In recent months, there has been increasing chatter about the possibility of the United States economy entering a recession, with several indicators flashing red.

In this line, analysis shared on X on June 1 by investment research platform Game of Trade offered a deep dive into the intricacies of economic indicators suggesting a potential recession on the horizon, with housing market trends and unemployment rates playing pivotal roles.

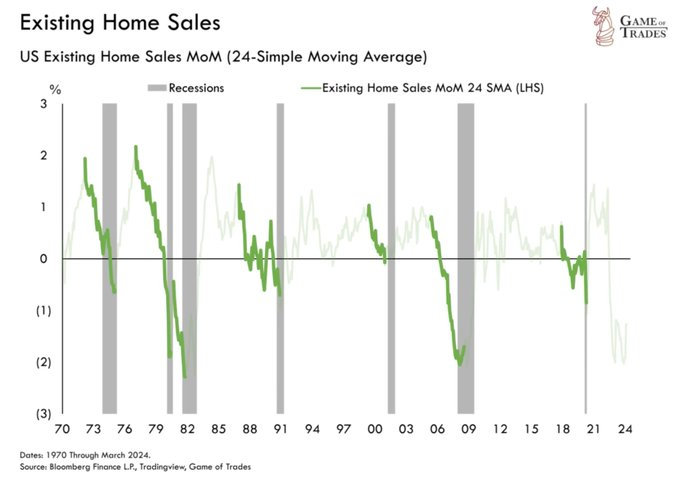

According to the analysis, housing is a crucial leading indicator for recessions, with rising unemployment being the most significant characteristic of economic downturns.

The platform acknowledged that historically, the gap between recessions averages about 5.5 years, indicating that the next recession could be expected as late as 2026 if this pattern holds.

However, the analysis pointed out that economic cycles are not purely about average timing. External shocks such as oil crises, pandemics, and market crashes have historically triggered recessions, making them difficult to predict.

Weakening house markets

Despite this, one reliable precursor remains a weakening housing market. Data tracking two-year housing sales reveals that when housing markets falter, a recession often follows with a slight delay.

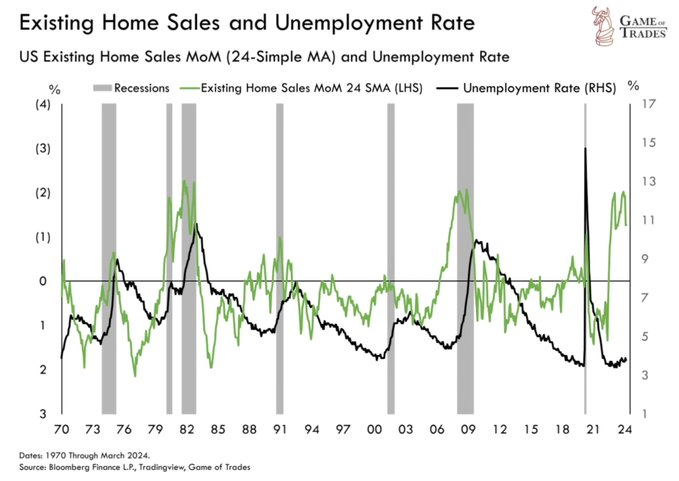

Game of Trade finding also suggested a strong correlation between housing market trends and unemployment rates. By shifting housing market data forward by 18 months, a near-perfect correlation with upcoming recessions and recoveries emerges.

“This happens because housing is highly sensitive to interest rates. When the Fed hikes rates, housing feels the impact first. Whereas, the rest of the economy takes more time to feel the lagging effects of rising rates,” the platform noted.

Additionally, the insights observed that the unemployment rate takes time to bottom out during all recessions and then rise. The only exception to this pattern was in 2020 when the pandemic caused a massive and immediate economic shock.

At the moment, the unemployment rate has been rising since April 2023, marking about a year of increase. Historical comparisons show that it took about one year of rising unemployment before the recessions in 2000 and 2006 and approximately 1.5 years in 1989.

Next recession timeline

Therefore, the assessment noted that if the housing market’s predictions hold true, a recession could occur by late 2024. However, the historically low unemployment rate might delay its onset.

Additionally, significant government spending in recent years could further postpone the next recession. Such heavy spending, unseen since the 1960s, delayed the recession until spending levels normalized back then, potentially mirroring the current economic landscape.