The price of XRP has found strength above the $3 support zone as the token targets a new all-time high, with technical indicators suggesting $4 might be in sight.

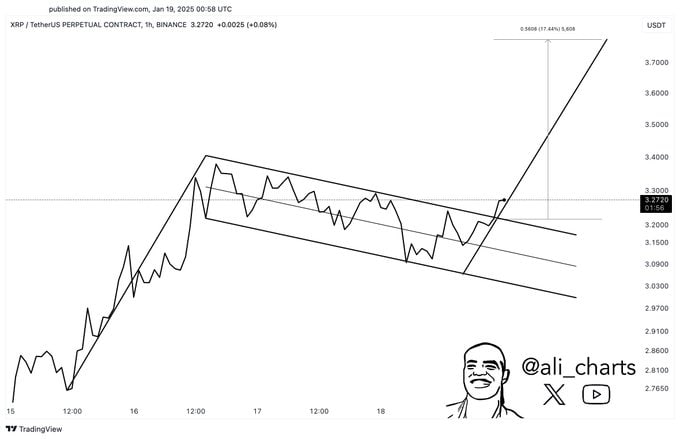

Specifically, an analysis by prominent cryptocurrency expert Ali Martinez observed that XRP has broken out of a bullish flag pattern—an indication that the asset might confirm a continuation of its prior uptrend after a prolonged consolidation, he said in an X post on January 19.

This breakout signals that XRP’s price could climb higher, potentially targeting $4 in the coming days.

A bullish flag forms after a sharp rally, where the price consolidates in a rectangular pattern as traders pause. A breakout above the upper trendline points to renewed momentum, often matching the initial rally’s height.

Martinez’s analysis suggests that XRP’s recent breakout aligns with these patterns, potentially driving the token to $4, a gain of over 20% from its current price.

For the long term, Martinez noted that XRP could potentially target the $15 mark after breaking out of a symmetrical triangle pattern on the monthly chart. This pattern typically indicates market indecision, but once a breakout occurs, it leads to a notable price trend.

XRP set for a ‘monstrous move’

Similarly, another analysis by MikybullCrypto, shared on January 19, stated that XRP is gearing up for a “monstrous move” based on a bullish pennant formation on the four-hour chart. This technical pattern, characterized by tight consolidation following a steep rally, often signals the continuation of an upward trend.

Currently trading around $3.20, XRP has paused after a sharp move from the $2.30 range. A breakout above the pennant’s upper trendline could see the token targeting $3.60 or higher, based on the height of the prior rally.

Overall, XRP has witnessed bullish momentum in recent months after breaking out of a prolonged consolidation below the $1 mark. The asset’s current price movement hinges on several factors, including regulatory and political developments.

Notably, its recent momentum was partly inspired by the election of Donald Trump, who is considered bullish for digital currencies.

At the same time, Gary Gensler’s exit as the head of the Securities and Exchange Commission (SEC) is seen as another bullish factor for the token. The SEC’s case against Ripple has been widely regarded as a significant inhibitor of XRP’s price growth.

Nevertheless, before the new administration takes office, the SEC remains persistent in pursuing the legal matter. Specifically, the regulator recently appealed the case, challenging a July 2023 ruling that dismissed some claims.

The appeal questions whether Ripple’s XRP sales to retail investors qualify as unregistered securities under the Howey Test, citing investor profit expectations tied to Ripple’s promotions.

Ripple’s Chief Legal Officer, Stuart Alderoty, criticized the filing as a “rehash of failed arguments.” He believes the case will lose momentum under the Trump administration.

Meanwhile, Ripple has achieved minor victories in the case. On January 11, a federal judge approved sealing certain documents to protect sensitive information. These sealed records include confidential and personally identifiable details about Ripple’s summary judgment motion.

XRP price analysis

As of press time, XRP was trading at $3.13 after gaining over 1% in the last 24 hours. On a weekly timeframe, the token is up by over 25%.

If XRP can sustain its valuation above the $3 support level, a target of $4 remains achievable. However, dropping below this critical support could invalidate the current bullish trajectory.

Featured image via Shutterstock