SMCI’s downfall.

Featured image:

QubixStudio, California, United States — June 3, 2024. Digital Image. Shutterstock.