With GameStop (NYSE: GME) being a hot topic right now, with the renewed trading activity from Roaring Kitty, it is easy for traders to overlook other potential short squeeze targets that are experiencing sustainable gains, particularly in the recent sessions.

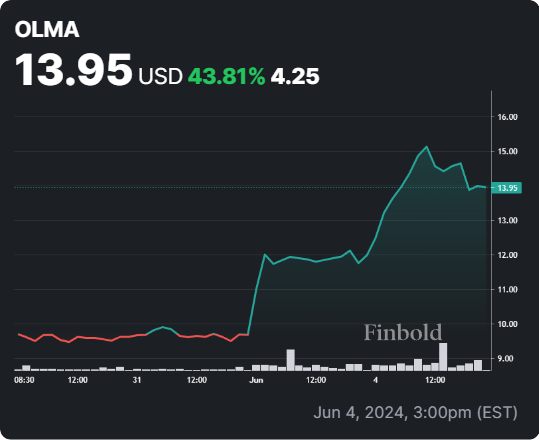

Notably, Olema Pharmaceuticals (NASDAQ: OLMA) has experienced a remarkable surge, with its stock price skyrocketing by an impressive 52.56% in the previous five trading sessions, climbing from $9.17 to $13.95 as of the latest close.

Despite many short squeezes that took place on no news or pure speculation, OLMA stock has viable reasons for success.

Pfizer’s breakthrough spells success for Olema

Over the weekend, peer-reviewed data for Pfizer’s (NYSE: PFE) drug PF-07248144 was published in Nature Medicine alongside a presentation at the 2024 Annual Meeting of the American Society of Clinical Oncology (ASCO).

In the publication, based on the drug’s first human trial, researchers reported that combining PF-07248144 with the FDA-approved cancer therapy fulvestrant showed a ‘tolerable safety profile and durable antitumor activity’ for some patients with HER2-negative breast cancer.

PF-07248144 targets a tumor-related compound called histone lysine acetyltransferases (KATs). It works similarly to Olema’s KAT6 inhibitor, OP-3136, which is still in preclinical development.

This breakthrough could significantly impact the cancer-treating medicine as we know it, potentially bringing impressive gains to OLMA stock.

Analysts from Wall Street agree on OLMA stock

Pfizer’s findings were described as ‘the most exciting Phase 1 results’ by Oppenheimer analyst Matthew Biegler.

Biegler, who has an ‘outperform’ rating and a $21 per share target on Olema stock, noted that Olema is the only other publicly traded biotech company studying KAT-6. He also mentioned that Olema’s potential cancer therapy, OP-3136, ‘looks better.’

Meanwhile, Jefferies analyst Michael Yee commented on the results, highlighting that KAT6 is a novel cancer target yet to be fully explored. Yee, who has a ‘buy’ rating and a $30 target on OLMA, said, ‘We expect interest to pick up now.’

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.