Space — the final frontier, represents a wealth of possibilities, but efforts at commercialization have been relatively sparse.

However, progress is afoot — whether through Elon Musk’s SpaceX and Starlink, rival Jeff Bezos and Blue Origin, or sympathy plays like BlackSky (NYSE: BKSY), for-profit ventures are increasingly turning to the cosmos, attempting to secure a foothold and first-mover advantage in an as-of-yet untapped sphere.

There’s a crucial issue at play, however — a vast majority of those businesses are private. While it is possible to invest in them, mostly through specialized platforms, those are generally limited to accredited investors.

Picks for you

That’s not to say that you’re completely out of options — for example, Globalstar Inc (NYSE American: GSAT) is one such publicly traded company — with a constellation of 24 satellites in low-Earth orbit used to provide satellite communications.

The business recently got a $1.5 billion investment from Apple (NASDAQ: AAPL), which includes a 20% equity stake. At press time, GSAT stock was trading at $1.94, with year-to-date (YTD) returns of 3.48%.

Such a large influx of capital from one of the world’s leading tech companies is certainly positive — but even more encouragingly, in a rare instance when it comes to insider transactions, one of the company’s largest shareholders recently doubled down — and purchased more GSAT stock.

Board member loads up on GSAT stock

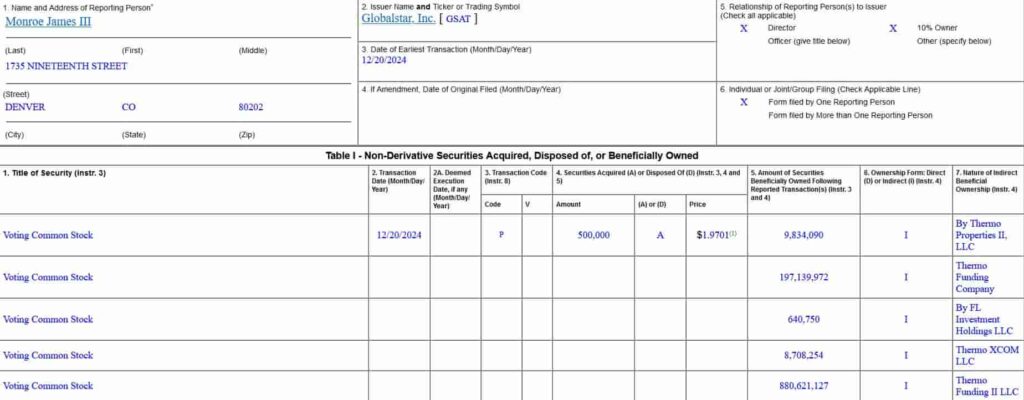

Per data retrieved by Finbold’s insider trading radar from a recently publicized SEC filing, James Monroe, a member of Globalstar’s board, who owns at least 10% of the company, bought 500,000 GSAT shares on December 12.

Executed at an average price of $1.97 apiece, the total value of the trade is approximately $985,000. Interestingly enough, unlike most insider transactions, this one was not prearranged — as a closer look at the filing in question reveals that it was not executed according to a 10b5-1 plan.

The Apple deal could prove to be a crucial tailwind for the business — at present, the average price forecast for the stock set by Wall Street analysts sits at $3.00 — a figure that equates to a 56.66% upside. Of the three analysts who track the company, two rate it a ‘Buy’ and one rates it a ‘Hold’.

This latest purchase, however, was just a drop in the bucket — even before the sale, the director was holding well over a billion GSAT shares.

Still, it’s hard to argue that even such a relatively small acquisition does not represent a bullish signal — after all, why would Monroe increase his stake, even a little, if he didn’t see the move as beneficial?

Featured image via Shutterstock