Bitcoin (BTC) crashed recently, dragging the entire cryptocurrency market down, with over $300 billion erased from the total capitalization since July 3. In the last 24 hours, over 230,000 crypto traders lost more than $660 million in long-squeeze liquidations.

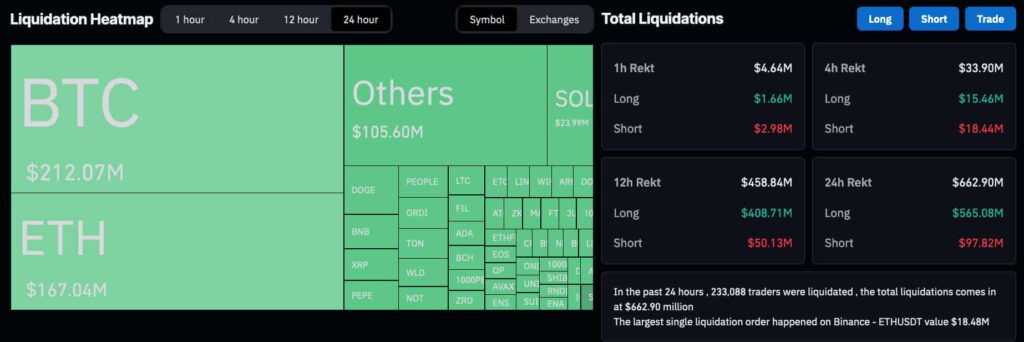

Finbold retrieved liquidation data from CoinGlass on July 5, evidencing the damage caused by this recent crash. In particular, $662.90 million of liquidations took place, with $565.08 million coming from long-position crypto traders.

The long squeeze affected 233,088 traders, and Binance‘s ETH/USDT pair had the largest order, with $18.48 million. Yet, Bitcoin liquidated over $212 million from traders, while Ethereum (ETH) liquidated $167 million. They represent 32% and 25% of the total liquidations, respectively, of which 85% were from longs.

Picks for you

$300 billion erased from crypto total market cap, traders tremble

Notably, the crash started on July 3, with the crypto total market cap index by TradingView (TOTAL) marking a $2.25 trillion capitalization back then and going as low as $1.90 trillion this morning as traders started panic selling.

The drop represents a $311 billion market cap loss in approximately 60 hours, being one of the worst hits recently.

Massive Bitcoin sell-offs affected the whole market

While crypto and stock traders await economic data from the United States this Friday, analysts blame massive Bitcoin sell-offs. Mt. Gox finally started the repayments of the 2014 event, distributing billions of dollars in BTC and Bitcoin Cash (BCH). Speculators wonder if Mt. Gox repayments can drive Bitcoin’s price below $50,000.

Meanwhile, the German government continues its Bitcoin dumps, offloading hundreds of millions of dollars in BTC daily. As reported by Finbold, Miners have also capitulated in the past few weeks, selling mined Bitcoin at a higher pace than usual.

In this context, the decentralized finance (DeFi) influencer and Ethereum and Solana (SOL) enthusiast Ignas urged cryptocurrencies to “break free from BTC correlation.”

As all this developed, investors’ concerns rose, shifting the previously bullish sentiment to a dominating bearish outlook. Traders expect increased volatility for crypto assets in the coming days, requiring extra caution with leverage positions moving forward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.