In what seems like an end to a legal fight between Florida’s Republican Governor Ron DeSantis and Walt Disney (NYSE: DIS), the famous entertainment company is set to invest around $17 billion in building its 5th theme park in Florida.

Disney has agreed to donate up to 100 acres of its Disney World property for district-managed infrastructure projects, award at least half its construction contracts to Florida-based companies, and spend at least $10 million on affordable housing in central Everglade State.

This resolves nearly two years of litigation, which began after Governor DeSantis took over the district from Disney supporters due to the company’s opposition to a controversial Florida law.

Disney parks drive a substantial amount of revenue for DIS

The Experiences division, which includes theme parks and consumer products, reported a 10% increase in revenue to $8.4 billion, with operating profit rising 12% to nearly $2.3 billion in the second quarter.

This growth was primarily driven by international markets, especially Hong Kong Disneyland, while Walt Disney World and the cruise line also performed well. However, according to CFO Hugh Johnston on an earnings call, Disneyland’s results declined year-on-year despite increased attendance and per capita spending due to higher costs, including labor.

Johnston also noted a surprising forecast: Parks growth for the current fiscal third quarter is expected to be flat. He attributed this to a ‘normalization of post-Covid demand.’ While travel remains high and demand is healthy, there are signs of a global slowdown from the peak levels seen post-Covid

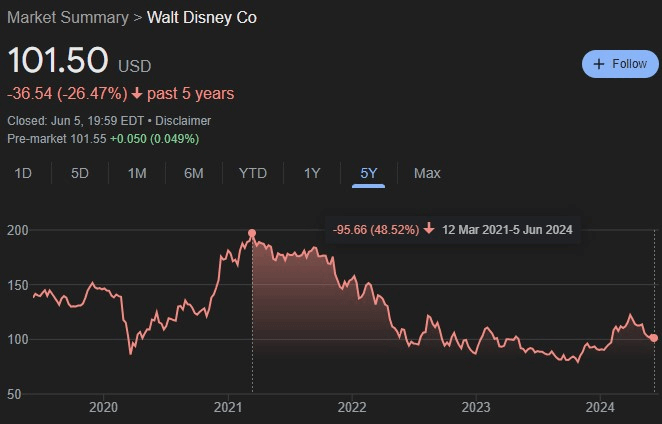

Disney stock is way off its all-time high

Boycotts and the global pandemic have negatively impacted DIS stock, which remains far from its all-time high of nearly $200, which it reached almost four years ago.

During the Coronavirus shutdowns, the industry faced significant challenges, and boycotts explicitly targeted Disney. As a result, DIS stock dropped below $90 in 2022.

Since then, DIS shares have been on a slow, rough road to recovery. Their odds of increasing with new revenue streams in the upcoming years are set to increase.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.