Investor sentiment has undergone a notable shift as uncertainty tightens its grip on the stock market, marking a departure from the prevailing optimism of recent months.

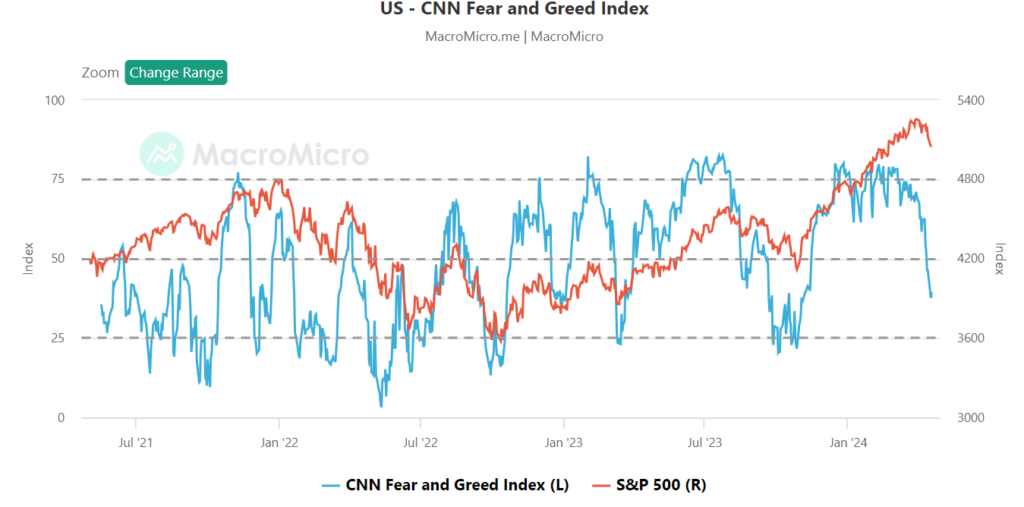

The latest data from the CNN Fear & Greed Index indicate a significant surge in fear, suggesting potential turbulence ahead for investors.

As of April 16, the index stood at 37.64. It’s worth noting that the last time the index reached such fear-inducing levels was back in November 2023, marking a notable deviation from the prevalent bullish trend.

The Fear & Greed Index, widely regarded as a critical gauge of investor sentiment, evaluates the level of fear or greed in the market based on various factors such as stock price momentum, market volatility, investor surveys, and put-and-call options.

A reading below 50 typically signals fear among investors, while a reading above 50 suggests greed.

Stock market crash warning

The sudden shift towards fear has raised concerns among market participants about the possibility of an impending stock market crash. Historically, periods of heightened fear have often preceded significant market downturns, prompting investors to reevaluate their risk exposure and investment strategies.

Amidst these escalating fear levels, the market has registered several bearish indicators, potentially pointing to an impending crash.

Notably, banking giant Goldman Sachs (NYSE: GS) has issued a warning, highlighting the brewing turbulence in the stock market. This caution is fueled by reports indicating that hedge funds in the United States have been offloading stocks at the fastest pace seen in three months while simultaneously increasing their short positions. Additionally, some indicators are pointing to a possible crash similar to the 1987 one.

This surge in market fear comes amidst lingering concerns about inflation. Recent inflation data also suggests that the Federal Reserve is unlikely to lower rates anytime soon. Furthermore, geopolitical uncertainties, particularly in the Middle East following Iran’s retaliatory attacks on Israel, have added to the prevailing sense of unease.

Overall, putting everything into consideration, recent months have registered indications suggesting a decline in confidence among retail and institutional investors in the US stock market. Since the start of April, the market has registered notable days trading in the red with shares of numerous companies.