Gold reached a new all-time high (ATH) last Friday, surpassing the $2,500 price per ounce, while Bitcoin (BTC) lags behind. The so-called “digital gold” divergence from the precious metal has sparked discussions in the finance community, evaluating their fundamental differences.

In particular, trader and analyst Kashyap Sriram, who has over eight years of experience in finance, shared his insight. Sriram first commented in a post by Lawrence McDonald, a New York Times best-selling author, who questioned Bitcoin’s store of value narrative, comparing BTC and gold price performances.

“Bitcoin’s best days are behind it. Gold’s best days are just beginning. This is the hard money rotation that libertarian crypto investors are going to miss.”

– Kashyap Sriram, answering Lawrence McDonald

The analyst then went further on the underlying difference between the two assets. Essentially, he explained that Satoshi Nakamoto “modeled Bitcoin after gold,” even using the word “mining” to describe BTC’s proof-of-work model.

The underlying difference: Mining Bitcoin vs. mining gold

“If all the gold miners ceased operations today, gold will still have value. If all the bitcoin miners went offline, the value of bitcoin goes to zero.”

– Kashyap Sriram

While strange at first, Kashyap Sriram’s statement above is technically true. This is because the yellow metal does not require miners to work, while Bitcoin does. Gold miners’ sole function is to work to find already existing gold units on earth.

Meanwhile, Bitcoin miners are effectively running the software and keeping the network alive by publishing new blocks in the blockchain. Without miners, there is no blockchain, and without a blockchain, BTC holders can not spend their coins.

Essentially, a Bitcoin miner does not discover existing BTCs. Their prime function is to keep the network alive while rewarding themselves through the creation of new Bitcoin units with a special transaction called “coinbase.” The issuance of new coins is limited by the protocol at 3.125 per mined block. This amount will programmatically halve every 210,000 blocks toward zero.

Bitcoin mining decentralization versus gold

Sriram’s criticism continues, analyzing the current state of Bitcoin mining decentralization. As explained, eleven mining pools currently control the entire network and are responsible for 99% of all published blocks.

“Bitcoin mining is super capital intensive, highly concentrated, and therefore, extremely vulnerable. Decentralization in bitcoin is a myth. The bitcoin network is very, very fragile and at the mercy of a few giants.”

– Kashyap Sriram

Interestingly, the analyst explained that despite its $1.2 trillion capitalization, Bitcoin’s network is secured by a mining network worth around $25 billion—equivalent to 40% of a single gold miner’s market cap, Newmont (NYSE: NEM).

Additionally, the Bitcoin mining centralization concern could be even worse, considering a study from April recently reported by Finbold. According to in-depth research, on-chain data suggests five of the eleven mining pools could be controlled by a single company.

Bitcoin and gold price analysis

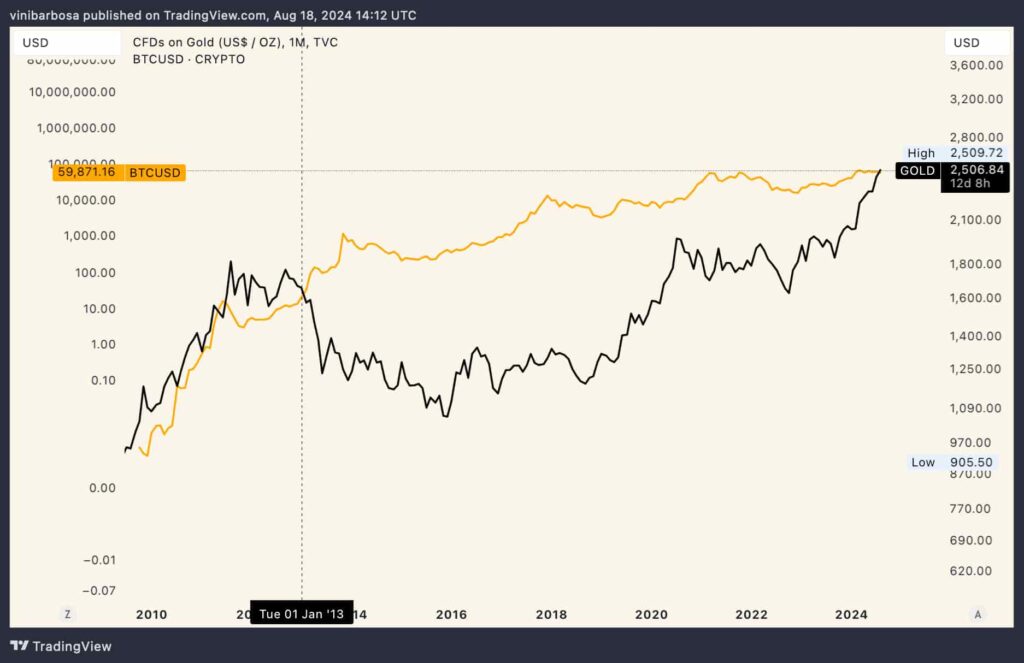

As of this writing, Bitcoin trades at $59,871, 19% below its ATH but with an unprecedented performance since launch. On August 16, gold closed the week at $2,506.84 per ounce after nailing a new all-time high of $2,509.72.

Since 2013, BTC has outperformed the leading commodity in a distance that became tighter over time. Now, gold has finally surpassed the leading cryptocurrency in the comparative chart, challenging Bitcoin’s most chanted value proposition.

In the previously mentioned post, Lawrence McDonald compared some historical price data from Bitcoin and gold. In particular, the finance expert highlighted gold’s worst drawdown of 21% against BTC’s drawdowns, which were as large as 82%.

As things develop, investors can decide to get financial exposure to Bitcoin, gold, or both – looking for an inflation hedge. Cryptocurrencies like BTC are inherently more volatile than solid commodities with industrial demand like gold, hence requiring caution.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.