A leading finance expert predicts a significant surge in global liquidity that could propel markets to new highs. Michael Howell, founder and CEO of CrossBorder Capital, believes that central banks are poised to inject substantial liquidity into the financial system, which will drive asset prices higher.

In a two-week-old interview on the Wealthion YouTube channel, Howell stated, “We’re on the cusp of a major liquidity expansion coming out of the Federal Reserve.” He noted that recent comments by Federal Reserve Chair Jerome Powell indicate growing concerns about the economy.

“Powell’s last speech was sufficiently nervous about the economy that it suggested there was some hint of panic,” Howell observed.

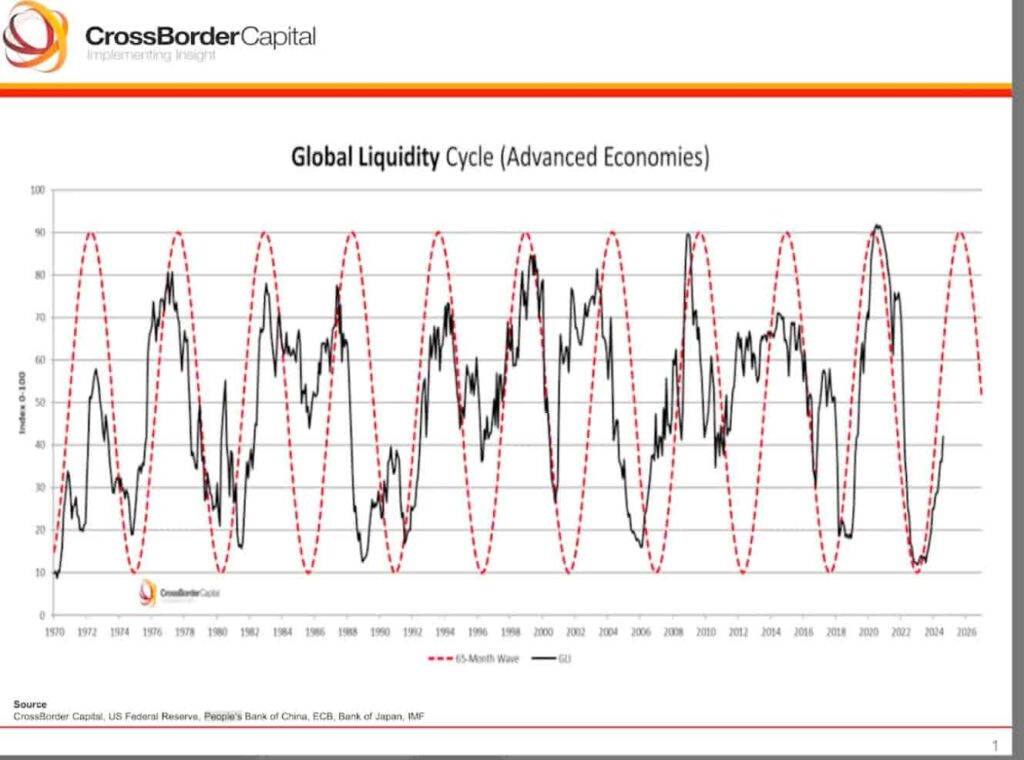

Notably, CrossBorder Capital’s research shows that global liquidity in advanced economies follows a long-term cycle. Recent insights show this liquidity is now surging again after two years of retracement and low economic activity.

Central banks shifting towards easing policies

According to Howell, central banks worldwide are shifting towards more accommodative monetary policies. He forecasted that the Federal Reserve would begin cutting interest rates and expanding its balance sheet. “Cutting interest rates now and adding more liquidity is really what they’re up to,” Howell explained.

Indeed, The Federal Open Market Committee (FOMC) decided to cut interest rates by 50 basis points in the meeting that followed this interview.

Moreover, CrossBorder Capital’s CEO pointed out that other major central banks are likely to follow suit. “The European Central Bank, the Bank of England, all central banks want to ease,” he said. “This is basically what we’re getting.”

People’s Bank of China (PBOC) role in the global liquidity

Furthermore, Howell highlights the role of the People’s Bank of China (PBOC) in the global liquidity landscape. He notes that the PBOC has maintained tight monetary policy over the past year to support the yuan against the US dollar.

However, any move by the PBOC to ease policy could significantly boost global liquidity. “What they need is monetary policy easing in their economy right now,” Howell said, referring to China’s current economic slowdown.

He also emphasizes the impact of China’s economy on global inflation trends. “One of the questions to raise is to what extent is a slow Chinese economy also contributing to this fall-off in inflation,” Howell added.

Bullish implications for markets and investors

With an anticipated surge in global liquidity, Howell expects financial markets to benefit significantly. He emphasizes that liquidity is a key driver of asset prices. “When you get an expansion in liquidity, typically asset markets in general rise,” he noted. Therefore, investors may find opportunities as increased liquidity pushes markets higher.

Barchart’s post on X this Saturday shared a similar bullish perception of the global liquidity rise.

The bearish case and counterpoints for a global liquidity surge

Nevertheless, Howell cautions that rising debt levels pose potential risks. He observes that governments are increasing debt, and interest expenses are growing.

“One of the things that people have got to recognize is that debt goes hand in hand with liquidity,” Howell said. “We’re in a situation now where financial markets have moved away from being new capital-raising mechanisms into being basically debt refinancing mechanisms.”

As such, the need for liquidity to refinance debt becomes critical. “Every financial crisis has largely been a refinancing crisis,” he remarked. Thus, while increased liquidity may support markets, investors should remain aware of the underlying debt dynamics.

Additionally, Howell points out that this influx of liquidity may have implications for inflation. He suggests that while monetary inflation could support asset prices, it may also lead to higher consumer prices over time.

“The reality is that monetary inflation may well spill over to a greater extent into the high street than before,” he said.

Global liquidity will play an important role in finance markets

In conclusion, the expected influx of global liquidity presents a bullish scenario for financial markets. As central banks ease monetary policies, the additional liquidity may drive asset prices higher. Investors could benefit from this trend, particularly in equities and other financial assets, like Bitcoin (BTC), as mentioned in the interview.

Yet, Howell advises caution due to potential risks associated with rising debt levels and potential inflationary pressures. “These are the costs that come through,” he said. “It’s a slow erosion of economic welfare.” Therefore, investors should monitor liquidity trends and debt developments closely.

By staying informed, finance participants can navigate the markets effectively and capitalize on emerging opportunities. As Howell stated, “Investors need to radically change to a different mindset that reflects an era of monetary inflation.”

In closing, understanding the dynamics of global liquidity is essential for making sound investment decisions in the current economic landscape.