Only seven companies have reached the trillion-dollar goal post–six technology companies and one Saudi Arabian oil conglomerate. However, this Big Pharma member is not far behind and could skyrocket to a trillion-dollar valuation relatively soon. Today, we’ll explore Eli Lilly (NYSE: LLY), the odds of it reaching the market capitalization of $1 trillion, and why you should consider investing in it right now.

What was the state of the pharmaceutical industry in 2024?

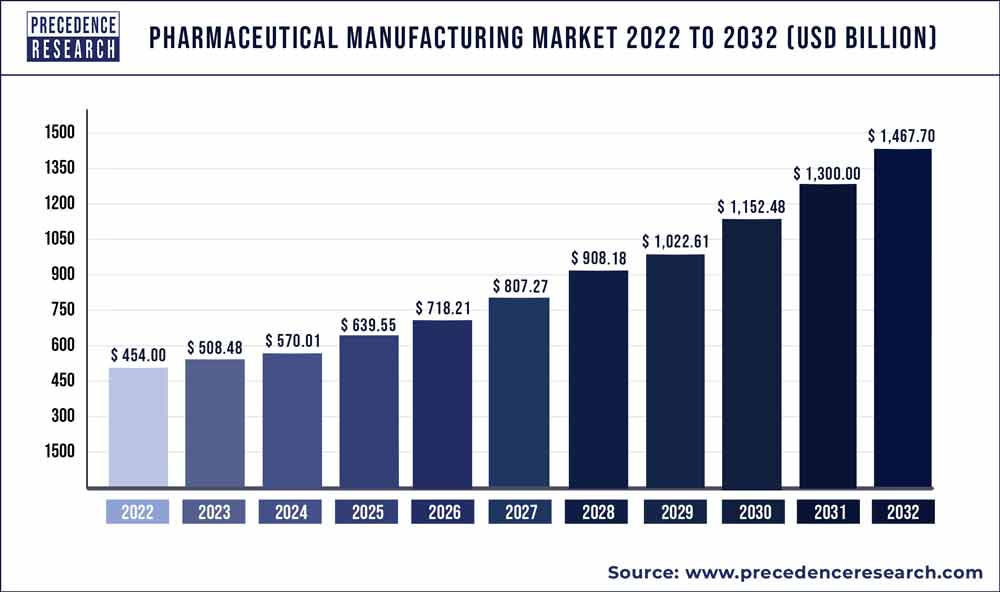

Despite the fear that pharmaceutical industry sales would plummet after the global pandemic was over, this did not happen. In fact, global sales of pharmaceutical products are consistently on the rise, no matter how the rest of the economy performs.

That said, there is the risk of an imminent “patent cliff” as some of the world’s most in-demand drugs have their patent expiry dates by 2030, such as Merck‘s Keytruda (2028), Bristol Myers Squibb & Pfizer‘s Eliquis (2027-2029), and Regeneron & Bayer‘s Eylea (2025-2026). Expiring patents introduce the risk of generic competition, potentially cutting off vital sources of revenue for the big players.

However, many novel treatments are based on biological solutions rather than chemical synthesis, making the switch to generic treatments harder and disincentivizing doctors to change prescriptions.

Still, the growing and aging population will increase demand for pharmaceutical products in the long term. In line with that, pharma companies have recently invested heavily in R&D, which could produce drugs and therapies to complement the phased-out healthcare products.

Even without that, the recent market hikes in weight-loss drugs and neurodegenerative disease treatments ensure that the companies in this domain fare better than your average company. Well, these are precisely the fields in which Eli Lilly excels.

Could Eli Lilly reach a trillion-dollar valuation?

The largest public pharmaceutical company has witnessed tremendous growth in little over three years. In early January 2021, Eli Lilly stock price was about $166, and its market capitalization was $173.4 billion. As of May 2024, the stock is trading at $787 (a 474% increase), and the company’s market cap is $748 billion (a 431% surge). This level of growth is massive, making the company four times its size just a couple of years ago.

Additionally, the LLY stock has beaten the market consecutively for these three years, returning 64% in 2021, 32% in 2022, and 59% in 2023. That was 37%, 51%, and 35% higher than the market returned each year, respectively, and it rewarded faithful investors and attracted the new.

Considering the current trend, Eli Lilly is soon poised to become a trillion-dollar company. This landmark event could happen, but it would depend more on its future pipeline than its present portfolio. Nonetheless, the company’s current drugs should deliver even better results in the next couple of years, especially its two diabetes drugs: Mounjaro should provide $33 billion, and Zepbound is expected to achieve over $16 billion in annual sales by 2029.

About Eli Lilly

Founded in 1867 and headquartered in Indiana, Eli Lilly has built a reputation for inventing and manufacturing highly sought-after drugs. Historically, it was the first mass-scale polio vaccine and insulin therapy for diabetes. Today, these are still diabetes and weight-loss therapies, but also antidepressants and antipsychotics, as well as numerous other essential treatments.

In fact, many believe that Eli Lilly will be the first pharmaceutical company to reach a trillion-dollar valuation. Eli Lilly’s stock, LLY, is a component of the S&P 100 and S&P 500 indices, and it trades on the NYSE stock exchange.

Eli Lilly stock price forecast 2025

Sturdy financials and healthy financial reports have turned the analysts’ sentiment toward an even higher Eli Lilly stock price forecast for 2025. As a principal leader in a resilient and ever-popular industry, the pharmaceutical titan is poised for growth in the following year.

| Metric | Value |

| Eli Lilly average price target | $887.42 |

| Eli Lilly high forecast | $1,001.00 |

| Eli Lilly low forecast | $740.00 |

| Eli Lilly change from the last price | 14.74% |

Eli Lilly current stock price

Is Eli Lilly the next trillion-dollar company? – the bottom line

Being a prominent company at the helm of a growing sector reassures any investor afraid of an industry retracting from the end of the COVID-19 pandemic. Eli Lilly is expected to grow even larger, and its current tempo, if maintained, could even make Eli Lilly the next trillion-dollar company in every sector, not just its own category.

Hopes are high for the pharma behemoth, and Wall Street analysts expect even better results in 2025. Eli Lilly has the potential to meet these expectations and potentially even new drugs to fuel more demand and give better returns for investors in the years to come.

The ultimate decision is still yours, however, so make sure you do your own research and have a solid grasp of the pharmaceutical market before you spend any money.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.