Speculation about a potential recession in the United States economy has been escalating, with several indicators pointing to uncertainty.

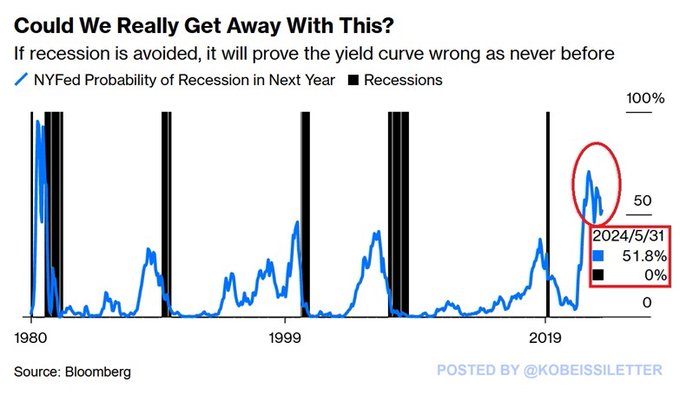

At the moment, an analysis by capital market commentary platform The Kobeissi Letter published on June 22 suggested that the probability of a recession within the next 12 months remains significant.

Based on the Federal Reserve model utilizing the US Treasury yield curve, there is currently a 52% chance of an economic downturn over the next year. While this probability has decreased from its peak of 71% in May 2023, it still signals caution for the US economy.

According to the platform, historically, when this model has indicated a recession probability exceeding 30%, an economic downturn has followed within two years. This trend has held true for the last 40 years, underscoring the reliability of the indicator.

Data provided indicated that each significant spike in recession probability (exceeding 30%) has been closely followed by an actual recession.

Yield curve signal

Additionally, the yield curve, a critical economic indicator, has been inverted for over 700 days, the longest duration in history. Notably, an inverted yield curve, where short-term interest rates exceed long-term rates, typically precedes a recession.

This extended inversion further complicates the possibility of a “soft landing,” where the economy slows down without entering a recession, according to The Kobeissi Letter.

Given the historical context and current economic indicators, the likelihood of avoiding a recession appears slim. If the recession does not materialize, it will challenge the predictive power of the yield curve.

“Over the last 40 years, each time this probability has exceeded 30%, the US economy experienced an economic downturn within 2 years. Meanwhile, the yield curve has been inverted for over 700 days, the longest stretch in history. A soft landing may still be difficult to attain,” the platform noted.

Overall, several indicators of a recession have emerged. For instance, as reported by Finbold, a troubling trend in the labor market shows permanent job losses are accelerating aggressively.

Historically, significant spikes in permanent job losses have consistently preceded recessions since 1995.