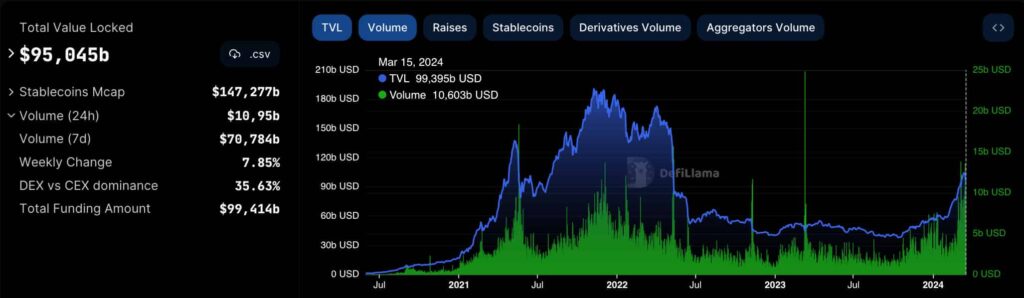

Decentralized Finance (DeFi) has grown significantly in the past few years according to total value locked (TVL) and exchanged volume. As of recently, the volume in DeFi has consistently surged to above $10 billion daily, similar to 2021’s bull market.

In particular, volume is a solid metric for identifying trends and investors’ interest in the cryptocurrency market or specific sectors.

However, volume can spike in atypical days without consistency, which creates false technical indicators. Looking at consistent behavior is crucial when evaluating trends and the market’s momentum.

On that note, Finbold retrieved data from DefiLlama on March 17, which shows a strong momentum for decentralized exchanges. This suggests the DeFi ecosystem is heating up for a remarkable rally with expressive capital flow among decentralized finance protocols.

Daily volume in DeFi surpasses $10 billion

Notably, the daily exchange volume in DeFi has surpassed the $10 billion mark, currently at $10.95 billion. As for the week, the 7-day volume has reached $70.784 billion, for a 7.85% increase, according to DefiLlama.

Interestingly, this growth resembles the one in early 2021 and, later, in the past cycle’s apex in November-December 2021. Moreover, the recent volume has reached even higher levels with consistency, despite the occasional spikes.

Such a consistent volume growth suggests DeFi may be entering a strong momentum attracting solid capital from cryptocurrency investors and decentralized exchange traders.

This is also evidenced by a growing share of decentralized exchange volume against centralized exchanges. DefiLlama highlights a 35% dominance of the former, indicating one-third of cryptocurrency traders use decentralized exchanges for their operations.

$100 billion in total value locked

In the meantime, DeFi’s total value locked fluctuates on the $100 billion level. This metric amounts to how much investors have allocated in DeFi protocols for liquidity mining, staking, and lending.

It is noteworthy that the 24-hour volume corresponds to over 10% of the $95 billion in TVL on March 17. In 2021, the total value locked reached an all-time high of $190 billion, twice as today’s, with a similar volume.

Therefore, this benchmark suggests both the total value locked and volume may grow to even higher grounds moving forward.

Nevertheless, investing in DeFi and trading in decentralized exchanges have risks and is mostly an experimental endeavor. Users must understand the mechanics and security concerns of these tools to avoid accruing losses.