The cryptocurrency market has crashed, with most cryptocurrencies registering double-digit losses since June 17. In this scenario, crypto bulls lost nearly $400 million in long position liquidations, with over 165,000 traders getting ‘rekt.’

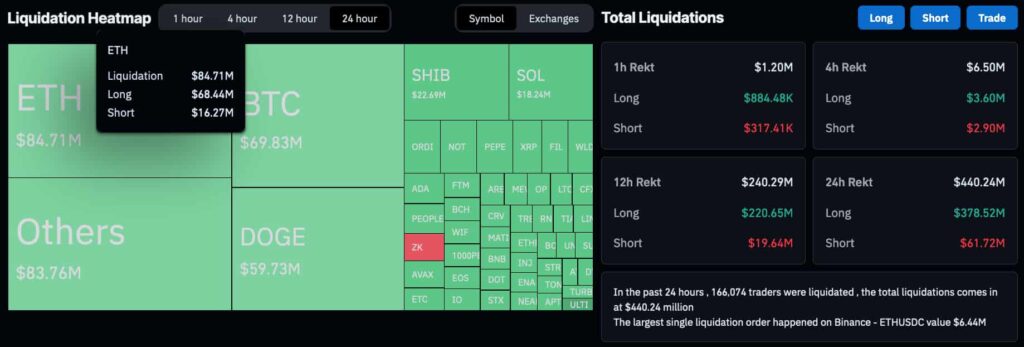

Finbold retrieved data from CoinGlass showing a total liquidation of $440.24 million in the last 24 hours. Notably, $378.52 million was from long positions that reached their liquidation prices, with a dominance of Ethereum (ETH). On the other hand, short-sellers lost less than $62 million.

Crypto bulls of the leading Web3 and DeFi blockchain lost $68.44 million, while Ethereum bears lost $16.27 million. Moreover, the largest single liquidation occurred with an ETH pair against the USDC on Binance, a $6.44 million order.

According to CoinGlass‘s heatmap, “Others” cryptocurrencies had the second highest amount of liquidations, while Bitcoin (BTC) was the third most punished cryptocurrency, with $69.83 million lost in total from bears and bulls.

Crypto bulls getting punished as volatility takes over to the downside

Overall, the market capitalization lost $136 billion from June 17 to the crash lows, as registered by TradingView‘s index. In particular, the Crypto Total Market Cap Index (TOTAL) dropped aggressively from $2.385 trillion to $2.249 trillion. It is currently at $2.293 trillion, slightly recovering from its worst moments today.

Interestingly, Finbold had been reporting bearish signs and indicators for the cryptocurrency market, especially for BTC and ETH. Bitcoin miners have capitulated aggressively with historical sell-offs, while Ethereum’s network value indicators hinted at an overvalued asset.

Analysts believe it is a good time to buy altcoins as crypto bulls got liquidated and de-leveraged their overall exposure. The TOTAL3 index, which refers to the capitalization of all cryptocurrencies, excluding Bitcoin and Ethereum, reached support at a $593 billion market cap, signaling a “once in a few years” opportunity.

However, crypto traders—either bulls or bears—must act cautiously in the following days, considering the increased volatility, and avoid leveraged trades.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.