While gold and silver dominate the commodities market, palladium is quietly stealing the spotlight, with prices surging 6% in a single day, setting the stage for a potentially historic year-end close.

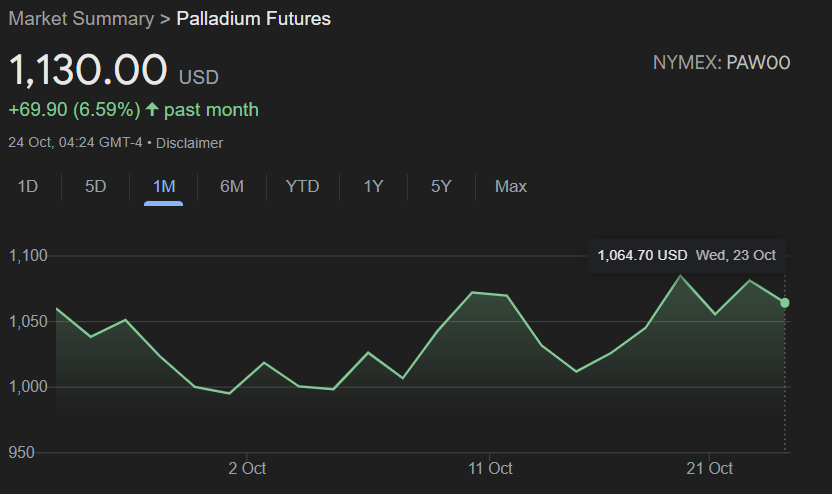

At press time, palladium futures were priced at $1,130, up 6.18% for the day.

This is a continuation of the recent bullish momentum, which has seen the metal rally over 6.59% on the monthly time frame.

The shiny metal’s price action had been consolidating within a range for months, with resistance at $1,109.50 proving difficult to break. However, the current rally has broken through this barrier, setting the stage for what could be its most decisive close of the year.

Why is palladium rallying

While various factors can influence the metal’s valuation, the current momentum is attributed to geopolitical events, particularly sanctions against Russia.

Investor interest spiked after reports indicated that the United States asked G7 members to explore sanctions on Russian palladium and titanium.

If implemented, the move could tighten supply, as Russia is one of the world’s largest suppliers of palladium, accounting for nearly 40% globally.

This sentiment is supported by commodity strategist Ole Hansen, who stated in an X post on October 24 that the potential restriction of Russian palladium has rattled market participants.

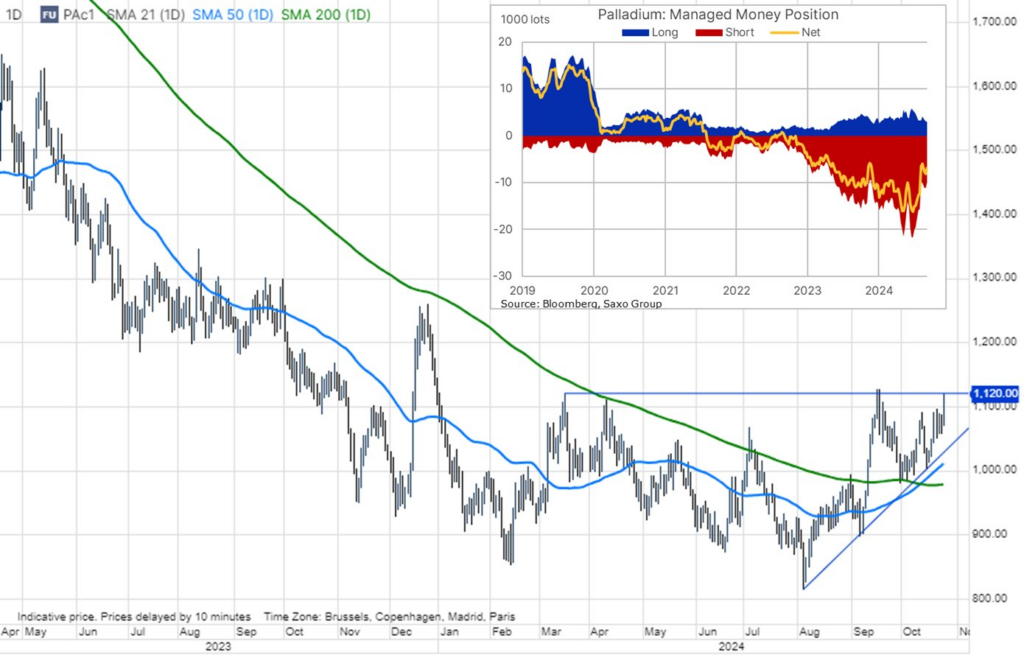

The expert’s analysis suggested breaking above the $1,120 resistance following months of downward pressure might signal further upside momentum. Palladium had been on a downtrend since early 2023 but began recovering in mid-2024.

It is now trading above the 50-day moving average, signaling bullish momentum in the short term.

Meanwhile, managed money positions in the commodity have seen notable short-covering, indicating a shift in sentiment toward long positions. The looming threat of sanctions could further exacerbate supply concerns, potentially driving prices higher.

On the other hand, a commodities technical analyst with the pseudonym Graddhy noted in an X post on October 22 that palladium appears ready to start a bull market, describing the metal as offering a life-changing opportunity.

Gold dominates commodities bull market

In general, gold is the king of the ongoing commodities bull market, and the yellow metal reached new highs above $2,700. Some analysts have set a target of $3,000 in the coming months, driven by gold’s traditional role as a hedge in times of economic uncertainty and geopolitical tensions in the Middle East.

Silver has also seen significant gains, reaching 12-year highs, partly fueled by non-traditional catalysts such as military demand.

Similarly, uranium has attracted investor interest due to its potential role in meeting clean energy demands for the artificial intelligence sector.