One of the most controversial expectations in the cryptocurrency market is known as “the flippening.” The flippening is the forecast of Ethereum (ETH) surpassing Bitcoin (BTC) in market capitalization, which is both praised and criticized.

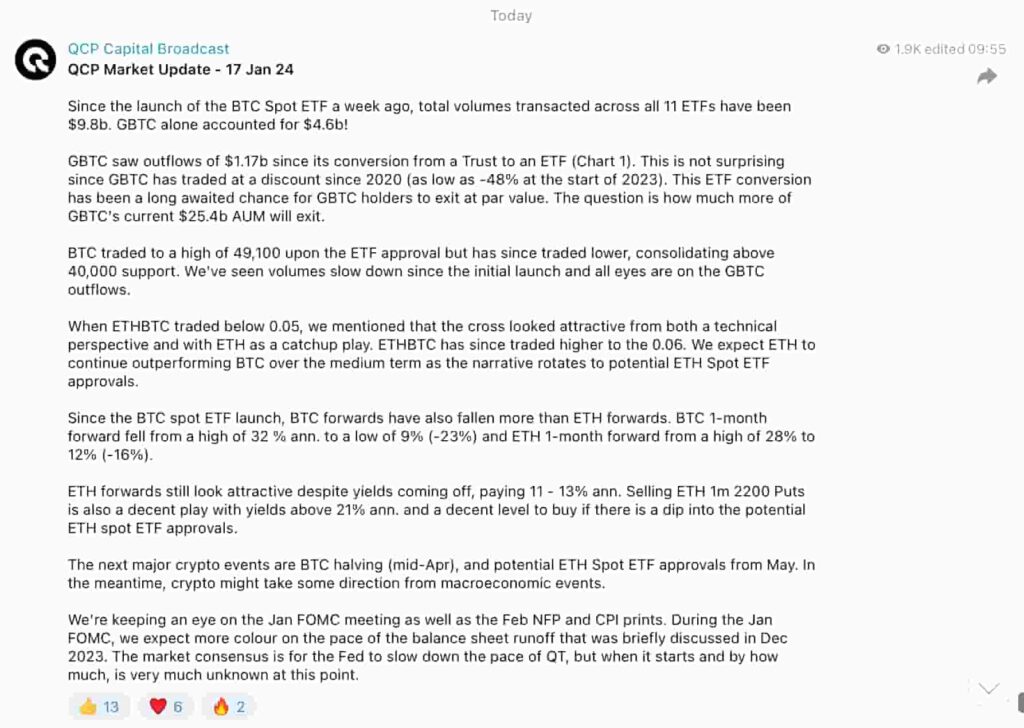

Interestingly, QCP Capital foresees Ethereum outperforming Bitcoin in price appreciation in 2024, according to a January 17 market update. The trading firm specializing in digital assets and cryptocurrencies shared the report on a Telegram group with 11,000 subscribers.

Despite not mentioning a ‘flippening,’ QCP Capital mentioned the positive results of a previous report on ETH paired against BTC. Moreover, the trading firm forecasts Ethereum to continue outperforming the leading cryptocurrency due to ETH spot ETF expectations.

“When ETHBTC traded below 0.05, we mentioned that the cross looked attractive from both a technical perspective and with ETH as a catchup play. ETHBTC has since traded higher to 0.06. We expect ETH to continue outperforming BTC over the medium term as the narrative rotates to potential ETH Spot ETF approvals.”

— QCP Capital Broadcast

Could an Ethereum spot ETF approval cause the flippening?

The narrative started boiling after an interview with Larry Fink, CEO of BlackRock Inc. (NYSE: BLK), on CNBC. In particular, Fink explained that BlackRock sees value in tokenization and believes the SEC will approve an Ethereum spot ETF.

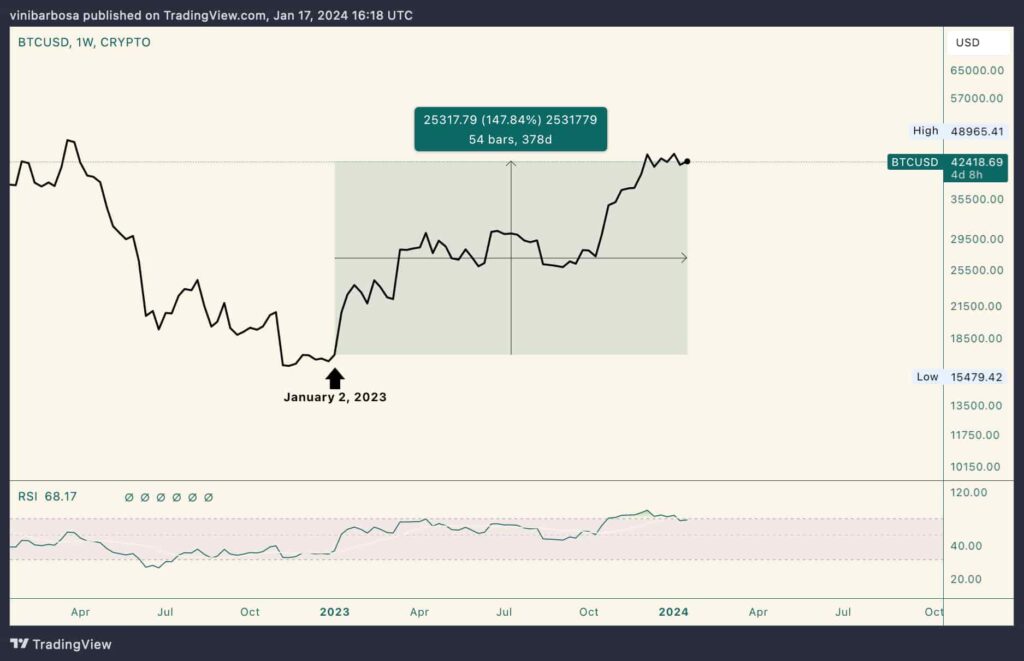

Notably, Bitcoin has surged by nearly 150% since January 2, 2023, until its current price of $42,418. Rumors and expectations on a Bitcoin spot ETF approval gained traction during this period while the market was pricing it.

A similar price action on Ethereum would put the leading Web3, and dominating DeFi blockchain, at above $6,235. This would drive ETH capitalization to around $750 billion, still nearly $100 billion lower than Bitcoin’s current market cap. Therefore, would not be enough for a ‘flippening,’ even if BTC kept its $830 billion value by press time.

Nevertheless, QCP Capital is still optimistic about a medium-term outperformance for the second-largest cryptocurrency over the largest one. According to the trading firm analysis, ETH could offer a better risk-reward for 2024’s investors.

Still, investing in this market is unpredictable, and having caution is crucial while deploying capital for price speculation.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.