With the gains starting to propel altcoins, Ethereum (ETH) seems to have had the best performance recently, as its price just reached an 18-month high. The move has prompted analysts to discuss the possibility of ETH attaining the $3,000 target, last reached in April 2022.

The current Ethereum trend suggests a sustained upward trajectory. The upcoming quarter has a potential ascent to $3,000, per a post on X from crypto analyst Jelle on January 15.

“ETH reached the highest level in 18 months, and it doesn’t look like it’s stopping anytime soon. Expecting $3000 in the coming quarter,” she said.

This breakout is indicated on the multiyear price chart and can be a possible indicator of a surge in the price of this digital asset in the next couple of months.

Further positive indicators

Not only does the multiyear price chart show promising signs for ETH, but shorter time spans also paint a bullish picture for this crypto asset.

Notably, Ethereum has broken out from an ascending triangle pattern on the weekly chart. Despite transient volatility, it remains focused on achieving a target of $3,400, per a post from crypto expert Ali Martinez on January 14.

Meanwhile, ETH has surpassed the critical level of $2,130, indicating a potential for further continuation. Following this breakthrough, there is a projection for an upward movement toward new cycle highs at $2,700, with an ongoing outlook for continuation towards $3,500 within the next 2-3 months, according to a post from cryptocurrency analyst Michael van de Poppe on January 12.

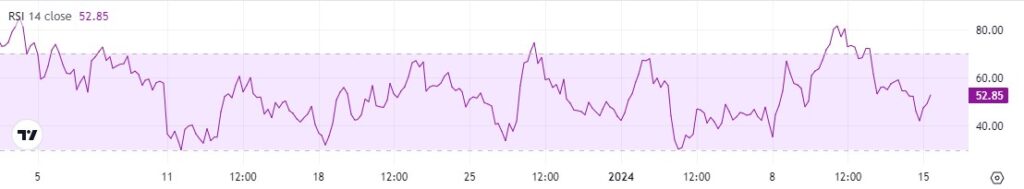

Ethereum RSI looks bullish

Furthermore, the relative strength index (RSI) is specifically crafted to depict the market’s current and historical strengths or weaknesses and showcase positive momentum.

It stands at close to 53 for ETH at the time of press, a value above 50, and indicates a bullish signal for its recent trading strength.

ETH price analysis

At the time of writing, this digital asset was trading at $2,534, losing 0.39% in the past 24 hours but adding 13.87% on the weekly chart and 11.24% on the monthly level.

Over the last year, the asset has seen a remarkable 66% price increase, outperforming 60% of the top 100 cryptocurrencies. Additionally, it is trading above its 200-day simple moving average, indicating a positive trend outlook in the mid to long-term.

Whether the prediction will come true and ETH surpasses the $3,000 threshold, only time will tell, but experts and technical indicators are optimistic as of now.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.